Tesco 2000 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2000 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC

32

notes to the financial statementscontinued

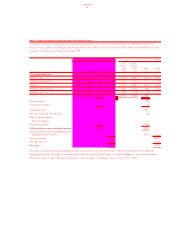

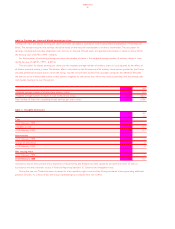

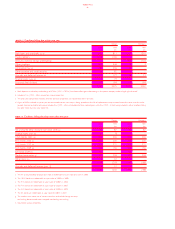

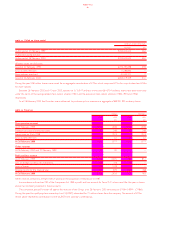

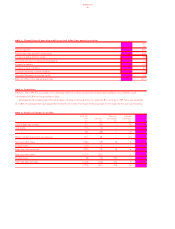

NOTE 19 Net debt

Group Company

2000 1999 2000 1999

£m £m £m £m

Due within one year: Bank and other loans 832 811 1,327 1,341

Finance leases 15 19 – –

Due within one to two years: Bank and other loans 266 137 127 127

Finance leases 13 4 – –

Due within two to five years: Bank and other loans 272 477 272 465

Finance leases 11 4 – –

Due wholly or in part by instalments after five years:

Finance leases 27 – – –

Due otherwise than by instalments after five years:

Bank and other loans 970 596 1,093 596

Gross debt 2,406 2,048 2,819 2,529

Less: Cash at bank and in hand 88 127 – –

Money market investments and deposits 258 201 21 2

Net debt 2,060 1,720 2,798 2,527

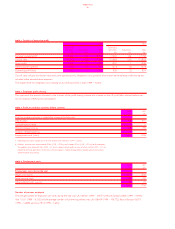

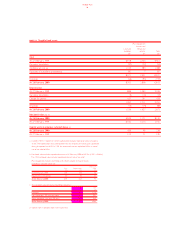

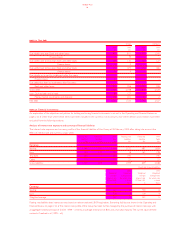

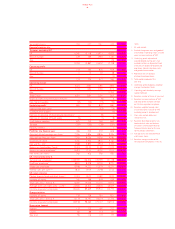

NOTE 20 Financial instruments

An explanation of the objectives and policies for holding and issuing financial instruments is set out in the Operating and Financial Review on

pages 2 to 6. Other than where these items have been included in the currency risk disclosures, short-term debtors and creditors have been

excluded from the following analyses.

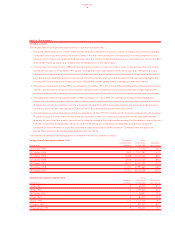

Analysis of interest rate exposure and currency of financial liabilities

The interest rate exposure and currency profile of the financial liabilities of the Group at 26 February 2000 after taking into account the

effect of interest rate and currency swaps were:

Floating rate Fixed rate 2000 Floating rate Fixed rate 1999

liabilities liabilities Total liabilities liabilities Total

£m £m £m £m £m £m

Currency

Sterling 1,186 512 1,698 1,172 487 1,659

Euro 104 147 251 16 162 178

Thai baht 235 – 235 190 – 190

Other 222 – 222 21 – 21

Gross liabilities 1,747 659 2,406 1,399 649 2,048

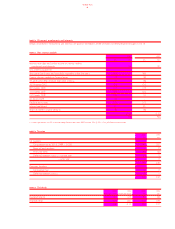

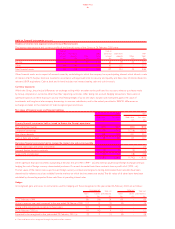

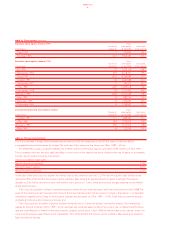

Fixed rate financial liabilities

2000 1999

Weighted Weighted Weighted Weighted

average average time average average time

interest rate for which rate interest rate for which rate

26 Feb 2000 is fixed 27 Feb 1999 is fixed

% Years % Years

Currency

Sterling 6.7 15 9.0 6

Euro 5.8 3 5.9 4

Weighted average 6.7 12 8.2 5

Floating rate liabilities bear interest at rates based on relevant national LIBOR equivalents. Borrowing facilities are shown in the Operating and

Financial Review on pages 2 to 6. The interest rate profile of the Group has been further managed by the purchase of interest rate caps with

an aggregate notional principal of £100m (1999 – £100m), an average strike price of 8.3% and a two year maturity. The current value of these

contracts, if realised, is nil (1999 – nil).