US Bank 2015 Annual Report Download

Download and view the complete annual report

Please find the complete 2015 US Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

ion Legacies Value Leadership Opportunities

nnovation Integrity Knowledge Progress Securit

hip Opportunities Connections Ethics Goals Gr

egacies Commerce Communities Value Leade

grity Knowledge Progress Security Life Expan

ections Ethics Goals Growth Hope Ideas Inno

Communities Value Leadership Opportunities C

ess Security Life Expansion Legacies Commer

h Hope Ideas Innovation Integrity Knowledge P

hip Opportunities Connections Ethics Goals Gr

egacies Commerce Communities Value Leade

grity Knowledge Progress Security Life Expan

tunities Connections Ethics Goals Growth Hop

The Power of

Possible

2015 Annual Report

Table of contents

-

Page 1

... Integrity Knowledge p Opportunities Connections Ethics Goals Gr gacies Commerce Communities Value Leade grity Knowledge Progress Security Life Expan unities Connections Ethics Goals Growth Hop 2015 Annual Report n Legacies Value Leadership Opportunities novation Integrity Knowledge Progress... -

Page 2

... our retail, small business, wholesale and institutional customers and our communities. It's what drives success for our company, employees and shareholders. There's great power in possible, and we live it every day, in everything we do. Because when we invest in the power of possible, we all win. -

Page 3

...$422b in total assets at Dec 31, 2015 67,000 employees FOUR MAJOR LINES OF BUSINESS - Consumer + Small Business Banking - Wholesale Banking + Commercial Real Estate - Wealth Management + Securities Services - Payment Services 18.6m customers Founded in BUSINESS SCOPE Regional - Consumer + Small... -

Page 4

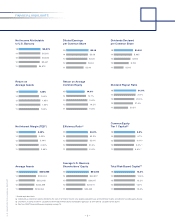

...Efficiency Ratio (a) 15 14 13 12 11 53.8% 53.2% 52.4% 51.5% 51.8% Common Equity Tier 1 Capital (b) 15 14 13 12 11 9.6% 9.7% 9.4%(c) 9.0%(c) 8.6%(c) Average Assets 15 14 U.S . BANCORP 2015 ANNUAL REPORT 13 12 11 $408,865 $380,004 $352,680 $342,849 $318,264 Average U.S. Bancorp Shareholders' Equity... -

Page 5

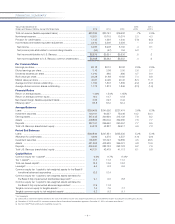

...Return on average common equity ...Net interest margin (taxable-equivalent basis) ...Efficiency ratio(a) ... Average Balances Loans ...Investment securities ...Earning assets ...Assets ...Deposits ...Total U.S. Bancorp shareholders' equity ... Period End Balances Loans ...Allowance for credit losses... -

Page 6

...-leading financial results year after year after year. And, by returning capital and running a trustworthy and reputable banking business, our shareholders know that we will do it well and we will do it right. That's why we were named one of the World's Most Ethical Companiesâ„¢ in 2015 by the... -

Page 7

... for the year and returning 72 percent of our 2015 earnings to shareholders through dividends and share buybacks. In addition, our return on average assets (ROA), return on average equity (ROE) and efficiency ratio continued to lead the industry. As we managed the twists and turns of a challenging... -

Page 8

...U.S. Bancorp alongside the evolution of our customers' financial plans and dreams. Our core businesses - Wholesale Banking and Commercial Real Estate, Consumer and Small Business Banking, Wealth Management and Securities Services and Payment Services - are all well positioned for growth. In 2015, we... -

Page 9

... Chief Executive Officer U.S. Bancorp February 25, 2016 AWARDS + RECOGNITIONS A 2015 World's Most Ethical Company - Ethisphere Institute, March 2015 BCA 10: Best Businesses Partnering for the Arts - Americans for the Arts, October 2015 #1 Most Admired Superregional Bank - Fortune, February 2016... -

Page 10

... and Chief Credit Officer 15. Kent V. Stone Vice Chairman, Consumer Banking Sales and Support 16. Jeffry H. von Gillern Vice Chairman, Technology and Operations Services 04. James L. Chosy Executive Vice President, General Counsel and Corporate Secretary 05. Terrance R. Dolan Vice Chairman, Wealth... -

Page 11

... Financial Services, Inc. 27. O'dell M. Owens, M.D., M.P.H. Medical Director, Cincinnati Health Department 28. Craig D. Schnuck Former Chairman and Chief Executive Officer, Schnuck Markets, Inc. 29. Patrick T. Stokes Former Chairman and Former Chief Executive Officer, Anheuser-Busch Companies, Inc... -

Page 12

U.S. BANCORP 2015 ANNUAL REPORT - 10 - -

Page 13

... shareholders. Through our lines of business, we connect with our customers and help them achieve their possible. The power of possible comes to life in our four core businesses: CONSUMER + SMALL BUSINESS BANKING WHOLESALE BANKING + COMMERCIAL REAL ESTATE WEALTH MANAGEMENT + SECURITIES SERVICES... -

Page 14

...up the face of an entrepreneur when we give her the green light to convert an old warehouse space into the restaurant she's always dreamed of opening. And it shines in the smile of a newlywed couple when we tell them they're approved to buy their first home. U.S . BANCORP 2015 ANNUAL REPORT - 12 - -

Page 15

...control of their finances by being available when and where they need us. Through all the traditional means, plus new and emerging technologies, we make it easy for customers to take control of their finances. Whether it's in a branch, at an ATM, over the phone with our 24-hour service centers - 13... -

Page 16

... customers for banking with us. Our START Smart savings program provides an incentive to save by rewarding customers for reaching incremental savings milestones. Small Business No two small businesses are alike, but each needs relevant and timely financial products and support to thrive. U.S. Bank... -

