TD Bank 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2010 Annual Report

Ours is a story of growth. Growth that’s

rooted in our simple strategy. Growth that’s

supported by our genuine commitment to

customers, employees, shareholders and

communities. Growth that’s inspired by our

vision to be The Better Bank.

td.com/ar2010

Table of contents

-

Page 1

Ours is a story of growth. Growth that's rooted in our simple strategy. Growth that's supported by our genuine commitment to customers, employees, shareholders and communities. Growth that's inspired by our vision to be The Better Bank. td.com/ar2010 2010 Annual Report -

Page 2

...the interactive TD Annual Report online by scanning the QR code below or visiting td.com/ar2010 For information on TD's commitments to the community see the TD Corporate Responsibility Report online by scanning the QR code below or visiting td.com/corporateresponsibility 2010 report available March... -

Page 3

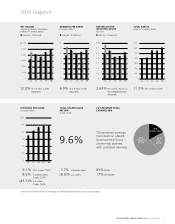

...63% TD's 2010 return on risk-weighted assets (adjusted) 11.2% TD's 5-year CAGR DIVIDENDS PER SHARE (Canadian dollars) TOTAL SHAREHOLDER RETURN (5-year CAGR) TD'S PREMIUM RETAIL EARNINGS MIX $3.0 2.5 17% 2.0 1.5 1.0 9.6% 06 07 08 09 10 TD's premium earnings mix is built on a North American... -

Page 4

...Financial positions at year-end Total assets Total deposits Total loans Per common share (Canadian dollars) Diluted earnings - reported Diluted earnings - adjusted Dividend payout ratio - adjusted Closing market price Total shareholder return Financial ratios Tier 1 capital ratio Total capital ratio... -

Page 5

... TD's 2010 Corporate Responsibility Report available March 2011 • $56.3 million invested in ï¬scal 2010 COMMUNITY • Donate minimum of 1% of domestic pre-tax proï¬ts (ï¬ve-year average) to charitable and not-for-proï¬t organizations • Make positive contributions by: - supporting employees... -

Page 6

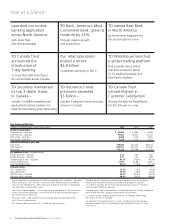

... in customer service, additional banking hours and the opening of 21 new branches. In the U.S., we added about 240 stores through the acquisition of The South Financial Group, Inc. and the operations of three Florida banks purchased from the U.S. Federal Deposit Insurance Corporation. A STORY... -

Page 7

... strategy has clearly worked well for us. In 2002, we were the third largest Canadian bank by market capitalization. Today, we're the sixth largest in North America, and our market capitalization has tripled in that time. We'll continue to win market share with our product and service offering and... -

Page 8

... over time. Total shareholder return was 23 per cent for the year and remained above the Canadian and U.S. bank peer averages on a compounded basis. Our policy is to manage dividends based on the board's outlook on long-term sustainable earnings. With that in mind, we hope to be in a better position... -

Page 9

... the succession planning process for the position of CEO; • Oversee the selection, evaluation, development and compensation of other members of senior management; • Produce a report on compensation for the beneï¬t of shareholders, which is published in TD's annual Proxy Circular, and review, as... -

Page 10

... 35 Corporate 2009 FINANCIAL RESULTS OVERVIEW 36 Summary of 2009 Performance 37 2009 Financial Performance by Business Line GROUP FINANCIAL CONDITION 39 Balance Sheet Review 40 Credit Portfolio Quality 50 Capital Position 53 Off-Balance Sheet Arrangements 55 Related-Party Transactions 56 Financial... -

Page 11

... bank in North America by branches and serves approximately 19 million customers in four key businesses operating in a number of locations in key ï¬nancial centres around the globe: Canadian Personal and Commercial Banking, including TD Canada Trust and TD Insurance; Wealth Management, including TD... -

Page 12

... certain executive employment and award agreements, contract termination fees and the write-down of long-lived assets due to impairment. Integration charges consisted of costs related to employee retention, external professional consulting charges, marketing (including customer communication and... -

Page 13

...as of the reporting date. The rate used in the charge for capital is the equity cost of capital calculated using the capital asset pricing model. The charge represents an assumed minimum return required by common shareholders on the Bank's invested capital. The Bank's goal is to achieve positive and... -

Page 14

... Treasury sold the Bank its South Financial preferred stock and the associated warrant acquired under the Treasury's Capital Purchase Program and discharged all accrued but unpaid dividends on that stock for total cash consideration of approximately $134 million. The acquisition was accounted for by... -

Page 15

... year ended October 31, 2010, compared with last year, as shown in the table below. Impact of Foreign Exchange Rate on U.S. Personal and Commercial Banking and TD Ameritrade Translated Earnings (millions of Canadian dollars) 2010 vs. 2009 U.S. Personal and Commercial Banking Decreased total revenue... -

Page 16

...,3 Total loans Total earning assets Interest-bearing liabilities Deposits Personal Banks Business and government Total deposits Subordinated notes and debentures Obligations related to securities sold short and under repurchase agreements Preferred shares and Capital Trust Securities Total interest... -

