Ulta 2012 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2012 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

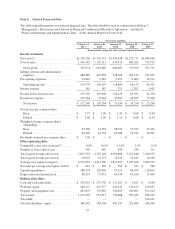

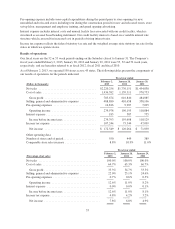

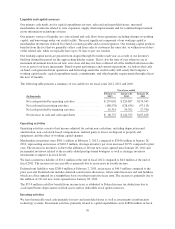

(1) Our fiscal year-end is the Saturday closest to January 31 based on a 52/53-week year. Each fiscal year

consists of four 13-week quarters, with an extra week added onto the fourth quarter every five or six years.

(2) Fiscal 2012 was a 53-week operating year and the 53rd week represented approximately $40 million in net

sales.

(3) Comparable store sales increase reflects sales for stores beginning on the first day of the 14th month of

operation. Remodeled stores are included in comparable store sales unless the store was closed for a portion

of the current or comparable prior year.

(4) Total square footage per store is calculated by dividing total square footage at end of year by number of

stores at end of year.

(5) Average total square footage represents a weighted average which reflects the effect of opening stores in

different months throughout the year.

(6) Net sales per average total square foot was calculated by dividing net sales for the year by the average square

footage for those stores open during each year.

Item 7. Management’s Discussion and Analysis of Financial Condition and Results of Operations

The following discussion and analysis of our financial condition and results of operations should be read in

conjunction with our financial statements and related notes included elsewhere in this Annual Report on

Form 10-K. This discussion contains forward-looking statements within the meaning of Section 21E of the

Securities Exchange Act of 1934, as amended, and the safe harbor provisions of the Private Securities Litigation

Reform Act of 1995, which reflect our current views with respect to, among other things, future events and

financial performance. You can identify these forward-looking statements by the use of forward-looking words

such as “outlook,” “believes,” “expects,” “plans,” “estimates,” or other comparable words. Any forward-

looking statements contained in this Form 10-K are based upon our historical performance and on current plans,

estimates and expectations. The inclusion of this forward-looking information should not be regarded as a

representation by us or any other person that the future plans, estimates or expectations contemplated by us will

be achieved. Such forward-looking statements are subject to various risks and uncertainties, which include,

without limitation: the impact of weakness in the economy; changes in the overall level of consumer spending;

changes in the wholesale cost of our products; the possibility that we may be unable to compete effectively in our

highly competitive markets; the possibility that our continued opening of new stores could strain our resources

and have a material adverse effect on our business and financial performance; the possibility that new store

openings and existing locations may be impacted by developer or co-tenant issues; the possibility that the

capacity of our distribution and order fulfillment infrastructure may not be adequate to support our recent

growth and expected future growth plans; the possibility of material disruptions to our information systems;

weather conditions that could negatively impact sales; our ability to attract and retain key executive personnel;

our ability to successfully execute and implement our common stock repurchase program; and other risk factors

detailed in our public filings with the Securities and Exchange Commission (the “SEC”), including risk factors

contained in Item 1A, “Risk Factors” of this Annual Report on Form 10-K for the year ended February 2, 2013.

We assume no obligation to update any forward-looking statements as a result of new information, future events

or developments. References in the following discussion to “we”, “us”, “our”, “the Company”, “Ulta” and

similar references mean Ulta Salon, Cosmetics & Fragrance, Inc. unless otherwise expressly stated or the

context otherwise requires.

Overview

We were founded in 1990 as a beauty retailer at a time when prestige, mass and salon products were sold through

distinct channels – department stores for prestige products, drug stores and mass merchandisers for mass

products, and salons and authorized retail outlets for professional hair care products. After extensive research, we

recognized an opportunity to better satisfy how women want to shop for beauty products. We developed a unique

retail approach by combining one-stop shopping, a compelling value proposition, convenient locations and an

uplifting specialty retail experience. We believe our strategy provides us with the competitive advantages that

have contributed to our strong financial performance.

30