Page 17

- 15 - -

Page 18

"2015 required strong management focus and conviction as we balanced decisions about operating efficiencies with opportunities for investing in future growth." Richard K. Davis Chairman and Chief Executive Officer U.S. Bancorp U.S. BANCORP 2015 ANNUAL REPORT - 16 - -

Page 19

... Banking office in Dallas, Texas. Our average commercial loans grew 11 percent, and we saw record revenue in a number of areas. We also led more bond issuances and welcomed a growing number of foreign exchange customers. Finally, we brought Commercial Real Estate into Wholesale Banking, enabling us... -

Page 20

... goals so we can offer relevant support. U.S . BANCORP 2015 ANNUAL REPORT Our assets under management have grown to more than $124 billion. And U.S. Bank Wealth Management was once again ranked among the top 20 U.S. wealth managers by Barron's in 2015. SECURITIES SERVICES Made up of Corporate Trust... -

Page 21

..., our investments in the right people and products resulted in market share growth and industry accolades. In the U.S. we were the top trustee in market share in two of our three core categories, municipal and structured finance, and second in corporate transactions. Our Securities Services teams... -

Page 22

... and corporate customers. We also process payments and keep commerce alive through our merchant services division, Elavon, Inc., a wholly owned subsidiary. U.S . BANCORP 2015 ANNUAL REPORT #3 largest issuer of commercial purchasing cards in the United States1 - Retail Payment Services ranked #5 in... -

Page 23

...geolocation and Visa® TravelTag™ last year to help travelers use their cards with fewer issues related to fraud management, and we launched RealTime Rewards for our FlexPerks Rewards Cards members to instantly redeem earned rewards for purchases. And more is on the horizon for 2016. 2015 was busy... -

Page 24

...on the bottom line - the day-to-day transactions that keep a company running. But businesses wouldn't exist without the foundation of a community. That's why, since the day we first opened our doors for business, we've been deeply committed to our communities. U.S . BANCORP 2015 ANNUAL REPORT - 22... -

Page 25

... 2015 in community development lending and tax credit financing throughout the communities we serve. These activities go a long way in helping communities and residents find their possible by creating new jobs, rehabilitating historic buildings, building affordable and market-rate homes, developing... -

Page 26

... Home Play U.S . BANCORP 2015 ANNUAL REPORT "We strive to be a responsible steward of the environment and acknowledge that we have a responsibility to our customers, employees, investors and the communities that we serve to better understand the impact of our operations on global climate change... -

Page 27

... banks and non-banks; changes in customer behavior and preferences; breaches in data security; effects of mergers and acquisitions and related integration; effects of critical accounting policies and judgments; and management's ability to effectively manage credit risk, market risk, operational risk... -

Page 28

... and consumer lending, new credit card accounts and total deposits, by building momentum in its core business, particularly within Wealth Management and Securities Services and Payment Services, and by maintaining a very strong capital base. The Company's common equity tier 1 to risk-weighted assets... -

Page 29

...equity ... Period End Balances Loans ...Investment securities ...Assets ...Deposits ...Long-term debt ...Total U.S. Bancorp shareholders' equity ... Asset Quality Nonperforming assets ...Allowance for credit losses ...Allowance for credit losses as a percentage of period-end loans ... Capital Ratios... -

Page 30

... from sales of shares of Visa Inc. Class B common stock, a 2015 market valuation adjustment to write down the value of student loans during the period they were held for sale ("student loan market adjustment"), and lower mortgage banking revenue, partially offset by higher revenue in most other fee... -

Page 31

... One branch acquisitions, Wholesale Banking and Commercial Real Estate and corporate trust balances. Average time deposits for 2015 were $6.2 billion (14.9 percent) lower than 2014. Changes in time deposits are largely related to those deposits managed as an alternative to other wholesale funding... -

Page 32

..., including the impact of the Charter One branch acquisitions, Wholesale Banking and Commercial Real Estate, and Wealth Management and Securities Services balances. Average total savings deposits for 2014 were $15.2 billion (11.2 percent) higher than 2013, reflecting growth in Consumer and Small... -

Page 33

... 2014 2013 2015 v 2014 2014 v 2013 Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage... -

Page 34

...rates. Credit and debit card revenue and corporate payment products revenue increased 5.8 percent and 2.5 percent, respectively, primarily due to higher transaction volumes. Deposit service charges were 3.4 percent higher due to account growth, the Charter One branch acquisitions and pricing changes... -

Page 35

... return on plan assets due to 2015 actual and 2016 expected contributions, a higher discount rate and lower expected amortization due to recognition of prior losses. Because of the complexity of forecasting pension plan activities, the accounting methods utilized for pension plans, the Company... -

Page 36

...result of customers paying down balances in the second half of 2015. Average commercial real estate loans increased $1.8 billion (4.5 percent) in 2015, compared with 2014. Table 8 provides a summary of commercial real estate loans by property type and geographical location. The Company reclassifies... -

Page 37

... activity during 2015. Average residential mortgages were essentially flat in 2015, compared with 2014. Residential mortgages originated and placed in the Company's loan portfolio include well-secured jumbo mortgages and branch-originated first lien home equity loans to borrowers with high credit... -

Page 38

..., and home equity and second mortgages, partially offset by lower retail leasing and student loan balances. Of the total residential mortgages, credit card and other retail loans outstanding at December 31, 2015, approximately 73.4 percent were to customers located in the Company's primary banking... -

Page 39

...Mexico, Utah ...Total banking region ...Florida, Michigan, New York, Pennsylvania, Texas ...All other states ...Total outside Company's banking... 0 CREDIT CARD LOANS BY GEOGRAPHY 2015 At December 31 (Dollars in Millions) Loans Percent Loans 2014 Percent California ...Colorado ...Illinois ...Minnesota... -

Page 40

...time based upon various factors such as ongoing asset/ liability management activities, assessment of product profitability, credit risk, liquidity needs, and capital implications. If the Company's intent or ability to hold an existing portfolio loan changes, it is transferred to loans held for sale... -