Page 17

... 8 TRADING-RELATED INCOME 2010 2009 2008 (millions of Canadian dollars) Net interest income Trading income (loss) Loans designated as trading under the fair value option1 Total trading-related income (loss) By product Interest rate and credit portfolios Foreign exchange portfolios Equity and... -

Page 18

... assets Restructuring costs Marketing and business development Brokerage-related fees Professional and advisory services Communications Other expenses Capital and business taxes Postage Travel and relocation Other Total other expenses Total expenses Efï¬ciency ratio - reported Efï¬ciency ratio... -

Page 19

... charge related to an agreement with Canada Revenue Agency. TD reports its investment in TD Ameritrade using the equity method of accounting. TD Ameritrade's tax expense of $132 million in the year, compared to $196 million in 2009, is not part of the Bank's tax rate reconciliation. TAXES 2010... -

Page 20

... fewer business days. The Bank's earnings are also impacted by market-driven events and changes in foreign exchange rates. For a discussion of this year's fourth quarter results, see the "Fourth Quarter 2010 Performance Summary" section. 18 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION... -

Page 21

...) in Canadian Personal and Commercial Banking and Wholesale Banking Settlement of TD Banknorth shareholder litigation FDIC special assessment charge Agreement with Canada Revenue Agency Total adjustments for items of note Net income - adjusted Preferred dividends Net income available to common... -

Page 22

..., international trade, and day-to-day banking needs. TD expanded its U.S. franchise in 2010 with the acquisition of The South Financial Group, Inc. and the operations of three Florida banks from the FDIC. Wholesale Banking provides a wide range of capital markets and investment banking products and... -

Page 23

... restructuring charges relating to U.S. Personal and Commercial Banking acquisitions - Decrease (increase) in fair value of credit default swaps hedging the corporate loan book, net of provision for credit losses - (Recovery of) income taxes due to changes in statutory income tax rates - Provision... -

Page 24

... current rates. NET INCOME BY BUSINESS SEGMENT (as a percentage of total net income) 70% 60 50 40 30 20 10 0 08 09 10 08 09 10 08 09 10 08 09 10 Canadian Personal and Commercial Banking Wealth Management U.S. Personal and Commercial Banking Wholesale Banking 22 TD BANK GROUP ANNUAL REPORT 2010... -

Page 25

... 1,922 1,798 1,314 1,080 249 $ 8,826 Other revenue includes internal commissions on sales of mutual funds and other wealth management products, fees for foreign exchange, safety deposit box rentals and other branch services. TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS 23 -

Page 26

...: account activities, account information, product offerings, facility, fees, and problem resolution. • TD Insurance gross originated premiums grew 11%, retaining the #1 direct writer position and increasing overall market share in Canada. CHALLENGES IN 2010 • Continued low interest rate... -

Page 27

...new branches, partially offset by lower litigation costs and capital taxes. The average FTE stafï¬ng levels increased by 1,383, or 4%, compared with last year. The efï¬ciency ratio improved to 47.6%, compared with 50.0% last year. KEY PRODUCT GROUPS Personal Banking • Personal Deposits - In 2010... -

Page 28

... selection). Excludes the Bank's investment in TD Ameritrade. Certain revenue lines are presented net of internal transfers. Effective the third quarter of 2008, the Bank transferred the U.S. wealth management businesses to the Wealth Management segment for management reporting purposes. Prior... -

Page 29

... nearly $570 million of net sales in two months. • TD Investment Management was recognized by Beneï¬ts Canada as the fastest growing pension money manager for 2010 in the greater than $10 billion assets category.1 CHALLENGES IN 2010 • Transaction revenue for online brokerage business in Canada... -

Page 30

...scal year ended September 30, 2010, TD Ameritrade reported net income in Canadian dollars was $592 million, a decrease of $52 million, or 8%, compared with last year. Wealth Management's return on invested capital was 14.5%, compared with 12.8% last year. Revenue for the year was $2,457 million, an... -

Page 31

...price, and service. In the U.K. and Europe, TD Waterhouse International provides multi-currency and multi-exchange online brokerage services for retail investors, and custody and clearing services for corporate clients. This business has a leading market share, is ranked number one in trades per day... -

Page 32

... 3855, certain available-for-sale and held-to-maturity securities were reclassified to loans. 3 Investment securities at October 31, 2008 include $9,690 million (US $8,354 million) of debt securities reclassified as loans in 2009. 30 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND... -

Page 33

...charges relating to U.S. Personal and Commercial Banking acquisition Net income - adjusted Selected volumes and ratios Return on invested capital Efï¬ciency ratio - reported Efï¬ciency ratio - adjusted Margin on average earning assets (TEB)3 Number of U.S. retail stores Average number of full-time... -

Page 34

...three Florida banks in FDICassisted transactions. On September 30th, the Bank closed on the acquisition of South Financial. As at October 31, 2010, South Financial had total assets of US$9.7 billion and total deposits of US$8.6 billion. In U.S. dollar terms, revenue for the year was US$4,591 million... -

Page 35

...0 08 09 10 Revenue (millions of Canadian dollars) 2010 2009 2008 Investment banking and capital markets Corporate banking Equity investments Total $ 2,351 454 69 $ 2,874 $ 3,154 397 (330) $ 3,221 $ 553 370 327 $ 1,250 BUSINESS HIGHLIGHTS • Net income on a reported basis for the year of $866... -

