Telstra 2000 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2000 Telstra annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

8

International/Pan-Asian Growth. We also see

real opportunities to leverage our strengths

and expand into global markets, particularly

the Asia Pacific region and primarily in mobiles/

wireless and internet/data/e-commerce. We aim

to establish a portfolio of investments in the

region and link them all together with our

regional backbone network. Through this

process we aim to be the partner of choice for

the South East Asia region for any individual,

company or other telco wishing to do business

in this part of the world. For example, we

believe we can become a major regional cellular

operator. This will allow us to work with other

carriers in the Americas and Europe to provide

our combined customers with seamless global

services while driving down operational costs.

The Pacific Century CyberWorks (PCCW)

alliance, which was announced recently, will

provide us with the capability to achieve many

of these objectives.This deal combines the

expertise and resources of two of the largest

communications and convergence businesses

in Asia to create leading pan-Asian businesses

in wireless communications and data/Internet

Protocol (IP) carriage. It will give us scale

efficiencies to assist in achieving clear market

leadership. It will give us an immediate

customer base in a growing region, something

that would be very slow and expensive to grow

organically and, importantly, it gives us a

forward thinking partner in PCCW.

Our combined backbone assets will make

us a large and dominant player in the region,

extremely well placed to tap into the massive

growth in data traffic into and out of the region.

The wireless company places the under-utilised

and highly attractive Cable & Wireless Hong Kong-

Telecom mobile business in a vehicle that will

allow it, and like investments, to flourish.

We believe the PCCW alliance will create

a set of huge businesses for Telstra. Also in

the international arena, in Singapore we have

joined forces with Keppel, the intention being

to provide corporate and consumer customers

with end-to-end voice, data and Internet

Protocol based services.We also announced

the pooling of our New Zealand assets with

Saturn to create Telstra Saturn, which will be

a formidable competitor in that market. We

will be rolling out a state-of-the-art broadband

network in New Zealand and are well placed

to leverage both the products and relationships

we already have in Australia.

Telstra and KPN have finalised an agreement

to form a joint venture company by merging

their respective mobile satellite communications

businesses. The joint venture company is

trading worldwide as ‘Station 12’, and enjoys

a combined start-up global market share of

some 24 per cent, making it a major, and

arguably the leading, player in the global

satellite communications industry.

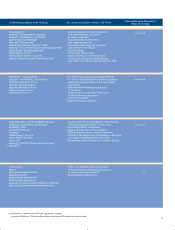

150,000 broadband connections over 12-18 months >1,000,000 in 5 years

ACCESS SERVICE

$millions $millions

Group assets

18,609

17,571

16,703

15,430

1997

1998

1999

2000

30,339

27,682

26,470

25,858

1997

1998

1999

2000

Sales revenue