Ulta 2012 Annual Report Download

Download and view the complete annual report

Please find the complete 2012 Ulta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 012

Table of contents

-

Page 1

2012 -

Page 2

... of operation. Remodeled stores are included in comparable store sales unless the store was closed for a portion of the current or comparable prior year. (4) Net sales per average total square foot was calculated by dividing net sales for the year by the average square footage for those stores open... -

Page 3

... store growth; introducing new products, services and brands; enhancing our loyalty program; broadening our marketing reach; and increasing our digital focus including ulta.com. Store Growth We opened 101 net new stores in 2012, increasing square footage by 23%. We ended the year with 550 locations... -

Page 4

... 22% square footage growth. We continue to see a strong pipeline of new products, services and brands to enhance our offering, and are delighted to continue our expansion of Clinique boutiques to additional stores. To provide a solid foundation for ULTA Beauty's growth in the years ahead, we plan to... -

Page 5

..., based upon the closing sale price of the common stock on July 28, 2012, as reported on the NASDAQ Global Select Market, was approximately $4,199,998,000. Shares of the registrant's common stock held by each executive officer and director and by each entity or person that, to the registrant... -

Page 6

...Changes in and Disagreements with Accountants on Accounting and Financial Disclosure ...Item 9A. Controls and Procedures ...Item 9B. Other Information ...Item 10. Item 11. Item 12. Item 13. Item 14. Part III Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security... -

Page 7

..., gift-with-purchase offers and multi-product gift sets for our prestige brands, and a comprehensive customer loyalty program. An Off-Mall Location. Our stores are predominately located in convenient, high-traffic locations such as power centers. Our typical store is approximately 10,000 square feet... -

Page 8

... eleven million Ulta customers are members of our loyalty programs. We utilize this valuable proprietary database to drive traffic, better understand our customers' purchasing patterns and support new store site selection. We regularly employ a broad range of media, including digital, catalogs and... -

Page 9

... of our stores. We plan to continue expanding our portfolio of services in the future by establishing Ulta as a leading salon authority providing high quality and consistent services from our licensed stylists and introducing new beauty-related services. Enhancing our successful loyalty programs. We... -

Page 10

...are well positioned to capitalize on the growth of Internet sales of beauty products. We believe our website and retail stores provide our customers with an integrated multichannel shopping experience and increased flexibility for their beauty buying needs. Improving our operating margin. We plan to... -

Page 11

... our broad selection of merchandise, from moderate-priced brands to higher-end prestige brands, offers a unique shopping experience for our customers. The products we sell can also be found in department stores, specialty stores, salons, mass merchandisers and drug stores, but we offer all of these... -

Page 12

... run frequent promotions and gift coupons for our mass brands, gift-with-purchase offers and multi-product gift sets for our prestige brands, and a comprehensive customer loyalty program. We believe our private label products are a strategically important category for growth and profit contribution... -

Page 13

..., social media, display advertising, and other digital marketing channels. Ulta's email marketing programs are effective in communicating with and driving sales from online and retail store customers. Staffing and operations Retail Our current Ulta store format is staffed with a general manager... -

Page 14

... and is approximately 437,000 square feet in size. The third distribution center, located in Chambersburg, Pennsylvania, opened in April 2012 to support our future growth needs. The Chambersburg warehouse contains approximately 373,000 square feet. Inventory is shipped from our suppliers to our... -

Page 15

... experienced any work stoppages and believe we have good relationships with our associates. Available Information Our principal website address is www.ulta.com. We make available at this address under investor relations (at http://ir.ulta.com), free of charge, our proxy statement, annual report to... -

Page 16

... and changes in the level of inventory purchased by our customers, and may signify a reset of consumer spending habits, all of which may adversely affect our business, financial condition, profitability and cash flows. Economic conditions have also resulted in a tightening of the credit markets... -

Page 17

... be successful in attracting, assimilating and retaining the personnel required to grow and operate our business profitably. Effective February 21, 2013, Carl S. Rubin resigned from his position as President and Chief Executive Officer and Dennis K. Eck, a current board member, is currently serving... -

Page 18

...example, our planned expansion will require us to increase the number of people we employ as well as to monitor and upgrade our management information and other systems and our distribution infrastructure. These increased demands and operating complexities could cause us to operate our business less... -

Page 19

...commerce operations are increasingly important to our business. The Ulta.com website serves as an effective extension of Ulta's marketing and prospecting strategies (beyond catalogs, newspaper inserts and national advertising) by exposing potential new customers to the Ulta brand, product offerings... -