Page 41

... and dividend income, and as collateral for public deposits and wholesale funding sources. While the Company intends to hold its investment securities indefinitely, it may sell available-for-sale securities in response to structural changes in the balance sheet and related interest rate risk and... -

Page 42

... a tax rate of 35 percent. Yields on available-for-sale and held-to-maturity investment securities are computed based on amortized cost balances, excluding any premiums or discounts recorded related to the transfer of investment securities at fair value from available-for-sale to held-to-maturity... -

Page 43

... with 2014, reflecting growth in Consumer and Small Business Banking, Wholesale Banking and Commercial Real Estate and Wealth Management and Securities Services balances, as well as the impact of the Charter One branch acquisitions. Interest-bearing time deposits at December 31, 2015, decreased... -

Page 44

... from fluctuations in interest rates, foreign exchange rates, and security prices that may result in changes in the values of financial instruments, such as trading and availablefor-sale securities, mortgage loans held for sale ("MLHFS"), MSRs and derivatives that are accounted for on a fair value... -

Page 45

... loans held by the Company that it considers to have a potential or well-defined weakness that may put full collection of contractual cash flows at risk. The Company's internal credit quality ratings for consumer loans are primarily based on delinquency and nonperforming status, except for a limited... -

Page 46

... credit commitments. The Company also engages in non-lending activities that may give rise to credit risk, including derivative transactions for balance sheet hedging purposes, foreign exchange transactions, deposit overdrafts and interest rate swap contracts for customers, investments in securities... -

Page 47

... lease financing, agricultural credit, warehouse mortgage lending, small business lending, commercial real estate, health care and correspondent banking. The Company also offers an array of consumer lending products, including residential mortgages, credit card loans, auto loans, retail leases, home... -

Page 48

... include only loans originated according to the Company's underwriting programs specifically designed to serve customers with weakened credit histories. The sub-prime designation indicators have been and will continue to be subject to reevaluation over time as borrower characteristics, payment - 46... -

Page 49

... 31, 2015 relate to cards originated through the Company's branches or cobranded, travel and affinity programs that generally experience better credit quality performance than portfolios generated through other channels. Tables 9, 10 and 11 provide a geographical summary of the residential mortgage... -

Page 50

... 31, 2015, 2014, 2013, 2012, and 2011, respectively. Loan Delinquencies Trends in delinquency ratios are an indicator, among other considerations, of credit risk within the Company's loan portfolios. The entire balance of an account is considered delinquent if the minimum payment contractually... -

Page 51

... of Ending Loan Balances 2015 2014 The following tables provide further information on residential mortgages and home equity and second mortgages as a percent of ending loan balances by borrower type at December 31: Residential mortgages (a) 2015 2014 Prime Borrowers 30-89 days ...90 days or... -

Page 52

.... Credit card and other retail loan TDRs are generally part of distinct restructuring programs providing customers modification solutions over a specified time period, generally up to 60 months. In accordance with regulatory guidance, the Company considers secured consumer loans that have had debt... -

Page 53

... temporary hardships. Consumer lending programs include payment reductions, deferrals of up to three past due payments, and the ability to return to current status if the borrower makes required payments. The Company may also make short-term modifications to commercial lending loans, with the most... -

Page 54

...Millions) 2015 2014 2013 2012 2011 Commercial Commercial ...Lease financing ...Total commercial ...Commercial Real Estate Commercial mortgages ...Construction and development ...Total commercial real estate ...Residential Mortgages(b) ...Credit Card ...Other Retail Retail leasing ...Home equity and... -

Page 55

... location detail for residential (residential mortgage, home equity and second mortgage) and commercial (commercial and commercial real estate) loan balances: At December 31 (Dollars in Millions) Amount 2015 2014 As a Percent of Ending Loan Balances 2015 2014 Residential Minnesota ...Illinois... -

Page 56

... residential mortgages and home equity and second mortgages by borrower type: Year Ended December 31 (Dollars in Millions) Average Loans 2015 2014 Percent of Average Loans 2015 2014 Residential Mortgages Prime borrowers ...Sub-prime borrowers ...Other borrowers ...Loans purchased from GNMA mortgage... -

Page 57

... home equity loans and lines in a junior lien position. The Company also considers information received from its primary regulator on the status of the first liens that are serviced by other large servicers in the industry and the status of first lien mortgage accounts reported on customer credit... -

Page 58

... 1 8 SUMMARY OF ALLOWANCE FOR CREDIT LOSSES (Dollars in Millions) 2015 2014 2013 2012 2011 Balance at beginning of year ...Charge-Offs Commercial Commercial ...Lease financing ...Total commercial ...Commercial real estate Commercial mortgages ...Construction and development ...Total commercial real... -

Page 59

...; changes in lending policy, underwriting standards, internal review and other relevant business practices; and the regulatory environment. The consideration of these items results in adjustments to allowance amounts included in the Company's allowance for credit losses for each of the above loan... -

Page 60

... operational risks. Each business unit of the Company is required to develop, maintain and test these plans at least annually to ensure that recovery activities, if needed, can support mission critical functions, including technology, networks and data centers supporting customer applications and... -

Page 61

...balance sheet, implementing certain pricing strategies for loans and deposits and through the selection of derivatives and various funding and investment portfolio strategies. The Company manages the overall interest rate risk profile within policy limits. The ALCO policy limits the estimated change... -

Page 62

...to interest rate risk, the Company is exposed to other forms of market risk, principally related to trading activities which support customers' strategies to manage their own foreign currency, interest rate risk and funding activities. For purposes of its internal capital adequacy assessment process... -

Page 63

...'s funding and liquidity risk to meet its daily funding needs and to address expected and unexpected changes in its funding requirements. The Company engages in various activities to manage its liquidity risk. These activities include diversifying its funding sources, stress testing, and holding... -