Page 36

...control infrastructure. KEY PRODUCT GROUPS Investment Banking and Capital Markets • Investment banking and capital markets revenue, which includes advisory, underwriting, trading, facilitation, and execution services, was $2,351 million, a decrease of $803 million, or 25%, compared with last year... -

Page 37

... conï¬dence in the Bank and to addressing the dynamic complexities and challenges from changing demands and expectations of our customers, shareholders and employees, governments, regulators, and the community at large. TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS 35 -

Page 38

... costs, and ongoing investments in control processes. Canadian Personal and Commercial banking noninterest expenses increased by $203 million due to higher employee compensation, full year inclusion of the U.S. insurance and credit card businesses, and investment in new branches. Wealth Management... -

Page 39

... partially offset by higher trading volumes in the online brokerage operation, increased long-term mutual fund sales, and increased revenue from new issues. The Bank's reported investment in TD Ameritrade generated net income for the year of $252 million, a decrease of $37 million, or 13%, compared... -

Page 40

...risk as measured by Value-at-Risk (VaR), the exit of the public equity investment portfolio, and continued reductions in credit trading positions outside North America. Corporate segment reported net loss for the year was $1,719 million, compared with a reported net loss of $147 million in 2008. The... -

Page 41

... and government loans and residential mortgages. The FDIC-assisted transactions and the acquisition of The South Financial Group, Inc. added $8 billion to total loans. The translation effect of the stronger Canadian dollar caused the value of loans (net of allowance for loan losses) in U.S. Personal... -

Page 42

... U.S. acquisitions. Exposure to other geographic regions was limited. The largest U.S. exposures by state were in New York and New Jersey, each of which represented 4% of total loans net of speciï¬c allowance, compared with 5% in 2009. 40 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION... -

Page 43

... reclassified to loans. Loans subject to the loss share agreements with the FDIC are considered "FDIC covered loans". The credit losses related to FDIC covered loans are determined net of the amount expected to be reimbursed by the FDIC. 41 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION... -

Page 44

...Net loans 2009 Net loans 2008 Net loans 2010 2009 2008 (millions of Canadian dollars, except as noted) Canada Atlantic provinces British Columbia and territories1 Ontario1 Prairies1 Québec Total Canada United States Carolinas (North and South) Florida New England2 New Jersey New York Pennsylvania... -

Page 45

... in New York and New Jersey, representing 6% and 8% of net impaired loans, down from 13% and 11% respectively, in 2009. TA B L E 26 CHANGES IN GROSS IMPAIRED LOANS AND ACCEPTANCES 2010 2009 (millions of Canadian dollars) Balance at beginning of period âˆ' personal, business & government Impact... -

Page 46

... value option. Effective 2009, MUR mortgages, and any related credit losses, have been reclassified from personal - residential mortgages to business & government retroactively to 2008. This is to achieve consistent reporting across all operating business segments. TD BANK GROUP ANNUAL REPORT 2010... -

Page 47

.... Debt securities classiï¬ed as loans represented $140 million, or 21%, of the total speciï¬c allowance in 2010. Allowances for credit losses are more fully described in Note 3 to the 2010 Consolidated Financial Statements. TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS 45 -

Page 48

...the total allowance to a level that management considers adequate to absorb all credit-related losses in the Bank's loan portfolio. New provisions in the year are reduced by any recoveries. The Bank recorded total provision for credit losses of $1,625 million in 2010, compared with a total provision... -

Page 49

...is recorded for trading loans or loans designated as trading under the fair value option. Effective 2009, MUR mortgages, and any related credit losses, have been reclassified from personal - residential mortgages to business & government retroactively to 2008. This is to achieve consistent reporting... -

Page 50

...portfolio continues to perform as expected. These loans are recorded at amortized cost. See Note 3 to the Consolidated Financial Statements for further information regarding the accounting for loans and related credit losses. 48 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS -

Page 51

... the time of acquisition, the portfolio was recorded at fair value, which became the new cost basis for this portfolio. See Note 7 to the 2010 Consolidated Financial Statements for more details. The portfolio was classiï¬ed as available-for-sale, and subsequently carried at fair value with changes... -

Page 52

GROUP FINANCIAL CONDITION Capital Position TA B L E 33 CAPITAL STRUCTURE AND RATIOS 1 (millions of Canadian dollars, except as noted) 2010 Basel II 2009 2008 Basel II Basel II Tier 1 capital Common shares Contributed surplus Retained earnings Net unrealized foreign currency translation ... -

Page 53

... Sheet Management determines the adequacy of the Bank's available capital in relation to required capital. DIVIDENDS The Bank's dividend policy is approved by the Board of Directors. At October 31, 2010, the quarterly dividend was $0.61 per share, consistent with the Bank's current target payout... -

Page 54

...are well positioned to fully meet the Basel III capital adequacy requirements. As such, we do not anticipate a need to make signiï¬cant changes to our business operations or raise any common equity to meet the Basel III requirements. 52 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND... -