Page 20

... power center. Such a reduction in customer traffic would reduce our sales and leave us with excess inventory, which could have a material adverse effect on our business, financial condition and results of operations. We may respond by increasing markdowns or initiating marketing promotions... -

Page 21

...Ulta branded products and gift-with-purchase and other promotional products, consistent with applicable regulatory requirements, we could suffer lost sales and be required to take costly corrective action, which could have a material adverse effect on our business, financial condition, profitability... -

Page 22

...wage laws and other laws relating to employee benefits could cause us to incur additional wage and benefits costs, which could hurt our profitability and affect our growth strategy. ‰ Our salon business is subject to state board regulations and state licensing requirements for our stylists and our... -

Page 23

... costs and/or delays in store openings could increase our store opening costs, cause us to incur lost sales and profits, and damage our public reputation and could have a material adverse effect on our business, financial condition, profitability and cash flows. Our Ulta products and salon services... -

Page 24

... execute our growth strategy as planned and our results of operations may suffer. Failure to maintain adequate financial and management processes and controls could lead to errors in our financial reporting and could harm our ability to manage our expenses. Reporting obligations as a public company... -

Page 25

... ‰ changes in our merchandising strategy or mix; ‰ performance of our new and remodeled stores; ‰ the effectiveness of our inventory management; ‰ timing and concentration of new store openings, including additional human resource requirements and related pre-opening and other start-up costs... -

Page 26

... declare dividends in the future. We paid a special cash dividend on May 15, 2012. Any future dividend payments will be within the discretion of our Board of Directors and will depend on, among other things, our financial condition, results of operations, capital requirements, capital expenditure... -

Page 27

...aggregate purchase price of $150 million. The timing and actual number of shares repurchased depend on a variety of factors including the timing of open trading windows, price, corporate and regulatory requirements, and other market conditions. The program does not obligate the Company to repurchase... -

Page 28

... convenient, high-traffic, locations such as power centers. Our typical store is approximately 10,000 square feet, including approximately 950 square feet dedicated to our full-service salon. Most of our retail store leases provide for a fixed minimum annual rent and generally have a 10-year initial... -

Page 29

.... On April 12, 2012, the Company removed the case to the United States District Court for the Central District of California. The plaintiff and members of the proposed class are alleged to be (or to have been) non-exempt hourly employees. The suit alleges that Ulta violated various provisions of... -

Page 30

... has traded on the NASDAQ Global Select Market under the symbol "Ulta" since October 25, 2007. Our initial public offering was priced at $18.00 per share. The following table sets forth the high and low sales prices for our common stock on the NASDAQ Global Select Market during fiscal years 2012 and... -

Page 31

... as of the close of business on March 20, 2012. The special cash dividend, totaling $62.5 million, was paid on May 15, 2012. Our Board of Directors may determine future dividends after giving consideration to our levels of profit and cash flow, capital requirements, current and future liquidity... -

Page 32

.... Set forth below is a graph comparing the cumulative total stockholder return on Ulta's common stock with the NASDAQ Global Select Market Composite Index (NQGS) and the S&P Retail Index (RLX) for the period covering Ulta's first trading day on October 25, 2007 through the end of Ulta's fiscal year... -

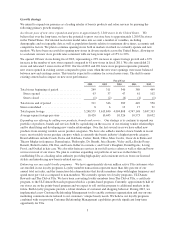

Page 33

... ...Dividends declared per common share ...Other operating data: Comparable store sales increase(3) ...Number of stores end of year ...Total square footage end of year ...Total square footage per store(4) ...Average total square footage(5) ...Net sales per average total square foot(6) ...Capital... -

Page 34

...different months throughout the year. (6) Net sales per average total square foot was calculated by dividing net sales for the year by the average square footage for those stores open during each year. Item 7. Management's Discussion and Analysis of Financial Condition and Results of Operations The... -

Page 35

...our operating margin. We believe that the expanding U.S. beauty products and salon services industry, the shift in distribution of prestige beauty products from department stores to specialty retail stores, coupled with Ulta's competitive strengths, positions us to capture additional market share in... -

Page 36

... expenses; ‰ salon payroll and benefits; ‰ customer loyalty program expense; and ‰ shrink and inventory valuation reserves. Our cost of sales may be negatively impacted as we open an increasing number of stores. Changes in our merchandise mix may also have an impact on cost of sales. This... -

Page 37

... sales ...Cost of sales ...Gross profit ...Selling, general and administrative expenses ...Pre-opening expenses ...Operating income ...Interest expense ...Income before income taxes ...Income tax expense ...Net income ...Other operating data: Number of stores end of period ...Comparable store sales... -

