TD Bank 2010 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2010 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4TD BANK GROUP ANNUAL REPORT 2010 GROUP PRESIDENT AND CEO’S MESSAGE

Group President and CEO’s Message

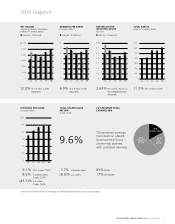

It was another great year for TD. As economic headwinds lingered, we delivered $5.2 billion in adjusted

profit, and our retail operations posted a record $4.8 billion in adjusted earnings. We continued to grow

our presence. In Canada, this meant continued leadership in customer service, additional banking hours and

the opening of 21 new branches. In the U.S., we added about 240 stores through the acquisition of

The South Financial Group, Inc. and the operations of three Florida banks purchased from the U.S. Federal

Deposit Insurance Corporation.

A STORY OF GROWTH

There’s no question that 2010 was a year of significant growth for TD.

While the economy is still recovering, our outstanding retail banking

businesses continued to deliver strong results, and our Wholesale

business earned above its target rate of return. This year, TD’s earnings

per share returned to a level roughly in line with 2007, which is a

remarkable achievement given the continuing challenges in the economy

and the fact that our share count is significantly higher than it was

three years ago. In short, we’re very proud of our performance.

Our Canadian Personal and Commercial Banking operations continue

to be our engine of growth, thanks to strength in the Canadian

housing market, strong volume growth in personal and business

deposits and market share gains in business banking. The operating

environment also improved for TD Insurance, positioning it well for

the future.

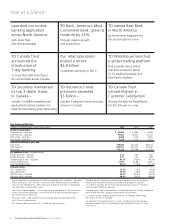

TD Bank, America’s Most Convenient Bank, continued to grow

organically and also completed a number of acquisitions to further

build out our Maine-to-Florida footprint and continued to perform well

despite the weak economy and an uncertain regulatory environment.

Performance in our Wealth Management business continued to

strengthen throughout the year, marking seven consecutive quarters

of improved profit. We continued to be competitive in attracting new

assets, and TD Investment Management was recognized by Benefits

Canada as the fastest-growing pension money manager for 2010 in

the greater than $10 billion assets category.

Meanwhile, our Wholesale business normalized as we had expected

and continued to deliver strong results in the face of challenging

market conditions. TD Securities also grew its fixed-income, currency

and commodities businesses and continued to build out its investment

banking capabilities.

SIGNIFICANT MILESTONES

A few things really stood out for me. First, TD Canada Trust continued

to set the high-watermark for providing legendary service and

unparalleled convenience to customers, winning the J.D. Power and

Associates award for the fifth year in a row and the Synovate award

for the sixth straight year – an outstanding success.

We continued to put our commitment to our customers into action.

We recognize that not all customers operate on the same schedule.

To better meet their needs, TD Canada Trust announced seven-day

banking, which will let customers at 300 branches across Canada

do their banking on any day of the week. And this year, we also

celebrated our 150th anniversary of operating in Quebec – a terrific

milestone in an important market. We continued to support the

communities where our customers and employees live and work. This

is much more than simple cheque-cutting – we worked to increase the

impact of our donations by encouraging our customers and employees

to get involved and by working directly with community groups.

It was a great year for our U.S. franchise. First, we bought the

operations of three banks from the U.S. Federal Deposit Insurance

Corporation (FDIC). We were pleased to be involved in these transac-

tions, which not only helped grow our presence in the U.S. but also

allowed us to work with the FDIC in its mission to maintain stability

and public confidence in the U.S. financial system. These acquisitions

were an excellent opportunity for TD to expand in the deposit-rich

Florida market. We were then able to successfully complete the

acquisition of The South Financial Group, Inc. (TSFG), an experienced

commercial lender with a presence in Florida and North and South

Carolina. The TSFG transaction was an acquisition that carried accept-

able asset risk and allowed us to rapidly increase our scale in the

strategically important Florida market. We plan to convert it to the TD

brand in 2011. While we’re still in the early days for these additions,

we’re happy with what we’ve seen so far in terms of performance.

We also remained focused on a conservative approach to risk

management. We take only risks that we understand and can manage

within an acceptable level. That approach has been crucial to our ability

to navigate the financial crisis. It was also reflected in the acquisitions

we completed in 2010.

If you look at all of TD’s accomplishments throughout 2010, it’s

clear that we strengthened our position as a growth-oriented top

North American bank. Our success was recognized by Euromoney,

one of the world’s leading international business and investment

magazines, which named TD the Best Bank in North America for the

second year in a row.

A GROWTH-ORIENTED NORTH AMERICAN BANK

We’re very pleased with how our U.S. Personal and Commercial

Banking business is performing. Our focus has been on organic growth

complemented by strategic acquisitions, and we made progress on

both fronts. In 2010, TD Bank, America’s Most Convenient Bank, added

32 new stores, aside from the acquisitions we made. The year also

marked an important milestone for our U.S. business, as it delivered

the highest level of adjusted profit since TD entered that market.

On the regulatory front, we saw some clarity regarding the regulation

of overdraft fees, and we’re happy to see the U.S. banking system is

moving toward a more packaged approach, similar to Canada’s.

The economy and the U.S. regulatory environment remain uncertain,

but despite the current economic challenges, our commitment to the

U.S. is unwavering. We’ll continue to lend to customers, just as we

have throughout the recession. In fact, since the downturn started in

2007, we’ve grown our U.S. lending volume by 25 per cent. We also

remain very happy with our investment in TD Ameritrade. Our relation-

ship represents a strategic fit with our retail bank with mutually

attractive cross-selling opportunities that will play an important role

in the success of both companies.