Page 55

... mortgages, personal loans, and commercial mortgages to enhance its liquidity position, to diversify sources of funding and to optimize the management of the balance sheet. All products securitized by the Bank were originated in Canada and sold to Canadian securitization structures or Canadian... -

Page 56

... structured products business, the Bank no longer originates Collateralized Debt Obligation vehicles (CDOs). Total CDOs purchased and sold in the trading portfolio as at October 31, 2010, were as follows: TA B L E 38 COLLATERALIZED DEBT OBLIGATIONS 1 (millions of Canadian dollars) 2010 Positive... -

Page 57

...are on market terms and conditions unless, in the case of banking products and services for ofï¬cers, otherwise stipulated under approved policy guidelines that govern all employees. The amounts outstanding are as follows: (millions of Canadian dollars) 2010 2009 TRANSACTIONS WITH EQUITY-ACCOUNTED... -

Page 58

... the U.S. Federal Deposit Insurance Corporation, and various other regulatory agencies internationally. The adoption of new economic or monetary policies by such agencies, changes to existing policies or changes in the supply of money and the general level of interest rates can impact the Bank's pro... -

Page 59

... and reduce access to capital markets. A lowering of credit ratings may also affect the Bank's ability to enter into normal course derivative or hedging transactions and impact the costs associated with such transactions. TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS 57 -

Page 60

... Executive Committees Enterprise Risk Management Committee Asset/Liability Committee Risk Capital Assessment Committee Operational Risk Oversight Committee Disclosure Committee Reputational Risk Committee Audit Risk Management Compliance Business Units 58 TD BANK GROUP ANNUAL REPORT 2010... -

Page 61

... the management of TD's non-trading market risk and each of its consolidated liquidity, funding and capital positions. • Disclosure Committee - chaired by the Group Head and Chief Financial Ofï¬cer, oversees that appropriate controls and procedures are in place and operating to permit timely... -

Page 62

...cost charged against that capital. Lastly, we review and assess annually TD management's performance against TD's risk appetite as an input into compensation decisions. Enterprise Stress Testing Enterprise-Wide Stress Testing at TD is part of the long-term strategic, ï¬nancial, and capital planning... -

Page 63

... and annual review requirements for credit exposures. The key parameters used in our credit risk models are monitored on an ongoing basis. Unanticipated economic or political changes in a foreign country could affect cross-border payments for goods and services, loans, dividends, trade-related... -

Page 64

... of debt, and loan structure. Internal risk ratings are key to portfolio monitoring and management and are used to set exposure limits and loan pricing. Internal risk ratings are also used in the calculation of regulatory capital, economic capital, and general allowance for credit losses. Derivative... -

Page 65

... Data quality - Data used in the risk rating system is accurate, appropriate, and sufï¬cient. • Assumptions - Key assumptions underlying the development of the model remain valid for the current portfolio and environment. TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS 63 -

Page 66

... returns for TD through careful management of our positions and inventories. In our non-trading activities, we are exposed to market risk through the transactions that our customers execute with us. We comply with the Basel II market risk requirements as at October 31, 2010 using the Internal Model... -

Page 67

... associated with TD's trading positions. GMR is determined by creating a distribution of potential changes in the market value of the current portfolio. We value the current portfolio using the market price and rate changes (for equity, interest rate, foreign exchange, credit, and commodity products... -

Page 68

... capital market alternatives and, less frequently, product pricing strategies to manage interest rate risk. As at October 31, 2010, an immediate and sustained 100 bps increase in interest rates would have decreased the economic value of shareholders' equity by $165.4 million (2009 - $85.6 million... -

Page 69

...' equity (after tax) by currency for those currencies where TD has material exposure. from TD's net investments in foreign operations is hedged to the point where capital ratios change by no more than an acceptable amount for a given change in foreign exchange rates. Managing Available-for-sale... -

Page 70

... to purchase, sell or hold a financial obligation inasmuch as they do not comment on market price or suitability for a particular investor. Ratings are subject to revision or withdrawal at any time by the rating organization. 68 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION... -

Page 71

... year to 3 years Over 3 to 5 years Over 5 years Total 2009 Total (millions of Canadian dollars) Deposits1 Subordinated notes and debentures Operating lease commitments Capital lease commitments Capital trust securities Network service agreements Automated banking machines Contact centre technology... -

Page 72

... our employees, customers, assets and information, and in preventing and detecting errors and fraud. Annually, management undertakes comprehensive assessments of their key risk exposures and the internal controls in place to reduce or offset these risks. Senior management reviews the results... -

Page 73

... INSURANCE RISK We maintain a number of policies and practices to manage insurance risk. Sound product design is an essential element. The vast majority of risks insured are short-term in nature, that is, they do not involve longterm pricing guarantees. Geographic diversiï¬cation and product-line... -

Page 74

... on risk and control issues. Quarterly reports to our Audit Committee and Risk Committee include comments on any signiï¬cant internal audit issues at TD Ameritrade; risk issues are reported up to our Risk Committee as required, and at least annually. 72 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT... -

Page 75

... of fair value may also ï¬,uctuate due to developments in the business underlying the investment. Such ï¬,uctuations may be signiï¬cant depending on the nature of the factors going into the valuation methodology and the extent of change in those factors. TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT... -

