Tesco 2000 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2000 Tesco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TESCO PLC

31

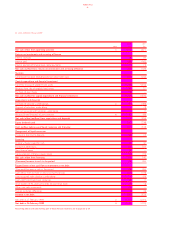

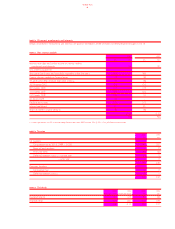

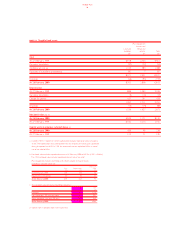

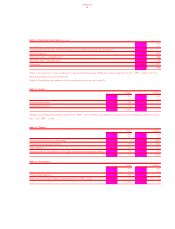

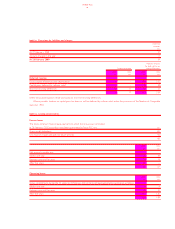

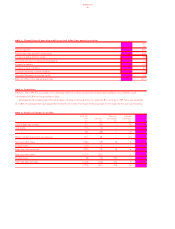

NOTE 17 Creditors falling due within one year

Group Company

2000 1999 2000 1999

£m £m £m £m

Bank loans and overdrafts (a) (b) 832 811 1,327 1,341

Trade creditors 1,248 1,100 – –

Amounts owed to Group undertakings – – 905 1,733

Other creditors 603 446 19 3

Corporation tax (c) 282 236 33 –

Other taxation and social security 78 92 1 –

Accruals and deferred income (d) 217 177 28 21

Finance leases (note 22) 15 19 – –

Proposed final dividend 212 194 212 194

3,487 3,075 2,525 3,292

a Bank deposits at subsidiary undertakings of £746m (1999 – £767m) have been offset against borrowings in the parent company under a legal right of set-off.

b Includes £11m (1999 – £9m) secured on various properties.

c The prior year comparative includes relief for advance corporation tax recoverable within one year.

d A gain of £45m, realised in a prior year, on terminated interest rate swaps is being spread over the life of replacement swaps entered into at the same time for similar

periods. Accruals and deferred income include £6m (1999 – £6m) attributable to these realised gains with £6m (1999 – £12m) being included in other creditors falling

due after more than one year (note 18).

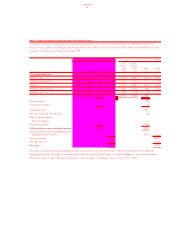

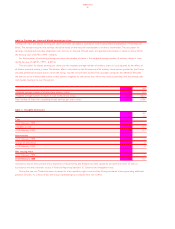

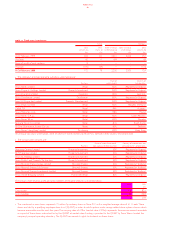

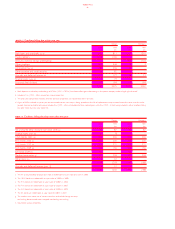

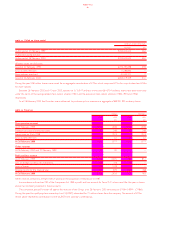

NOTE 18 Creditors falling due after more than one year

Group Company

2000 1999 2000 1999

£m £m £m £m

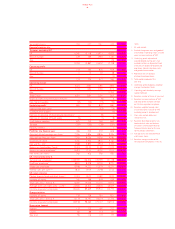

4% unsecured deep discount loan stock 2006 (a) 90 87 90 87

Finance leases (note 22) 518––

103⁄8% bonds 2002 (b) 200 200 200 200

83⁄4% bonds 2003 (c) 200 200 200 200

71⁄2% bonds 2007 (d) 325 325 325 325

51⁄8% bonds 2009 (e) 350 150 350 150

6% bonds 2029 (f ) 200 – 200 –

Medium term notes (g) 127 226 127 226

Other loans (h) 16 22 – –

1,559 1,218 1,492 1,188

Accruals and deferred income (note 17) 612––

1,565 1,230 1,492 1,188

a The 4% unsecured deep discount loan stock is redeemable at a par value of £125m in 2006.

b The 103⁄8% bonds are redeemable at a par value of £200m in 2002.

c The 83⁄4% bonds are redeemable at a par value of £200m in 2003.

d The 71⁄2% bonds are redeemable at a par value of £325m in 2007.

e The 51⁄8% bonds are redeemable at a par value of £350m in 2009.

fThe 6% bonds are redeemable at a par value of £200m in 2029.

g The medium term notes are of various maturities and include foreign currency

and sterling denominated notes swapped into floating rate sterling.

h Secured on various properties.