TD Bank 2001 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2001 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1.3

1.6

1.9

$2.2

1.0

97 98 99 00 01

1.25

2.00

2.75

$3.50

.50

97 98 99 00 01

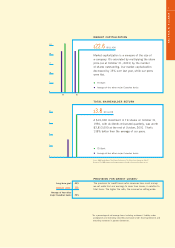

Key performance measures and goals

OPERATING CASH BASIS EFFICIENCY

RATIO FOR TD CANADA TRUST

The efficiency ratio measures how much in non-interest expenses

we spend to generate one dollar of revenue, which tells us how

efficiently we're operating. The lower the percentage, the greater

our efficiency. Our efficiency ratio goal has been established for

TD Canada Trust, as the efficiency ratio is a more relevant measure

for retail banking operations. Our goal for 2002 is 58.5% on an

operating cash basis and excluding funding costs related to the

Canada Trust acquisition.

OPERATING CASH BASIS RETURN ON EQUITY

Operating cash basis return on equity, or ROE, broadly measures

how effectively we use the money our shareholders invest

in us. Our ROE goal takes into consideration our outlook for

economic business conditions in each of the markets in which

our businesses operate.

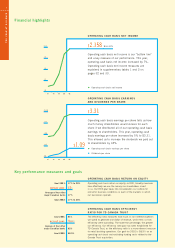

Financial highlights

OPERATING CASH BASIS EARNINGS

AND DIVIDENDS PER SHARE

$3.31

Operating cash basis earnings per share tells us how

much money shareholders would receive for each

share if we distributed all of our operating cash basis

earnings to shareholders. This year, operating cash

basis earnings per share increased by 5% to $3.31.

This allowed us to increase the dividends we paid out

to shareholders by 18%.

Operating cash basis earnings per share

Dividends per share

OPERATING CASH BASIS NET INCOME

$2.158 BILLION

Operating cash basis net income is our “bottom line”

and a key measure of our performance. This year,

operating cash basis net income increased by 7%.

Operating cash basis net income measures are

explained in supplementary tables 1 and 2 on

pages 32 and 33.

Operating cash basis net income

Goal 2001: 17% to 20%

RESULT 2001: 18%

Average of four other

major Canadian banks 17%

Goal 2002: 17% to 20%

Goal 2001: 61%

RESULT 2001: 59.6%

Average of four other

major Canadian banks 62%

Goal 2002: 58.5%

2

THE YEAR AT A GLANCE

$1.09