Page 76

... and supportable. Where possible, fair values generated internally are compared to relevant market information. The carrying values of the Bank's reporting units are determined by management using economic capital models to adjust net assets and liabilities by reporting unit. These models consider... -

Page 77

... used in calculating these amounts. The actuarial assumptions of expected long-term return on plan assets, compensation increases, health care cost trend rate and discount rate are management's best estimates and are reviewed annually with the Bank's actuaries. The Bank develops each assumption... -

Page 78

... for internal review and assessment. Training continues to be provided to key employees and the impact of the transition on our business practices, information technology, and internal controls over ï¬nancial reporting is being closely monitored. a) IFRS Transition Program Summary To manage the... -

Page 79

...Key accounting policies requiring revisions have been identiï¬ed. 3. Financial Statement Preparation and Reporting • Identify signiï¬cant changes in note disclosures and ï¬nancial statement presentation. • Assess the impact of transition on the IFRS Detailed Assessment; Design and Solution... -

Page 80

... Investor Relations and Communications Plans controls based on required process and technology changes. • For all signiï¬cant changes to policies and procedures identiï¬ed, assess effectiveness of ICFR and DC&P and implement any necessary changes. • Design and implement internal controls... -

Page 81

...is approximately $2.9 billion, which would be a reclassiï¬cation within shareholders' equity that has no impact on the Bank's Tier 1 capital. Business Combinations Designation of Financial Instruments Currency Translation TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS 79 -

Page 82

... of mortgages. On transition, IFRS opening retained earnings will reï¬,ect the impact of accounting for prior years' transfers as ï¬nancing transactions, rather than sales. Should transferred ï¬nancial assets remain on the Consolidated Balance Sheet under IFRS, the Bank's risk management and asset... -

Page 83

...the date the terms of the business combination are agreed to and announced. Restructuring Costs Costs of an acquirer's plan to exit an activity or to involuntarily terminate or relocate employees are recognized as a liability in the purchase price allocation. Acquisition-related costs Direct related... -

Page 84

... contained in the Bank's annual report on Form 40-F for ï¬scal 2010 ï¬led with the U.S. SEC and available on the Bank's website at http://www.td.com/investor/index.jsp and at the SEC's website (http://www.sec.gov). 82 TD BANK GROUP ANNUAL REPORT 2010 MANAGEMENT'S DISCUSSION AND ANALYSIS -

Page 85

... disclosure controls and procedures (DC&P) and internal control over ï¬nancial reporting (ICFR) to exclude the controls, policies and procedures of The South Financial Group, Inc., the results of which are included in the 2010 Consolidated Financial Statements of the Bank since the acquisition date... -

Page 86

... of the Bank's internal control over ï¬nancial reporting (ICFR) as at October 31, 2010 did not include the controls, policies and procedures of The South Financial Group, Inc., the results of which are included in the 2010 consolidated ï¬nancial statements of the Bank since the acquisition date of... -

Page 87

... of the Bank's internal control over ï¬nancial reporting (ICFR) as at October 31, 2010 did not include the controls, policies and procedures of The South Financial Group, Inc., the results of which are included in the 2010 consolidated ï¬nancial statements of the Bank since the acquisition date of... -

Page 88

...-bearing deposits with banks Securities (Note 2) Trading (Note 4) Available-for-sale (Note 1) Held-to-maturity (Note 1) Securities purchased under reverse repurchase agreements (Note 2) Loans (Note 3) Residential mortgages Consumer instalment and other personal Credit card Business and government... -

Page 89

... (Note 9) Restructuring costs (Note 25) Marketing and business development Brokerage-related fees Professional and advisory services Communications Other (Note 26) Income before income taxes, non-controlling interests in subsidiaries, and equity in net income of an associated company Provision for... -

Page 90

... of dividend reinvestment plan Proceeds from issuance of new shares Shares issued on acquisitions (Note 7) Balance at end of year Preferred shares (Note 18) Balance at beginning of year Shares issued Balance at end of year Treasury shares - common (Note 18) Balance at beginning of year Purchase of... -

Page 91

... notes and debentures Liability for preferred shares and capital trust securities Translation adjustment on subordinated notes and debentures issued in a foreign currency and other Common shares issued Sale of treasury shares Purchase of treasury shares Dividends paid Net proceeds from issuance of... -

Page 92

... collect the fee. Card services income includes interchange income from credit and debit cards and annual fees. Fee income, including service charges, is recognized as earned, except for annual fees, which are recognized over a 12-month period. 90 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 93

... Insurance Stock-Based Compensation Employee Future Beneï¬ts Integration and Restructuring Charges Other Non-Interest Expenses Income Taxes Earnings Per Share Fair Value of Financial Instruments Interest Rate Risk Contingent Liabilities, Commitments, Pledged Assets, Collateral and Guarantees Credit... -

Page 94

... in Note 3. Trading Securities purchased with the intention of generating proï¬ts in the near term are recorded on a trade date basis and are classiï¬ed as trading. Transaction costs are expensed as incurred. These securities are accounted for at fair value with the change in fair value as well as... -

