Tesco 2000 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2000 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC

2

operating and financial review

This operating and financial review analyses

the performance of Tesco in the financial

year ended 26 February 2000. It also

explains certain other aspects of the

Group’s results and operations including

taxation and treasury management.

Group performance

Group sales including VAT increased by 9.8% to £20,358m

(1999 – £18,546m).

Group profit before tax rose by 10.8% to £933m. Excluding

the net loss on disposal of fixed assets, goodwill amortisation and

integration costs, Group profit before tax increased 8.4% to £955m.

Group capital expenditure was £1,488m (1999 – £1,067m)

with £989m in the UK, including £579m on new stores and £182m

on extensions and refits. Total international capital expenditure was

£499m including £186m in Asia. In the year ahead we see Group

capital expenditure increasing to £1.6bn.

Group net debt in the year increased by £340m to £2,060m

(1999 – £1,720m), with gearing increasing to 43% (1999 – 39%).

Group interest and taxation

Net interest payable was £99m (1999 – £90m). Interest on our

additional borrowings, reflecting the cost of our investment plans,

was partially offset by lower interest rates.

Corporation tax has been charged at an effective rate of 27.8%

(1999 – 28.1%). Prior to accounting for the net loss on disposal

of fixed assets, integration costs and goodwill amortisation, our

underlying tax rate was 27.4% (1999 – 27.8%).

Shareholder returns and dividends

Adjusted diluted earnings per share (excluding the net loss on

disposal of fixed assets, integration costs and goodwill amortisation)

increased by 8.6% to 10.18p (1999 – 9.37p).

The Board has proposed a final net dividend of 3.14p giving a

total dividend for the year of 4.48p (1999 – 4.12p). This represents

an increase of 8.7% and dividend cover has been maintained at

2.27 times.

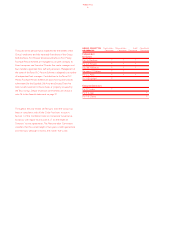

1996 1997 1998 1999 2000

13,028

14,984

17,447*

18,546

20,358

£m

Group sales

UK retail sales

GROUP PERFORMANCE

14,024

15,799*

17,070

2000 1999 Change

Group summary £m £m %

Group sales

(including value added tax) 20,358 18,546 9.8

Group operating profit

(prior to integration costs

and goodwill amortisation) 1,043 965 8.1

Profit on ordinary activities before tax†955 881 8.4

Adjusted diluted earnings per share†10.18p 9.37p 8.6

Dividend per share 4.48p 4.12p 8.7

† Excluding net loss on disposal of fixed assets,

integration costs and goodwill amortisation

*52 weeks pro forma

1996 1997 1998 1999 2000

666

758

841

1,067

1,488

£m

Group

UK

CAPITAL EXPENDITURE

TESCO SHARE PRICE

18,331

12,430

848

757

682

608

989

Feb 00Dec 99Oct 99Jun 99Mar 99

177.0

169.0

Pence