Page 38

... profit margin in fiscal 2012 was primarily driven by: ‰ 50 basis points of leverage in fixed store costs attributed to the impact of significantly higher sales levels in fiscal 2012; and ‰ 30 basis points improvement in merchandise margins driven by our marketing and merchandising strategies... -

Page 39

... of leverage in fixed store costs attributed to the impact of significantly higher sales levels in fiscal 2011; and ‰ 70 basis points improvement in merchandise margin due primarily to improved promotional pricing and a shift in category mix towards higher margin product compared with fiscal 2010... -

Page 40

... addition of 101 net new stores opened since January 28, 2012 and incremental inventory related to the recently added prestige brand boutiques as well as strategic inventory investments to improve in-stock levels. We had a current tax liability of $10.1 million at the end of fiscal 2012 compared to... -

Page 41

... well as inventory and other working capital reductions. We may require borrowings under the facility from time to time in future periods to support our new store program and seasonal inventory needs. Dividend On March 8, 2012, we announced that our Board of Directors had declared a $1.00 per share... -

Page 42

... our financial position or results of operations to date, a high rate of inflation in the future may have an adverse effect on our ability to maintain current levels of gross margin and selling, general and administrative expenses as a percentage of net sales if the selling prices of our products do... -

Page 43

... Merchandise inventories are carried at the lower of average cost or market value. Cost is determined using the weighted-average cost method and includes costs incurred to purchase and distribute goods as well as related vendor allowances including co-op advertising, markdowns, and volume discounts... -

Page 44

...maintaining adequate internal control over financial reporting for the Company. Internal control over financial reporting is a process designed by, or under the supervision of the principal executive officer and principal financial officer and effected by the board of directors, management and other... -

Page 45

... 120 days after our fiscal year ended February 2, 2013 pursuant to Regulation 14A under the Exchange Act in connection with our 2013 annual meeting of stockholders. Item 12. Security Ownership and Certain Beneficial Owners and Management and Related Stockholder Matters The information required by... -

Page 46

... of this Form 10-K: Report of Independent Registered Public Accounting Firm ...Balance Sheets ...Statements of Income ...Statements of Cash Flows ...Statements of Stockholders' Equity ...Notes to Financial Statements ...Exhibits ...43 45 46 47 48 49 61 The schedules required by Form 10-K have been... -

Page 47

... ended February 2, 2013, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), Ulta Salon, Cosmetics & Fragrance, Inc.'s internal control over financial reporting... -

Page 48

... Independent Registered Public Accounting Firm The Board of Directors and Stockholders Ulta Salon, Cosmetics & Fragrance, Inc. We have audited Ulta Salon, Cosmetics & Fragrance, Inc.'s internal control over financial reporting as of February 2, 2013, based on criteria established in Internal Control... -

Page 49

... January 28, 2012 Assets Current assets: Cash and cash equivalents ...Receivables, net ...Merchandise inventories, net ...Prepaid expenses and other current assets ...Deferred income taxes ...Total current assets ...Property and equipment, net ...Deferred compensation plan assets ...Total assets... -

Page 50

Ulta Salon, Cosmetics & Fragrance, Inc. Statements of Income Fiscal year ended January 28, January 29, 2012 2011 (In thousands, except per share data) February 2, 2013 Net sales ...Cost of sales ...Gross profit ...Selling, general and administrative expenses ...Pre-opening expenses ...Operating ... -

Page 51

Ulta Salon, Cosmetics & Fragrance, Inc. Statements of Cash Flows February 2, 2013 Fiscal year ended January 28, January 29, 2012 2011 (In thousands) Operating activities Net income ...$ 172,549 $ 120,264 $ 71,030 Adjustments to reconcile net income to net cash provided by operating activities: ... -

Page 52

..., 2012 ... Stock options exercised and other awards ...Common stock repurchased ...Net income ... Comprehensive income ...Excess tax benefits from stock-based compensation ...Stock compensation charge ...Dividends paid ... Balance - February 2, 2013 ... See accompanying notes to financial statements... -

Page 53

... per share data) 1. Business and basis of presentation Ulta Salon, Cosmetics & Fragrance, Inc. (Company or Ulta) was incorporated in the state of Delaware on January 9, 1990, to operate specialty retail stores selling cosmetics, fragrance, haircare and skincare products, and related accessories and... -

Page 54

...the year. ULTAmate Rewards is a points-based program in which customers earn points based on their purchases. Points earned are valid for one year and may be redeemed on any product or select salon service. The Company accrues the cost of anticipated redemptions related to these programs at the time... -

