Telus 2006 Annual Report Download - page 32

Download and view the complete annual report

Please find page 32 of the 2006 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TELUS adopted a shareholder rights plan (the “Rights Plan”) in March 2000 and issued one

right (a “Series A Right”) in respect of each Common Share outstanding as at such date and

issued one right (a “Series B Right”) in respect of each Non-Voting Share outstanding as of

such date. The Rights Plan has a term of 10 years subject to shareholder confirmation every

three years. The Rights Plan was amended and confirmed as amended by the shareholders

first in 2003 and then in 2005 and as currently stated will again require confirmation in 2008.

Each Series B Right, other than those held by an Acquiring Person (as defined in the Rights

Plan) and certain of its related parties, entitles the holder in certain circumstances following the

acquisition by an Acquiring Person of 20 per cent or more of the voting shares of TELUS

(otherwise than through the “Permitted Bid” requirements of the Rights Plan) to purchase from

TELUS $320 worth of Non-Voting Shares for $160 (i.e., at a 50 per cent discount).

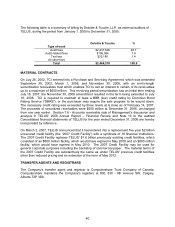

RATINGS

Ratings information contained in Management’s Discussion and Analysis -- Section 7.7 Credit

Ratings in TELUS’ 2006 Annual Report –Financial Review is hereby incorporated by reference.

Management’s Discussion and Analysis is available at www.sedar.com. Credit ratings are not

recommendations to purchase, hold or sell securities and do not address the market price or

suitability of a specific security for a particular investor. In addition, real or anticipated changes

in the rating assigned to a security will generally affect the market value of that security. There

can be no assurance that a rating will remain in effect for any given period of time or that a

rating will not be revised or withdrawn entirely by a rating agency in the future.

A description of the rating categories applied to TELUS as at December 31, 2006 from each

agency is below. The outlook or trend for TELUS from three agencies was stable, while

Moody’s investment grade rating was under review for possible upgrade.

Subsequent updates

On February 16, 2007, DBRS assigned a preliminary short term credit rating of R-1 (low) with a

stable trend to TELUS’ planned $800 million Commercial Paper program.

On February 26, 2007 Moody's Investor Service (“Moody’s”) upgraded the rating for TELUS’

senior unsecured to Baa1 from Baa2 with a stable outlook.

On March 5, 2007, DBRS Limited (“DBRS”) upgraded the rating of TELUS Notes to A (low) from

BBB (high) and confirmed its A (low) ratings for TCI debt and R-1 (low) rating for TELUS’

commercial paper, all with a stable trend.

On March 13, 2007, TELUS closed an offering of 4.50% Notes, Series CC, due March 15, 2012

(the “4.50% Notes”) for aggregate proceeds of approximately $300 million, and 4.95% Notes,

Series CD due March 15, 2017 (together with the 4.50% Notes, the “Notes”) for aggregate gross

proceeds of approximately C$700 million. Net proceeds of the offering will be used for general

corporate purposes including the redemption of TELUS' 7.50 % U.S. $ Series 1 Notes due June

2007. The Notes have been rated BBB+, stable outlook, by Standard & Poor’s, Baa1, stable

outlook, by Moody’s, BBB+, stable outlook by Fitch Ratings (“Fitch”) and A(low), stable trend by

DBRS.

31