Page 64

...available for additional borrowings. T A B L E 2 1 DEBT RATINGS Standard & Poor's Dominion Bond Rating Service Moody's Fitch U.S. Bancorp Long-term issuer rating ...Short-term issuer rating ...Senior unsecured debt ...Subordinated debt ...Junior subordinated debt ...Preferred stock ...Commercial... -

Page 65

... statement filed with the United States Securities and Exchange Commission under these rules is limited by the debt issuance authority granted by the Company's Board of Directors and/or the ALCO policy. At December 31, 2015, parent company long-term debt outstanding was $11.5 billion, compared with... -

Page 66

... retail lending services in Europe. While the Company does not offer commercial lending services in Europe, it does provide financing to domestic multinational corporations that generate revenue from customers in European countries and provides a limited number of corporate credit cards in Europe to... -

Page 67

... from securities lending activities in which indemnifications are provided to customers; indemnification or buy-back provisions related to sales of loans and tax credit investments; merchant charge-back guarantees through the Company's involvement in providing merchant processing services; and... -

Page 68

... requirement for banks calculating capital adequacy using advanced approaches under Basel III. The SLR is defined as tier 1 capital divided by total leverage exposure, which includes both on- and off-balance sheet exposures. At December 31, 2015, the Company's SLR exceeds the applicable minimum SLR... -

Page 69

... of risk-weighted assets ...Tier 1 capital as a percent of adjusted quarterly average assets (leverage ratio) ...* Not applicable. FOURTH QUARTER SUMMARY The Company reported net income attributable to U.S. Bancorp of $1.5 billion for the fourth quarter of 2015, or $0.80 per diluted common share... -

Page 70

... by fee revenue growth and the HSA deposit sale. The fee revenue growth reflected higher credit and debit card revenue, trust and investment management fees and merchant processing services revenue, partially offset by a decrease in mortgage banking revenue, primarily due to an unfavorable change in... -

Page 71

...the fourth quarter of 2014. LINE OF BUSINESS FINANCIAL REVIEW The Company's major lines of business are Wholesale Banking and Commercial Real Estate, Consumer and Small Business Banking, Wealth Management and Securities Services, Payment Services, and Treasury and Corporate Support. These operating... -

Page 72

T A B L E 2 5 LINE OF BUSINESS FINANCIAL PERFORMANCE Wholesale Banking and Commercial Real Estate Year Ended December 31 (Dollars in Millions) 2015 2014 Percent Change Consumer and Small Business Banking 2015 2014 Percent Change Condensed Income Statement Net interest income (taxable-equivalent ... -

Page 73

Wealth Management and Securities Services 2015 2014 Percent Change 2015 Payment Services 2014 Percent Change Treasury and Corporate Support 2015 2014 Percent Change 2015 Consolidated Company 2014 Percent Change $ 386 1,466 - 1,852 1,420 28 1,448 404 - 404 147 257 - $ 383 1,396 - 1,779 1,343 ... -

Page 74

Wholesale Banking and Commercial Real Estate Wholesale Banking and Commercial Real Estate offers lending, equipment finance and small-ticket leasing, depository services, treasury management, capital markets, international trade services and other financial services to middle market, large corporate... -

Page 75

... in 2015, compared with 3.11 percent in 2014. Treasury and Corporate Support Treasury and Corporate Support includes the Company's investment portfolios, most covered commercial and commercial real estate loans and related OREO, funding, capital management, interest rate risk management, income... -

Page 76

...) 2015 2014 2013 2012 2011 Total equity ...$ 46,817 Preferred stock ...(5,501) Noncontrolling interests ...(686) Goodwill (net of deferred tax liability)(1) ...(8,295) Intangible assets, other than mortgage servicing rights ...(838) Tangible common equity(a) ...Tangible common equity (as calculated... -

Page 77

... the estimated business cycle of a loan, may not change to the same degree as net charge-offs. Because risk ratings and inherent loss ratios primarily drive the allowance specifically allocated to commercial lending segment loans, the degree of change in the commercial lending allowance may differ... -

Page 78

... with applicable accounting principles generally accepted in the United States. These include all of the Company's available-for-sale investment securities, derivatives and other trading instruments, MSRs and MLHFS. The estimation of fair value also affects other loans held for sale, which... -

Page 79

... loss sharing agreements, and specific industry and market conditions that may impact discount rates and independent third party appraisals. On an ongoing basis, the accounting for purchased loans and related indemnification assets follows applicable authoritative accounting guidance for purchased... -

Page 80

and limitations related to certain types of assets including MSRs, purchased credit card relationship intangibles, and capital markets activity in the Company's Wholesale Banking and Commercial Real Estate segment. The Company does not assign corporate assets and liabilities to reporting units that ... -

Page 81

... under the Securities Exchange Act of 1934. The Company's system of internal control is designed to provide reasonable assurance regarding the reliability of financial reporting and the preparation of publicly filed financial statements in accordance with accounting principles generally accepted in... -

Page 82

...its cash flows for each of the three years in the period ended December 31, 2015, in conformity with U.S. generally accepted accounting principles. We also have audited, in accordance with the standards of the Public Company Accounting Oversight Board (United States), U.S. Bancorp's internal control... -

Page 83

... 31, 2015 and 2014, and the related consolidated statements of income, comprehensive income, shareholders' equity, and cash flows for each of the three years in the period ended December 31, 2015 and our report dated February 25, 2016 expressed an unqualified opinion thereon. Minneapolis, Minnesota... -

Page 84

... Accounting Policies ...Note 2 - Accounting Changes ...Note 3 - Business Combinations ...Note 4 - Restrictions on Cash and Due From Banks ...Note 5 - Investment Securities ...Note 6 - Loans and Allowance for Credit Losses ...Note 7 - Leases ...Note 8 - Accounting for Transfers and Servicing... -

