TD Bank 2001 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2001 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

4

TO OUR SHAREHOLDERS

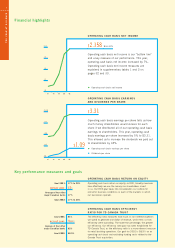

TD Bank Financial Group delivered solid results for 2001, and we have many accomplish-

ments. That’s a remarkable achievement in a year of tough markets and a slowing economy.

This year we faced two big challenges: the integration of our Canada Trust acquisition and

the impact of the economy and the markets on our businesses, particularly our traditionally

strong self-directed brokerage and telecommunications lending franchises. Our businesses

managed these challenges – and accomplished a great deal more – with considerable

resilience and expertise.

This success wouldn’t have been possible without our strong team of employees –

we’ve never asked more of them and we’re proud of their tremendous capability, flexibility

and professionalism.

TD Canada Trust, our personal and commercial bank, completed two critical things this

year: the integration of Canada Trust and the implementation of a single brand across the

country. Our merger with Canada Trust was the largest financial services merger ever com-

pleted in Canada. It brought together hundreds of branches, thousands of employees and

millions of customers, and took us from being the fifth largest retail bank in Canada to being

the leader in most of our retail businesses.

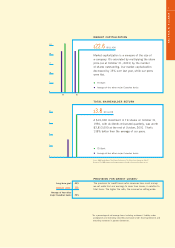

When we announced our intention to acquire Canada Trust in August 1999, we set specific

goals for cost management, customer satisfaction and growth in revenue and market share.

We’re on track to reach all of these goals, and are pleased to say that during this critical

phase we actually increased our market share in personal non-term deposits by 106 basis

points, ranking us #1 among the major financial institutions in Canada. We appreciate the

confidence our customers have placed in us, and we thank them for their patience and

understanding during the times our integration went less smoothly than we had hoped.

TD Securities, our integrated wholesale bank, delivered record earnings and return on

equity with its diverse business portfolio. Among its many successes for 2001 were the

integration of Newcrest Capital’s institutional equities business, and the completion of

a landmark series of cross-border offerings for TELUS Corporation with total proceeds of

$9.2 billion – the largest corporate financing ever completed by a Canadian issuer.

TD Waterhouse, our self-directed brokerage, opened more than 535,000 new accounts

despite dramatic declines in stock market activity and trading volumes across the industry.

This growth in accounts strengthened our customer base and is a reflection of the continuing

and long-term shift toward individual stock ownership and self-directed online investing.

TD Wealth Management, our asset management, advice and distribution group, increased

assets under management from $112 billion to $119 billion. These gains came from

new institutional mandates and mutual fund sales, demonstrating the strength of its

diverse businesses.

Focusing on what matters