Tech Data 2014 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2014 Tech Data annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

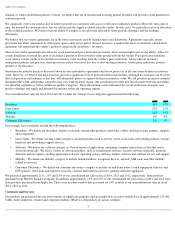

throughout the world, and customer channels may vary from region to region, during fiscal 2014 and 2013, sales within our consolidated

customer channels approximated the following:

No single customer accounted for more than 10% of our net sales during fiscal 2014, 2013 or 2012.

The market for VARs is attractive because VARs generally rely on distributors as their principal source of technology products and the related

financing for the products. This reliance is due to VARs typically not wanting to invest the resources to establish a large number of direct

purchasing relationships or stock significant product inventories. Direct marketers, retailers and corporate resellers may establish direct

relationships with vendors for their highest volume products, but utilize distributors as the primary source for other product requirements and an

alternative source for products acquired directly.

In addition to an extensive product offering from the world's leading technology vendors, we provide resellers a high level of customer service

through our training and technical support, suite of electronic commerce tools (including internet order entry and electronic data interchange

(“EDI”) services), customized shipping documents, product configuration/integration services and access to flexible financing programs. We

also provide services to our vendors by providing them the opportunity to participate in a number of special promotions, and marketing services

targeted to the needs of our resellers. While we believe that services such as these help to set us apart from our competition, they contribute less

than 10% of our consolidated net sales.

We provide our vendors with access to one of the largest bases of resellers throughout the Americas and Europe, delivering products to them

from our 28 regionally located logistics centers. We have located our logistics centers near our customers which enables us to deliver products

on a timely basis, thereby reducing the customers’ need to invest in inventory (see also Item 2, "Properties" for further discussion of our

locations and logistics centers).

Sales and Electronic Commerce

Our sales team consists of field sales and inside telemarketing sales representatives. The sales representatives are provided comprehensive

training on our policies and procedures, and the technical specifications of products, and attend product seminars offered by our vendors. Field

sales representatives are typically located in major metropolitan areas in their respective geographies and are supported by inside telemarketing

sales teams covering a designated territory. Our team concept provides a strong personal relationship between our customers’

representatives and

Tech Data. Territories with no field representation are serviced exclusively by inside telemarketing sales teams. Customers typically call our

inside sales teams on dedicated telephone numbers or contact us through various electronic methods to place orders. If the product is in stock and

the customer has available credit, customer orders are generally shipped the same day from the logistics center nearest the customer or the

intended end-user.

Customers often utilize our electronic ordering and information systems. Through our website, customers can gain remote access to our

information systems to place orders, or check order status, inventory availability and pricing. Certain of our larger customers have EDI services

available whereby orders, order acknowledgments, invoices, inventory status reports, customized pricing information and other industry standard

EDI transactions are consummated on-line, which improves efficiency and timeliness for the Company and our customers. In fiscal 2014 and

2013, approximately 45% and 43% of our consolidated net sales originated from orders received electronically.

Competition

We operate in a market characterized by intense competition, based on such factors as product availability, credit terms and availability, price,

speed of delivery, effectiveness of information systems and e-

commerce tools, ability to tailor solutions to customers' needs, quality and depth of

product lines and training, as well as service and support provided by the distributor to the customer. We believe we are well equipped to

compete effectively with other distributors in all of these areas.

We compete against several distributors in the Americas market, including broadline product distributors such as Ingram Micro Inc. ("Ingram

Micro"), Synnex Corp., and to a lesser extent, more specialized distributors such as Arrow Electronics, Inc. (“Arrow”) and Avnet, Inc.

(“Avnet”), along with some regional and local distributors. The competitive environment in Europe is more fragmented, with market share

spread among several regional and local competitors such as ALSO/Actebis and Esprinet, as well as international distributors such as Ingram

Micro, Westcon Group, Inc. (including its Comstor business unit), Arrow and Avnet.

The Company also faces competition from companies entering or expanding into the logistics and product fulfillment and e-commerce supply

chain services market and certain direct sales relationships between manufacturers, resellers, and end-users continue to introduce change into the

competitive landscape of our industry. As we expand our business into new areas, we may face increased

6

2014 2013

VARs

51

%

52

%

Direct marketers and retailers

28

%

27

%

Corporate resellers

21

%

21

%