Page 85

...(b) ...Total deposits ...Short-term borrowings ...Long-term debt ...Other liabilities ...Total liabilities ...Shareholders' equity Preferred stock ...Common stock, par value $0.01 a share - authorized: 4,000,000,000 shares; issued: 2015 and 2014 - 2,125,725,742 shares ...Capital surplus ...Retained... -

Page 86

... losses ... Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage... -

Page 87

... and losses on securities available-for-sale ...Other-than-temporary impairment not recognized in earnings on securities available-for-sale ...Changes in unrealized gains and losses on derivative hedges ...Foreign currency translation ...Changes in unrealized gains and losses on retirement plans... -

Page 88

...Income (Loss) Equity Interests (Dollars and Shares in Millions) Capital Surplus Retained Earnings Total Equity Balance December 31, 2012 ...Net income (loss) ...Other comprehensive income (loss) . . Redemption of preferred stock ...Preferred stock dividends ...Common stock dividends ...Issuance... -

Page 89

... sales of loans ...Purchases of loans ...Acquisitions, net of cash acquired ...Other, net ...Net cash used in investing activities ... Financing Activities Net increase in deposits ...Net (decrease) increase in short-term borrowings ...Proceeds from issuance of long-term debt ...Principal payments... -

Page 90

... and depository services through banking offices principally in the Midwest and West regions of the United States. The Company also engages in credit card, merchant, and ATM processing, mortgage banking, insurance, trust and investment management, brokerage, and leasing activities, principally in... -

Page 91

... for cash collateral paid or received. EQUITY INVESTMENTS IN OPERATING ENTITIES classes within the consumer lending segment are residential mortgages, credit card loans and other retail loans. The covered loan segment consists of only one class. The Company's accounting methods for loans differ... -

Page 92

... to risk rated loan portfolios, the Company currently examines up to a 15-year period of loss experience. For each loan type, this historical loss experience is adjusted as necessary to consider any relevant changes in portfolio composition, lending policies, underwriting standards, risk management... -

Page 93

... properties are generally charged down to the fair value of the collateral securing the loan, less costs to sell, at 180 days past due, and placed on nonaccrual status in instances where a partial charge-off occurs unless the loan is well secured and in the process of collection. Loans and lines... -

Page 94

...the Company's rating scale for problem credits, as minimal credit risk has been identified. Special mention loans are those that have a potential weakness deserving management's close attention. Classified loans are those where a well-defined weakness has been identified that may put full collection... -

Page 95

... in value along with holding costs, such as taxes and insurance, are reported in noninterest expense. LOANS HELD FOR SALE Loans held for sale ("LHFS") represent mortgage loans intended to be sold in the secondary market and other loans that management has an active plan to sell. LHFS are carried at... -

Page 96

...and account management fees are recognized as transactions occur or services are provided, except for annual fees which are recognized over the applicable period. Volume-related payments to partners and credit card associations and costs for rewards programs are also recorded within credit and debit... -

Page 97

... Wholesale Banking and Commercial Real Estate customers including standby letter of credit fees, non-yield related loan fees, capital markets related revenue and nonyield related leasing revenue. These fees are recognized as earned or as transactions occur and services are provided. Mortgage Banking... -

Page 98

... applicable to U.S. Bancorp common shareholders by the weighted average number of common shares outstanding. Diluted earnings per common share is calculated by adjusting income and outstanding shares, assuming conversion of all potentially dilutive securities. N O T E 2 ACCOUNTING CHANGES Revenue... -

Page 99

...discounts and credit-related other-than-temporary impairment. (b) Available-for-sale investment securities are carried at fair value with unrealized net gains or losses reported within accumulated other comprehensive income (loss) in shareholders' equity. (c) Prime securities are those designated as... -

Page 100

...each investment security. The total amount of other-than-temporary impairment recorded was immaterial for the years ended December 31, 2015, 2014 and 2013. Changes in the credit losses on debt securities are summarized as follows: Year Ended December 31 (Dollars in Millions) 2015 2014 2013 Balance... -

Page 101

... and political subdivisions ...Corporate debt securities ...Perpetual preferred securities ...Other investments ...Total available-for-sale ... (a) The Company had $5 million of unrealized losses on residential non-agency mortgage-backed securities. Credit-related other-than-temporary impairment... -

Page 102

... development ...Total commercial real estate ... Residential Mortgages Residential mortgages ...Home equity loans, first liens ...Total residential mortgages ...Credit Card ... Other Retail Retail leasing ...Home equity and second mortgages ...Revolving credit ...Installment ...Automobile ...Student... -

Page 103

... loss exposure to the Company because those losses are recoverable under loss sharing agreements with the FDIC. Activity in the allowance for credit losses by portfolio class was as follows: Commercial Real Estate Residential Mortgages Credit Card Other Retail Total Loans, Excluding Covered Loans... -

Page 104

...allowance for credit losses by portfolio class was as follows: Commercial Real Estate Residential Mortgages Credit Card Other Retail Total Loans, Excluding Covered Loans Covered Loans Total Loans (Dollars in Millions) Commercial Allowance Balance at December 31, 2015 Related to Loans individually... -

Page 105

... to mortgage loans whose payments are primarily insured by the Federal Housing Administration or guaranteed by the Department of Veterans Affairs. In addition, the amount of residential mortgage loans secured by residential real estate in the process of foreclosure at December 31, 2015 and 2014, was... -

Page 106

... and TDR loans, by portfolio class was as follows: Period-end Recorded Investment(a) Unpaid Principal Balance Commitments to Lend Additional Funds (Dollars in Millions) Valuation Allowance December 31, 2015 Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other... -

Page 107

... for the years ended December 31 follows: Average Recorded Investment Interest Income Recognized (Dollars in Millions) 2015 Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Total loans, excluding GNMA and covered loans ...Loans purchased from GNMA... -

Page 108

... a summary of loans modified as TDRs for the years ended December 31, by portfolio class: Pre-Modification Outstanding Loan Balance Post-Modification Outstanding Loan Balance (Dollars in Millions) Number of Loans 2015 Commercial ...Commercial real estate ...Residential mortgages ...Credit card... -

