TD Bank 2010 Annual Report Download - page 8

Download and view the complete annual report

Please find page 8 of the 2010 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

6TD BANK GROUP ANNUAL REPORT 2010 CHAIRMAN OF THE BOARD’S MESSAGE

Chairman of the Board’s Message

When I wrote to you a year ago, the global economy was still struggling

through the recession. Many companies and entire industries were

simply trying to ride out the storm. And while economic conditions

didn’t get worse in 2010, they also didn’t get much better. However,

we felt confident that our strategy of producing long-term profitable

growth by building great franchises and delivering value to our

customers, shareholders and communities would enable us to grow

in 2010. And it did.

Our focus on lower-risk retail banking allowed us not only to

weather the global economic storm, but to grow through it and

emerge with momentum. Ours is a strategy we believe in and one

that clearly works.

GROWING IN AN UNCERTAIN ECONOMY

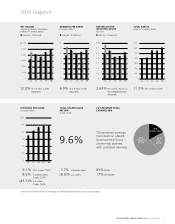

As you know, our adjusted earnings crossed the $5 billion mark for

the first time this past year. Our retail operations had record adjusted

earnings of $4.8 billion. Our adjusted earnings per share rose

eight per cent and are back to the record levels we saw in 2007. We

also had one of the highest levels of return on risk-weighted assets

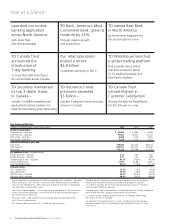

among our peers. Our U.S. franchise continued to grow both organi-

cally and through acquisitions, and we were once again recognized as

a leader in customer service.

DELIVERING FOR OUR SHAREHOLDERS

TD has a long history of maintaining its dividend, and despite

significant economic headwinds, this year was no different – a clear

indication of our confidence that TD will continue to grow earnings

over time. Total shareholder return was 23 per cent for the year and

remained above the Canadian and U.S. bank peer averages on a

compounded basis.

Our policy is to manage dividends based on the board’s outlook

on long-term sustainable earnings. With that in mind, we hope to

be in a better position to give you more clarity on our expectations

for dividends in 2011 with the release of our Q1 earnings.

The strength of our franchise and the resilience of our business

model never cease to amaze me. While the economic recovery remains

sluggish, particularly in the U.S., your board is confident that share-

holders will continue to benefit from TD’s strategy.

A CORPORATE GOVERNANCE LEADER

Your board is committed to representing the best interests of

shareholders through a strong focus on good corporate governance.

As a leader in this area, we are committed to continuing to enhance

our already robust governance foundation.

One of the simple but very valuable things we’ve done is reorganize

the board meeting to ensure quality time is devoted to strategy and

executive leadership. The first two hours of our meetings are reserved

for the CEO and directors to have free-flowing dialogue on strategic

issues that impact the long-term value of the corporation. These are

issues of critical importance to shareholders and include our growth in

the U.S. and our strategy for building TD’s future leadership.

We were pleased that for the fourth year in a row, our corporate

governance standards were ranked by GovernanceMetrics International

as being in the top one per cent of companies it ranks worldwide.

FORMALIZING OUR RISK APPETITE

TD’s risk culture today is truly defined by the business decisions made

and strategic actions taken up to and during the economic crisis –

we clearly made the right decisions. This year, we achieved another

significant milestone by putting what made us successful into simple

words, creating our risk appetite statement. The statement is the basic

yardstick against which we measure how much risk we are willing to

take in order to generate value for our shareholders.

We believe every employee in this organization is essentially a risk

manager. We want all employees to be knowledgeable about the risks

they take in their day-to-day activities. Why is this important? Adhering

to the bank’s strategy and risk appetite – something we’ve always

done – allows us to grow profitability without going out the risk curve.

FOCUS ON PEOPLE AND TALENT

TD has an enormous focus on developing talent to ensure we have

the best possible team today and tomorrow. The strength of our

employment brand has enabled us to attract and retain the very best

employees. Employees at TD know that their success is based on their

skills, their personal performance, their potential and the company’s

achievements. That’s why your board is focused on helping TD continue

to raise the bar when it comes to its unique and inclusive employee

culture and ensuring an ongoing focus on building talent for the future.

We’re delighted to have once again won a number of best employer

awards, including the Hewitt Associates 50 Best Employers in Canada.

TD was also named the best at developing the next generation of

leaders in a survey conducted by Canadian Business magazine and

Knightsbridge Human Capital Solutions.

COMPENSATION

Last year, we completed a comprehensive review of executive compen-

sation programs and fine-tuned our compensation practices in order to

appropriately align them with the risk appetite of the bank. I’m happy

to report that we’ve made tremendous progress on this front and that

the bank continues to evolve its approach to compensation. We’re taking

a balanced approach that is intended to attract, retain and reward talent

in alignment with the creation of long-term, profitable growth.

CHANGES TO THE BOARD

Managing talent is done at all levels, which is why we’re always looking

for individuals with new and diverse experience and knowledge.

That’s why I’m delighted to welcome Amy Brinkley to the board.

Amy, formerly a global risk executive at Bank of America, currently

serves on the board of Carter’s, Inc. Her rich banking background,

coupled with her extensive risk management experience, makes her a

valuable addition to the board.

As was announced on September 28, 2010, I will be retiring as

chairman of the board at the end of this year. I’d like to congratulate

Brian Levitt, who will become your new board chairman on January 1,

2011. I’m delighted that Brian will be taking over the reins. He is a

terrific director and knows the banking industry extremely well. Brian

has a very strong relationship with all of the board directors, as well as

with senior management. I think he’s a terrific choice, and I’m

delighted that I’ll be staying on the board.

I’d also like to thank Roger Phillips, Bill Ryan and Donna Hayes, who

stepped down from the board earlier this year. Their contributions

have been invaluable.

IN CLOSING

As I look back on my time as chairman, one of my proudest moments

was in 2002, when I first led the board in the appointment of Ed Clark.

Ed has done an outstanding job over the last eight years in leading

his management team to build The Better Bank. Back in 2002, our

market capitalization was about $19 billion. Today it stands at over

$64 billion, more than a three-fold increase.

The last few years have been incredibly challenging, but against a

backdrop of economic turmoil, TD has proudly stood out as a success

story. The fact that TD delivered record adjusted earnings in 2010

speaks to the enormous talent, drive and commitment of Ed, his leader-

ship team and TD’s more than 81,000 dedicated employees. On behalf

of the board, I would like to thank them all for their extraordinary

efforts in the past year.

Your board remains committed to working in the best interests

of shareholders. We look forward to serving you throughout 2011

and beyond.

John M. Thompson

Chairman of the Board of Directors