Page 95

... $ 27,088 $ 171,612 $ 148,823 2 Represents contractual maturities. Actual maturities may differ due to prepayment privileges in the applicable contract. Trading securities include securities designated as trading under the fair value option. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS 93 -

Page 96

...-sale portfolio with a carrying value of $2,004 million (2009 - $2,242 million) do not have quoted market prices and are carried at cost. The fair value of these securities was $2,172 million (2009 - $2,471 million) and is included in the table above. 94 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL... -

Page 97

... yield on any loan retained by the Bank is less than that of other comparable lenders involved in the ï¬nancing syndicate. In such cases, an appropriate portion of the fee is recognized as a yield adjustment to interest income over the term of the loan. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL... -

Page 98

.... As at October 31, 2010, the balance of FDIC covered loans and the indemniï¬cation assets were $1.7 billion and $168 million, respectively. ACCEPTANCES Acceptances represent a form of negotiable short-term debt issued by customers, which the Bank guarantees for a fee. Revenue is recognized on an... -

Page 99

...daily trading and lending activities and are not differentiated from other ï¬nancial assets in the portfolios. The carrying value of loans renegotiated during the year ended October 31, 2010, that would otherwise have been impaired, was $78 million (2009 - $18 million). TD BANK GROUP ANNUAL REPORT... -

Page 100

...Canadian dollars) At beginning of year Reportingperiod alignment2 Provision for credit losses Foreign exchange and other Recoveries adjustments Balance as at Oct. 31 Write-offs 2010 Speciï¬c allowance Residential mortgages Consumer instalment and other personal Credit card Business and government... -

Page 101

...At October 31, 2010, the cumulative change in fair value of these loans attributable to changes in credit risk was nil (2009 - loss of $16 million), calculated by determining the changes in credit spread implicit in the fair value of the loans. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS 99 -

Page 102

... 3.4 - 5.2% 5.8 0.1 18.4% 4.7 - 5.9% 5.6 - 5.2% 8.1 0.1 Represents monthly payment rate for secured personal and credit card loans. There are no expected credit losses for residential mortgage loans as the loans are government guaranteed. 100 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 103

...Canadian dollars) Gross loans 2010 Gross Write-offs, impaired net of loans recoveries Gross loans Gross impaired loans 2009 Write-offs, net of recoveries Type of loan Residential mortgages Consumer instalment and other personal Credit card Business and government and other loans Total loans managed... -

Page 104

... sold the Bank its South Financial preferred stock and the associated warrant acquired under the Treasury's Capital Purchase Program and discharged all accrued but unpaid dividends on that stock for total cash consideration of approximately $134 million. The acquisitions were accounted for by... -

Page 105

... will be made between the counterparties based upon the difference between a contracted rate and a market rate to be determined in the future, calculated on a speciï¬ed notional principal amount. No exchange of principal amount takes place. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS 103 -

Page 106

... dates. Commodity contracts include commodity forwards, futures, swaps and options, such as precious metals and energy-related products in both OTC and exchange markets. The Bank issues certain loan commitments to customers in Canada at a ï¬xed rate. These funding commitments are accounted... -

Page 107

...,685 793 793 $ 8,791 $ 49,445 694 694 $ 7,103 $ 48,152 The average fair value of trading derivatives for the year ended October 31, 2009 was: positive $62,685 million and negative $61,862 million. Averages are calculated on a monthly basis. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS 105 -

Page 108

... contracts Foreign exchange contracts Forward contracts Swaps Cross-currency interest rate swaps Total foreign exchange contracts Credit derivatives Credit default swaps - protection purchased Total credit derivatives Other contracts Equity contracts Total other contracts Fair value - non-trading... -

Page 109

... instruments. Gains (Losses) on Non-Trading Derivatives not Designated in Qualifying Hedge Accounting Relationships1 (millions of Canadian dollars) 2010 2009 Interest rate contracts Foreign exchange contracts Credit derivatives Equity Other contracts Total 1 $ (247) (4) (14) 214 (2) $ (53) (518... -

Page 110

... 2010 Remaining term to maturity Within 1 year Over 10 years 2009 Total Total Notional Principal Interest rate contracts Futures Forward rate agreements Swaps Options written Options purchased Total interest rate contracts Foreign exchange contracts Futures Forward contracts Swaps Cross-currency... -

Page 111

...are given financial guarantee treatment for credit risk capital purposes, are excluded in accordance with the guidelines of OSFI. The total positive fair value of the excluded contracts as at October 31, 2010 was $604 million (2009 - $903 million). TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS... -

Page 112

... with its fair value. Impairment in goodwill is charged to the Consolidated Statement of Income in the period in which the impairment is identiï¬ed. No impairment write-downs were required for the years ended October 31, 2010, 2009, and 2008. 110 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 113

... by Segment (millions of Canadian dollars) Canadian Personal and Commercial Banking U.S. Personal Wealth and Commercial Management Banking Wholesale Banking Corporate Total 2010 Carrying value of goodwill at beginning of year Goodwill arising on acquisitions Foreign currency translation adjustments... -