Page 109

...defaults in the table above, for the year ended December 31, 2015, the Company had a total of 1,885 residential mortgage loans, home equity and second mortgage loans and loans purchased from GNMA mortgage pools with aggregate outstanding balances of $252 million where borrowers did not successfully... -

Page 110

... occurs after the date of acquisition, the Company records an allowance for credit losses. The components of the net investment in sales-type and direct financing leases at December 31 were as follows: (Dollars in Millions) 2015 2014 Aggregate future minimum lease payments to be received... -

Page 111

... returns and provides credit, liquidity and remarketing arrangements to the program. As a result, the Company has consolidated the program's entities. At December 31, 2015, $2.3 billion of available-for-sale investment securities and $2.2 billion of short-term borrowings on the Consolidated Balance... -

Page 112

...ended December 31, 2015, 2014 and 2013, respectively. Loan servicing fees, not including valuation changes, included in mortgage banking revenue, were $728 million, $732 million and $754 million for the years ended December 31, 2015, 2014 and 2013, respectively. Changes in fair value of capitalized... -

Page 113

... Life(a) Amortization Method(b) (c) Balance 2015 2014 Goodwill ...Merchant processing contracts ...Core deposit benefits ...Mortgage servicing rights ...Trust relationships ...Other identified intangibles ...Total ... 8 years/8 years 22 years/5 years 10 years/6 years 8 years/4 years SL/AC SL... -

Page 114

... value of goodwill for the years ended December 31, 2015, 2014 and 2013: (Dollars in Millions) Wholesale Banking and Commercial Real Estate Consumer and Small Business Banking Wealth Management and Securities Services Payment Services Treasury and Corporate Support Consolidated Company Balance at... -

Page 115

...Trust Securities ("ITS") to third party investors, originally investing the proceeds in junior subordinated debt securities ("Debentures") issued by the Company and entering into stock purchase contracts to purchase preferred stock in the future. During 2010, the Company exchanged depositary shares... -

Page 116

... SHAREHOLDERS' EQUITY At December 31, 2015 and 2014, the Company had authority to issue 4 billion shares of common stock and 50 million shares of preferred stock. The Company had 1.7 billion and 1.8 billion shares of common stock outstanding at December 31, 2015 and 2014, respectively. The Company... -

Page 117

... may yet be purchased by the Company under the current Board of Directors approved authorization was $1.3 billion. The following table summarizes the Company's common stock repurchased in each of the last three years: (Dollars and Shares in Millions) Shares Value 2015 ...2014 ...2013 ... 52 54 65... -

Page 118

...Securities Securities Transferred From Available-For- Available-For-Sale to Sale Held-To-Maturity (Dollars in Millions) Unrealized Gains (Losses) on Derivative Hedges Unrealized Gains (Losses) on Retirement Plans Foreign Currency Translation Total 2015 Balance at beginning of period ...Changes... -

Page 119

... for calculating risk-weighted assets: a general standardized approach and more risk-sensitive advanced approaches, with the Company's capital adequacy being evaluated against the methodology that is most restrictive. Tier 1 capital is considered core capital and includes common shareholders' equity... -

Page 120

... Corp., a real estate investment trust, for the purpose of issuing 5,000 shares of Fixed-to-Floating Rate Exchangeable Noncumulative Perpetual Series A Preferred Stock with a liquidation preference of $100,000 per share ("Series A Preferred Securities") to third party investors. Dividends on the... -

Page 121

... per share were: Year Ended December 31 (Dollars and Shares in Millions, Except Per Share Data) 2015 2014 2013 Net income attributable to U.S. Bancorp ...Preferred dividends ...Impact of preferred stock redemption(a) ...Earnings allocated to participating stock awards ...Net income applicable to... -

Page 122

... $ - (19) Change In Fair Value Of Plan Assets Fair value at beginning of measurement period ...Actual return on plan assets ...Employer contributions ...Participants' contributions ...Lump sum settlements(a) ...Benefit payments ...Fair value at end of measurement period ... Funded (Unfunded) Status... -

Page 123

... (loss) for the years ended December 31 for the retirement plans: Pension Plans (Dollars in Millions) 2015 2014 2013 Postretirement Welfare Plan 2015 2014 2013 Components Of Net Periodic Benefit Cost Service cost ...Interest cost ...Expected return on plan assets ...Prior service cost (credit) and... -

Page 124

... and 6.8 years, respectively, for 2015, and 14.6, 11.5 and 6.4 years, respectively, for 2014. (b) With the help of an independent pension consultant, the Company considers several sources when developing its expected long-term rates of return on plan assets assumptions, including, but not limited to... -

Page 125

... 2014 Other 2013 Debt Securities Other Balance at beginning of period ...Unrealized gains (losses) relating to assets still held at end of year ...Purchases, sales, and settlements, net ...Balance at end of period ... $2 (1) - $1 $4 (2) - $2 $7 - (7) $- $3 - 1 $4 The following benefit payments... -

Page 126

... options granted and the assumptions utilized by the Company for newly issued grants: 2015 2014 2013 Estimated fair value ...Risk-free interest rates ...Dividend yield ...Stock volatility factor ...Expected life of options (in years) ... $12.23 1.7% 2.6% .37 5.5 $11.38 1.7% 2.6% .38 5.5 $12.13... -

Page 127

... of options. The risk-free interest rate for the expected life of the options is based on the U.S. Treasury yield curve in effect on the date of grant. The expected dividend yield is based on the Company's expected dividend yield over the life of the options. 2015 2014 2013 Fair value of options... -

Page 128

... on securities available-for-sale, derivative instruments in cash flow hedges, foreign currency translation adjustments, pension and postretirement plans and certain tax benefits related to stock options are recorded directly to shareholders' equity as part of other comprehensive income (loss). In... -