Page 55

... returns. The Company provides refunds for product returns within 60 days from the original purchase date. Salon revenue is recognized when services are rendered. Salon service revenue amounted to $121,357, $98,479 and $86,484 for fiscal 2012, 2011 and 2010, respectively. Company coupons and... -

Page 56

... and liabilities used for financial reporting purposes and the amounts used for income tax purposes and the amounts reported were derived using the enacted tax rates in effect for the year the differences are expected to reverse. Income tax benefits related to uncertain tax positions are recognized... -

Page 57

.... On April 12, 2012, the Company removed the case to the United States District Court for the Central District of California. The plaintiff and members of the proposed class are alleged to be (or to have been) non-exempt hourly employees. The suit alleges that Ulta violated various provisions of... -

Page 58

... of the Company's deferred tax assets and liabilities are as follows: February 2, 2013 January 28, 2012 Deferred tax assets: Reserves not currently deductible ...Employee benefits ...Net operating loss & credit carryforwards ...Accrued liabilities ...Inventory valuation ...Total deferred tax assets... -

Page 59

...no market data, which would require the Company to develop its own assumptions. As of February 2, 2013, the Company held financial liabilities of $2,876 related to its non-qualified deferred compensation plan. The liabilities have been categorized as Level 2 as they are based on third-party reported... -

Page 60

... a number of equity incentive plans over the years. The plans were adopted in order to attract and retain the best available personnel for positions of substantial authority and to provide additional incentive to employees, directors, and consultants to promote the success of the Company's business... -

Page 61

... stock awards During fiscal 2012 the Company issued restricted stock to certain employees and its board of directors. Employee grants will generally cliff vest after 3 years and director grants will cliff vest within one year. The compensation expense recorded in fiscal 2012 and 2011 was $1,408... -

Page 62

...as to age and length of service. The plan is funded through employee contributions and a Company match. In fiscal 2012, 2011 and 2010, the Company match was 100% of the first 3.0%, 2.5% and 2%, respectively, of eligible compensation. For fiscal years 2012, 2011 and 2010, the Company match was $3,040... -

Page 63

... period Charged to costs and expenses Balance at end of period Description Deductions Fiscal 2012 Allowance for doubtful accounts ...Shrink reserve ...Inventory - lower of cost or market reserve ...Insurance: Workers Comp / General Liability Prepaid Asset ...Employee Health Care Accrued Liability... -

Page 64

... as Chief Financial Officer and Assistant Secretary of the Company. Mr. Settersten previously served as Acting Chief Financial Officer and Assistant Secretary since October 18, 2012. On March 18, 2013, we announced that our Board of Directors had authorized a stock repurchase program pursuant... -

Page 65

... Plan Ulta Salon, Cosmetics & Fragrance, Inc. 2002 Equity Incentive Plan Ulta Salon, Cosmetics & Fragrance, Inc. 2007 Incentive Award Plan Ulta Salon, Cosmetics & Fragrance, Inc. 2011 Incentive Award Plan Ulta Salon, Cosmetics & Fragrance, Inc. Nonqualified Deferred Compensation Plan Employment... -

Page 66

..., Wells Fargo Capital Finance, LLC, J.P. Morgan Securities LLC, JPMorgan Chase Bank, N.A. and PNC Bank, National Association Form of Retention and Severance Agreement Code of Business Conduct Consent of Independent Registered Public Accounting Firm Certification of the Chief Executive Officer... -

Page 67

... Exhibit pursuant to Rule 24b-2 under the Securities Exchange Act. Omitted portions have been filed separately with the Securities and Exchange Commission. ** In accordance with Rule 406T of Regulation S-T, the Interactive Data Files in Exhibit 101 to the Annual Report on Form 10-K shall be deemed... -

Page 68

..., on April 3, 2013. ULTA SALON, COSMETICS & FRAGRANCE, INC. By: /s/ Scott M. Settersten Scott M. Settersten Chief Financial Officer and Assistant Secretary Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by the following persons on behalf of the... -

Page 69

... Board of Directors Michael R. MacDonald (2) Member of Board of Directors The Company has ï¬led with the Securities and Exchange Commission, as Exhibit 31 to its Annual Report on Form 10-K for ï¬scal year 2012, the Chief Executive Ofï¬cer and Chief Financial Ofï¬cer certiï¬cations as required... -

Page 70

PRESTIGE FRAGRANCES THE MEN'S SHOP -

Page 71

SALON STYLING TOOLS THE SALON -

Page 72