Page 114

... as trading and accounted for at fair value with the change in fair value recognized in the Consolidated Statement of Income. 2010 Demand Notice Term Total 2009 Total Personal Banks Business and government Trading Total1 Non-interest-bearing deposits included above In domestic ofï¬ces In foreign... -

Page 115

Term Deposits (millions of Canadian dollars) Within 1 year Over Over Over Over 1 year to 2 years to 3 years to 4 years to 2 years 3 years 4 years 5 years Over 5 years 2010 2009 Total Total Personal Banks Business and government Trading Total $ 12,614 8,482 33,036 21,753 $ 75,885 $ 15,786 25 5,... -

Page 116

... 95% of the average trading price of such common shares at that time. 114 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS Each Series N share is convertible by the holder, on or after January 31, 2014, into common shares on the same terms as described above. By giving at least 40 days of notice... -

Page 117

... yield plus 9.735%. For the period from and including September 15, 2009 to but excluding June 30, 2021. Starting on June 30, 2021 and on every fifth anniversary thereafter, the interest rate will be reset to the Government of Canada yield plus 4.00%. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL... -

Page 118

...) (2,434) 2,426 $ (79) - - - - $ $ $ $ $ $ When the Bank purchases its own shares as a part of its trading business, they are classified as treasury shares and the cost of these shares is recorded as a reduction in shareholders' equity. 116 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 119

... versa. The Series AG shares are redeemable by the Bank for cash, subject to regulatory consent, at $25.00 per share on April 30, 2014 and on April 30 every ï¬ve years thereafter. The Series AG shares qualify as Tier 1 capital of the Bank. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS 117 -

Page 120

... letters of credit and guarantees, less investments in associated corporations, goodwill and net intangibles, divided by Total adjusted capital. OSFI's target Tier 1 and Total capital ratios for Canadian banks are 7% and 10%, respectively. 118 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 121

...-related income by product line depicts trading income for each major trading category. 2010 2009 2008 Net interest income (loss) Trading income (loss) Loans designated as trading under the fair value option1 Total By product Interest rate and credit portfolios Foreign exchange portfolios Equity... -

Page 122

... to eligible employees of the Bank under the plan for terms of seven or ten years and vest over a four-year period. These options provide holders with the right to purchase common shares of the Bank at a ï¬xed price equal to the closing market price of the shares on the day prior to the date the... -

Page 123

...'s total shareholder return relative to the average of the other major Canadian banks. TD Banknorth also offered a performance-based restricted share unit plan to certain executives that provided for the grant of share units equivalent to the Bank's common shares which vest at the end of three years... -

Page 124

... service and management's best estimates of expected long-term return on plan assets, compensation increases, health care cost trend rate and discount rate, which are reviewed annually by the Bank's actuaries. The discount rate used to value liabilities is based on long-term corporate AA bond yields... -

Page 125

...ï¬t programs provide medical coverage and life insurance beneï¬ts to a closed group of employees and directors who meet minimum age and service requirements. Effective December 31, 2008, beneï¬ts under the retirement and supplemental retirement plans were frozen. In addition, TD Bank, N.A. and... -

Page 126

... professional consulting charges, marketing costs (including customer communication and rebranding) and integration-related travel costs. In the Consolidated Statement of Income, the integration charges are included in non-interest expenses. 124 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 127

...Other 2010 Total 2009 Total 2008 Total Balance at beginning of year Restructuring costs arising during the year: U.S. Personal and Commercial Banking Amount utilized during the year: Wholesale Banking U.S. Personal and Commercial Banking Foreign exchange and other adjustments Balance at end of year... -

Page 128

... of diluted earnings per share excluded weighted-average options outstanding of 7,077 thousand with a weighted-average exercise price of $68.94 as the option price was greater than the average market price of the Bank's common shares. 126 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 129

... the use of observable inputs such as benchmark yield curves and bid-ask spreads. The model also takes into account relevant data about the underlying collateral, such as weighted average terms to maturity and prepayment rate assumptions. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS 127 -

Page 130

... market prices and values of inputs. Management consistently applies valuation models and controls over a period of time in the valuation process. The valuations are also validated by past experience and through actual cash settlement under the contract terms. 128 TD BANK GROUP ANNUAL REPORT 2010... -

Page 131

... value of Level 3 assets and liabilities is determined using valuation models, discounted cash ï¬,ow methodologies, or similar techniques. This category generally includes retained interests in loan securitizations and certain derivative contracts. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS... -

Page 132

... $ 273 - 68 5,795 $ 69,957 $ 328 - - 168 $ 168 $ $ 22 $ FINANCIAL LIABILITIES Trading deposits Obligations related to securities sold short Derivatives Interest rate contracts Foreign exchange contracts Credit contracts Equity contracts Commodity contracts $ 27,469 19,328 167 2,742 620 $ 50,326... -

Page 133

... 3) for the years ended October 31, 2010 and 2009. Reconciliation of Changes in Fair Value for Level 3 Financial Assets and Liabilities (millions of Canadian dollars) Fair value as at Nov. 1, 2009 FINANCIAL ASSETS Total realized and unrealized gains (losses) Movements Transfers Fair value as at Oct... -