Page 129

...(212) (90) (165) (159) (5,311) (101) $(1,727) Deferred Tax Liabilities Leasing activities ...Mortgage servicing rights ...Goodwill and other intangible assets ...Loans ...Fixed assets ...Securities available-for-sale and financial instruments ...Other deferred tax liabilities, net ...Gross deferred... -

Page 130

... in foreign currency exchange rates. The ineffectiveness on all net investment hedges was not material for the year ended December 31, 2015. There were no nonderivative debt instruments designated as net investment hedges at December 31, 2015 or 2014. Other Derivative Positions The Company enters... -

Page 131

... short-term underwriting purchase and sale commitments with total asset and liability notional values of $36 million and $58 million at December 31, 2015 and 2014, respectively, and derivative liability swap agreements related to the sale of a portion of the Company's Class B common shares of Visa... -

Page 132

... Maturity In Years (Dollars in Millions) Notional Value Fair Value Notional Value Fair Value December 31, 2015 Interest rate contracts Receive fixed/pay floating swaps ...Pay fixed/receive floating swaps ...Options Purchased ...Written ...Futures Buy ...Sell ...Foreign exchange rate contracts... -

Page 133

... Interest rate contracts(a) ...Net investment hedges Foreign exchange forward contracts ...$ (15) 101 $ (26) 130 $ 25 (45) $(120) - $(115) - $(118) - Note: Ineffectiveness on cash flow and net investment hedges was not material for the years ended December 31, 2015, 2014 and 2013. (a) Gains (Losses... -

Page 134

..., through a single payment and in a single currency. Collateral arrangements require the counterparty to deliver collateral (typically cash or U.S. Treasury and agency securities) equal to the Company's net derivative receivable, subject to minimum transfer and credit rating requirements. The... -

Page 135

... securities. The securities loaned or borrowed typically are corporate debt securities traded by the Company's brokerdealer. In general, the securities transferred can be sold, repledged or otherwise used by the party in possession. No restrictions exist on the use of cash collateral by either party... -

Page 136

... Derivatives, trading and available-for-sale investment securities, MSRs and substantially all MLHFS are recorded at fair value on a recurring basis. Additionally, from time to time, the Company may be required to record at fair value other assets on a nonrecurring basis, such as loans held for sale... -

Page 137

... input, processing, and reporting components. All models are required to be independently reviewed and approved prior to being placed in use, and are subject to formal change control procedures. Under the Company's Model Risk Governance Policy, models are required to be reviewed at least annually to... -

Page 138

... foreign exchange rates and volatility. In addition, all derivative values incorporate an assessment of the risk of counterparty nonperformance, measured based on the Company's evaluation of credit risk as well as external assessments of credit risk, where available. The Company monitors and manages... -

Page 139

... the Company or the purchaser of the Visa Inc. Class B common shares when there are changes in the conversion rate of the Visa Inc. Class B common shares to Visa Inc. Class A common shares, as well as quarterly payments to the purchaser based on specified terms of the agreements. Management reviews... -

Page 140

... measurement of the Company's modeled Level 3 available-for-sale investment securities are prepayment rates, probability of default and loss severities associated with the underlying collateral, as well as the discount margin used to calculate the present value of the projected cash flows. Increases... -

Page 141

... loan close rate ...Inherent MSR value (basis points per loan) ... 9% 30 100% 196 79% 120 The significant unobservable input used in the fair value measurement of certain of the Company's asset/liability and customer-related derivatives is the credit valuation adjustment related to the risk... -

Page 142

... of foreign governments ...Corporate debt securities ...Perpetual preferred securities ...Other investments ...Total available-for-sale ...Mortgage loans held for sale ...Mortgage servicing rights ...Derivative assets ...Other assets ...Total ...Derivative liabilities ...Short-term borrowings... -

Page 143

... Principal Sales Payments Issuances Settlements 2015 Available-for-sale securities Mortgage-backed securities Residential non-agency Prime(a) ...Non-prime(b) ...Asset-backed securities Other ...Corporate debt securities ...Total available-for-sale ...Mortgage servicing rights ...Net derivative... -

Page 144

... with deposit, credit card, merchant processing and trust customers, other purchased intangibles, premises and equipment, deferred taxes and other liabilities. Additionally, in accordance with the disclosure guidance, insurance contracts and investments accounted for under the equity method are... -

Page 145

...through reductions to the conversion ratio applicable to the Class B shares held by Visa U.S.A. member banks, Visa Inc. has funded an escrow account for the benefit of member financial institutions to fund their indemnification obligations associated with the Visa Litigation. The receivable related... -

Page 146

... third party. The guarantees frequently support public and private borrowing arrangements, including commercial paper issuances, bond financings and other similar transactions. The Company also issues and confirms commercial letters of credit on behalf of customers to ensure payment or collection in... -

Page 147

... future payments guaranteed by the Company under these arrangements were approximately $8 million at December 31, 2015. Commitments from Securities Lending The Company participates in securities lending activities by acting as the customer's agent involving the loan of securities. The Company... -

Page 148

... risk, the Company may require the merchant to make an escrow deposit, place maximum volume limitations on future delivery transactions processed by the merchant at any point in time, or require various credit enhancements (including letters of credit and bank guarantees). Also, merchant processing... -

Page 149

...the Office of Foreign Assets Control. In October 2015, the Company entered into a Consent Order with the Office of the Comptroller of the Currency (the "OCC") concerning deficiencies in its Bank Secrecy Act/anti-money laundering compliance program, and requiring an ongoing review of that program. If... -

Page 150

...E 2 4 U.S. BANCORP (PARENT COMPANY) CONDENSED BALANCE SHEET At December 31 (Dollars in Millions) 2015 2014 Assets Due from banks, principally interest-bearing ...Available-for-sale securities ...Investments in bank subsidiaries ...Investments in nonbank subsidiaries ...Advances to bank subsidiaries... -

