Telus 2006 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2006 Telus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

services. In addition, both Bell Mobility and Rogers Communications are supporting other

MVNO partnerships with cable-TV companies such as Videotron and Eastlink, and other

resellers, such as President’s Choice, Petro-Canada and 7-Eleven. In the price-sensitive

market, Bell and Rogers are promoting their respective discount brand offerings to compete

against the MVNOs and TELUS. In 2006, TELUS signed an agreement with Amp’d Mobile, a

specialized provider of wireless multimedia services to target the young adult market with

services beginning in 2007. Competition within the wireless market is anticipated to remain

intense. There is a risk that the auction processes for AWS or a future auction of 2.5 GHz

spectrum could lead to additional wireless providers or increased entry on a regional basis.

TELUS also competes with numerous national, regional and local-paging companies for paging

customers in Alberta, B.C., and eastern Québec. TELUS offers a number of wireless Internet

offerings using the networks noted above as well as wireless LAN services such as WiFi

(802.11) in so-called “hotspots” and other areas utilizing unlicenced spectrum. In offering

wireless Internet and LAN access service, TELUS competes, to a limited extent, with wireline

business Internet access providers. It also competes with major equipment manufacturers for

private radio engineered systems.

Other emerging competitive services

Over the longer term there are a number of factors that are expected to increase competition in

the communications industry. Of note is the competitive escalation resulting from the continuing

convergence of cable-TV, satellite, computer, wireline and wireless technologies. In November

2005, TELUS commercially launched TELUS TV within select neighbourhoods in the Edmonton

and Calgary markets. In 2006, the expansion continued with a targeted commercial launch in

Vancouver, and there are plans underway to launch it in other major centres within its ILEC

territories. In this segment, TELUS competes with established cable-TV video providers Shaw

Communications and Cogeco, and with direct-to-home broadcast satellite companies, Bell

ExpressVu and Star Choice.

Competition is also intense in other areas as TELUS continues its growth into emerging markets

such as Web hosting and application services and human resource process outsourcing.

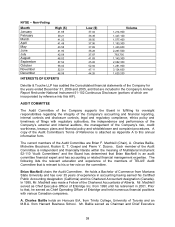

DIVIDENDS DECLARED

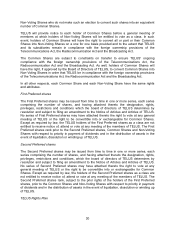

The dividends per Common Share and Non-Voting Share declared with respect to each quarter

by TELUS, during the three-year period ended December 31, 2006, are shown below.

Quarter ended (1) 2006 2005 2004

March 31 $0.275 $0.20 $0.15

June 30 $0.275 $0.20 $0.15

September 30 $0.275 $0.20 $0.15

December 31 $0.375 $0.275 $0.20

(1) Paid on the first business day of the next month.

TELUS’ Board of Directors reviews its dividend rate quarterly. On November 3, 2006, TELUS

announced that it was increasing its dividend to $0.375 per share on the issued and outstanding

Common and Non-Voting Shares. This 36 per cent increase was consistent with the Company’s

forward-looking dividend payout ratio guideline of 45 to 55 per cent of sustainable net earnings

first set in October 2004. TELUS’ quarterly dividend rate will depend on an ongoing assessment of

28