Page 134

... Level 3 occur when an instrument's fair value, which was previously determined using valuation techniques with signiï¬cant observable market inputs, is now determined using valuation techniques with signiï¬cant non-observable market inputs. 132 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS -

Page 135

... that are independent of changes in interest rates. Certain assets and liabilities are shown as non-rate sensitive although the proï¬le assumed for actual management may be different. Derivatives are presented in the ï¬,oating rate category. TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL RESULTS 133 -

Page 136

... funds available for the ï¬nancing needs of customers. The Bank's policy for requiring collateral security with respect to these contracts and the types of collateral security held is generally the same as for loans made by the Bank. Financial and performance standby letters of credit represent... -

Page 137

...dollars) 2010 2009 Commitments to extend credit exclude personal lines of credit and credit card lines, which are unconditionally cancellable at the Bank's discretion at any time. In addition, the Bank is committed to fund $423 million (2009 - $459 million) of private equity investments. Long-term... -

Page 138

... Securities purchased under reverse repurchase agreements Loans Residential mortgages Consumer instalment and other personal Credit card Business and government Debt securities classiï¬ed as loans2 Customers' liability under acceptances Derivatives3 Other assets Total assets Credit instruments4... -

Page 139

...on the risk rating for the standardized approach. Financial Assets Subject to the Standardized Approach by Risk-Weights (millions of Canadian dollars) 0% 20% 35% 50% 75% 100% 150% Total 2010 Loans Residential mortgages Consumer instalment and other personal Credit card Business and government Debt... -

Page 140

.... The financial instruments held by the insurance subsidiaries are mainly comprised of available-for-sale securities and securities designated as trading under the fair value option, which are carried at fair value on the Consolidated Balance Sheet. 138 TD BANK GROUP ANNUAL REPORT 2010 FINANCIAL... -

Page 141

...assets generated by the businesses in that segment. Due to the complexity of the Bank, its management reporting model uses various estimates, assumptions, allocations and risk-based methodologies for funds transfer pricing, inter-segment revenue, income tax rates, capital, indirect expenses and cost... -

Page 142

... the original loans originated from. RESULTS BY GEOGRAPHY For reporting of geographic results, segments are grouped into Canada, United States and International. Transactions are primarily recorded in the location responsible for recording the revenue or (millions of Canadian dollars) assets. This... -

Page 143

...Loans to Officers and Directors and their Associates (millions of Canadian dollars) 2010 2009 A description of signiï¬cant transactions of the Bank and its afï¬liates with TD Ameritrade is set forth below. Insured Deposit Account (formerly known as Money Market Deposit Account) Agreement The Bank... -

Page 144

... Canada (millions of dollars) Canada CT Financial Assurance Company (99.9%) Meloche Monnex Inc. Security National Insurance Company Primmum Insurance Company TD Direct Insurance Inc. TD General Insurance Company TD Home and Auto Insurance Company TD Asset Finance Corp. TD Asset Management Inc. TD... -

Page 145

..., Delaware New York, New New York, New New York, New New York, New New York, New New York, New Houston, Texas York York York York York York As at October 31, 2010 Carrying value of shares owned by the Bank $ 2 1,449 Singapore, Singapore 763 TD BANK GROUP ANNUAL REPORT 2010 PRINCIPAL SUBSIDIARIES... -

Page 146

... purchased under reverse repurchase agreements Loans (net of allowance for loan losses) Other Total Assets Liabilities Deposits Other Subordinated notes and debentures Liabilities for preferred shares and capital trust securities Non-controlling interest in subsidiaries Shareholders' equity Common... -

Page 147

... a reconciliation with reported results. 2 Effective 2008, treasury shares have been reclassified from common and preferred shares and shown separately. Prior to 2008, the amounts for treasury shares are not reasonably determinable. TD BANK GROUP ANNUAL REPORT 2010 TEN-YEAR STATISTICAL REVIEW 145 -

Page 148

... Number of Automated Banking Machines Capital ratios Other Other Statistics - Adjusted 2010 Per common share Performance ratios 1 Basic earnings 2 Diluted earnings 3 4 5 6 7 Return on total common equity Return on risk-weighted assets Efï¬ciency ratio Common dividend payout ratio Price earnings... -

Page 149

... employees on an average full-time equivalent basis. Prior to 2002, the number of employees is on an "as at" full-time equivalent basis. 9 Includes retail bank outlets, private client centre branches, and estates and trusts branches. 147 TD BANK GROUP ANNUAL REPORT 2010 TEN-YEAR STATISTICAL REVIEW -

Page 150

... change in market price plus dividends paid during the year as a percentage of the prior year's closing market price per common share. Value-at-Risk (VaR): A metric used to monitor and control overall risk levels and to calculate the regulatory capital required for market risk in trading activities... -

Page 151

... funds by contacting the Bank's transfer agent. Dividends will be exchanged into U.S. funds at the Bank of Canada noon rate on the ï¬fth business day after the record date or as otherwise advised by the Bank. Dividend information for 2011 is available at www.td.com under Investor Relations/Share... -

Page 152

® The TD logo and other trade-marks are the property of The Toronto-Dominion Bank or a wholly-owned subsidiary, in Canada and/or other countries. FSC LOGO TO BE PLACED IN BY PRINTER