Page 151

... from banks at beginning of year ...Cash and due from banks at end of year ... Transfer of funds (dividends, loans or advances) from bank subsidiaries to the Company is restricted. Federal law requires loans to the Company or its affiliates to be secured and generally limits loans to the Company or... -

Page 152

U.S. Bancorp Consolidated Balance Sheet - Five Year Summary (Unaudited) At December 31 (Dollars in Millions) 2015 2014 2013 2012 2011 % Change 2015 v 2014 Assets Cash and due from banks ...Held-to-maturity securities ...Available-for-sale securities ...Loans held for sale ...Loans ...Less allowance... -

Page 153

... losses ... Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage... -

Page 154

... losses ... Noninterest Income Credit and debit card revenue ...Corporate payment products revenue ...Merchant processing services ...ATM processing services ...Trust and investment management fees ...Deposit service charges ...Treasury management fees ...Commercial products revenue ...Mortgage... -

Page 155

U.S. Bancorp Supplemental Financial Data (Unaudited) Earnings Per Common Share Summary 2015 2014 2013 2012 2011 Earnings per common share ...Diluted earnings per common share ...Dividends declared per common share ...Ratios $ 3.18 3.16 1.010 1.44% 14.0 11.0 31.8 1,745 $ 3.10 3.08 .965 1.54% 14... -

Page 156

... Rates Average Balances 2014 Yields and Rates Year Ended December 31 (Dollars in Millions) Interest Assets Investment securities ...Loans held for sale ...Loans(b) Commercial ...Commercial real estate ...Residential mortgages ...Credit card ...Other retail ...Total loans, excluding covered loans... -

Page 157

2013 Average Balances Yields and Rates Average Balances 2012 Yields and Rates Average Balances 2011 Yields and Rates 2015 v 2014 % Change Average Balances Interest Interest Interest $ 75,046 5,723 67,274 38,237 47,982 16,813 47,125 217,431 10,043 227,474 6,896 315,139 (4,... -

Page 158

...Bank Holding Company Act of 1956. The Company provides a full range of financial services, including lending and depository services, cash management, capital markets, and trust and investment management services. It also engages in credit card services, merchant and ATM processing, mortgage banking... -

Page 159

... time. Violations of laws and regulations or deemed deficiencies in risk management practices also may be incorporated into the Company's bank supervisory ratings. A downgrade in these ratings, or other regulatory actions and settlements, such as the October 2015 Consent Order, can limit the Company... -

Page 160

... its mortgage lending and servicing businesses The Company is subject to investigations, examinations and inquiries by government agencies and bank regulators concerning mortgage-related practices, including those related to compliance with selling guidelines relating to residential home loans sold... -

Page 161

... of loans and debt securities it holds The Company's business activities and earnings are affected by general business conditions in the United States and abroad, including factors such as the level and volatility of short-term and long-term interest rates, inflation, home prices, unemployment and... -

Page 162

...securities and other investment vehicles (including mutual funds) generally pay higher rates of return than financial institutions, because of the absence of federal insurance premiums and reserve requirements. Further downgrades in the U.S. government's sovereign credit rating could result in risks... -

Page 163

... in real estate values and underlying economic conditions in California could result in significantly higher credit losses to the Company. Changes in interest rates can impact the value of the Company's mortgage servicing rights and mortgages held for sale, and can make its mortgage banking revenue... -

Page 164

... and expands its internal usage of web-based products and applications. In addition, the Company's customers often use their own devices, such as computers, smart phones and tablets, to make payments and manage their accounts. The Company has limited ability to assure the safety and security of its... -

Page 165

... ways that customers can make payments or manage their accounts, such as through the use of digital wallets or digital currencies. The Company's continued success depends, in part, upon its ability to address customer needs by using technology to provide products and services that customers want to... -

Page 166

... array of financial products and services at more competitive prices. The Company competes with other commercial banks, savings and loan associations, mutual savings banks, finance companies, mortgage banking companies, credit unions, investment companies, credit card companies, and a variety of... -

Page 167

... other capital investments in the Company's businesses may not produce expected growth in earnings anticipated at the time of the expenditure. The Company might not be successful in developing or introducing new products and services, adapting to changing customer preferences and spending and saving... -

Page 168

... this Annual Report. Changes in accounting standards could materially impact the Company's financial statements From time to time, the Financial Accounting Standards Board and the United States Securities and Exchange Commission change the financial accounting and reporting standards that govern the... -

Page 169

... Income and Capital Markets, of U.S. Bancorp, having served as Executive Vice President, Credit Fixed Income, of U.S. Bancorp from May 2009 to March 2014. Prior to that time, he held various leadership positions with Wells Fargo Securities from 2003 to 2009, and with Bank of America Securities from... -

Page 170

... President and Chief Credit Officer of U.S. Bancorp. Mr. Runkel, 39, has served in this position since December 2013. From February 2011 until December 2013, he served as Senior Vice President and Credit Risk Group Manager of U.S. Bancorp Retail and Payment Services Credit Risk Management, having... -

Page 171

...) Retired Chairman and Chief Executive Officer Hormel Foods Corporation (Consumer food products) 1. 2. 3. 4. 5. 6. Executive Committee Compensation and Human Resources Committee Audit Committee Community Reinvestment and Public Policy Committee Governance Committee Risk Management Committee - 169... -

Page 172

... click on About U.S. Bank. Mail At your request, we will mail to you our quarterly earnings, news releases, quarterly ï¬nancial data reported on Form 10-Q, Form 10-K and additional copies of our annual reports. Please contact: U.S. Bancorp Investor Relations 800 Nicollet Mall Minneapolis, MN 55402... -

Page 173

... Progres pportunities Connections Ethics Goals Growth cies Commerce Communities Value Leadership nowledge Progress Security Life Expansion Leg cs Goals Growth Hope Ideas Innovation Integ merce Communities Value Leadership Opportu U.S. Bancorp 800 Nicollet Mall Minneapolis, MN 55402 USBANK.COM...