US Bank 2015 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2015 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

— 5 —

and a community connected through

culture, recreation and play — continue to

be at the heart of possibility for all of us.

In addition to more than 255,000

volunteer hours and more than

$25.4million in foundation grants, our

Community Development Corporation

(CDC) invested $4.4 billion in the

revitalization of communities and

economic centers across the country.

That’s why we are recognized every

year by organizations like Junior

Achievement, Americans for the Arts,

United Way and local Chambers of

Commerce as well as civic partners for

making our communities better.

We make possible happen for our

employees by investing in our collective

vision and skills to create value for

shareholders and customers while

building productive and successful

careers. We are one U.S. Bank. We

make sound nancial decisions for the

enterprise that protect our employees

when the external environment

becomes unsteady, like it was in 2015,

such as delaying spending and hiring

instead of reducing our workforce.

Likewise, we make sound nancial

decisions for the enterprise that

allow us to support and cultivate our

employees’ futures. We recently made

every employee a shareholder of U.S.

Bancorp by awarding an appreciation

stock grant — because we believe in

the power of ownership and we want

our employees to know their role

as visionaries for our future, with a

personal stake in our success.

That’s why U.S. Bancorp’s employee

engagement scores remain in the

top quartile of all companies, across

all industries and across all regions

of the world.

The Power of Possible:

Make Value Happen

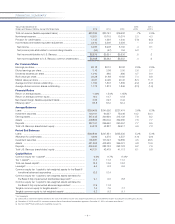

I am extremely proud of the remarkable

nancial performance that U.S.

Bancorp delivered in 2015 and the

value we created for our shareholders.

Remarkable, because it was a year

underscored by persistent and

historically low interest rates, modest

economic growth, increasing

regulatory requirements and rapidly

evolving customer needs and

expectations. More than any year in

recent history, 2015 required strong

management focus and conviction as

we balanced decisions about operating

efciencies with opportunities for

investing in future growth.

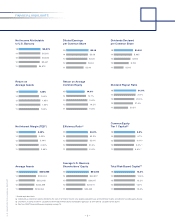

U.S. Bancorp rose to that challenge,

delivering record net income and record

diluted EPS for the year and returning

72 percent of our 2015 earnings to

shareholders through dividends and

share buybacks. In addition, our return

on average assets (ROA), return on

average equity (ROE) and efciency

ratio continued to lead the industry.

As we managed the twists and

turns of a challenging 2015, we also

positioned ourselves for growth as

we head into 2016 — as was indicated

by our record fourth quarter revenue

driven by continued momentum in

payment-related fees, increasing loan

growth and stable net interest margin.

We also made solid progress toward

achieving positive operating leverage

as we nished 2015, due to our

continued focus on prudent expense

management.

The Power of Possible:

Make Growth Happen

With a solid foundation established,

we are well positioned for growth in the

years ahead. Our business footprint

is attractive, with leadership in the

most growth-oriented marketplaces

that we have chosen to compete in,

including Payments, Treasury Services,

Wholesale Banking, Consumer and

Small Business Banking and Wealth

Management. And, our capital position

is strong — having exceptional capital

ratios and among the world’s best debt

ratings in the banking industry.