TD Bank 2001 Annual Report Download

Download and view the complete annual report

Please find the complete 2001 TD Bank annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Focusing on what matters

TD BANK FINANCIAL GROUP 146TH ANNUAL REPORT 2001

Table of contents

-

Page 1

Focusing on what matters T D B A N K F I N A N C I A L G R O U P 14 6 T H A N N U A L R E P O R T 2 0 0 1 -

Page 2

...debt capital markets • institutional equities • private equity • foreign exchange. A world leader in self-directed investing, servicing more than 3.3 million active customer accounts worldwide. Provides investors and financial advisors with a broad range of brokerage, mutual fund, banking and... -

Page 3

Investors. Customers. Employees. TD Bank Financial Group is its people. We are more than 13 million investors, customers and employees in Canada and around the world. What matters to each of you also matters to us. That's why we're focused on building the best Canadian-based financial institution ... -

Page 4

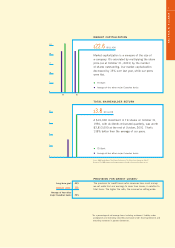

...: RESULT 2001: Average of four other major Canadian banks Goal 2002: 17% to 20% 18% 17% 17% to 20% Operating cash basis return on equity, or ROE, broadly measures how effectively we use the money our shareholders invest in us. Our ROE goal takes into consideration our outlook for economic business... -

Page 5

... 15 10 Market capitalization is a measure of the size of a company. It's calculated by multiplying the share price (as at October 31, 2001) by the number of shares outstanding. Our market capitalization decreased by 13% over last year, while our peers were flat. TD Bank Average of four other... -

Page 6

... of cross-border offerings for TELUS Corporation with total proceeds of $9.2 billion - the largest corporate financing ever completed by a Canadian issuer. TD Waterhouse, our self-directed brokerage, opened more than 535,000 new accounts despite dramatic declines in stock market activity and trading... -

Page 7

... to compete both internationally and at home. At TD, we build, buy and borrow in order to achieve scale. For example, we've built scale as a wholesale banker through TD Securities. We've bought scale through our acquisitions of Waterhouse Investor Services, Canada Trust and Newcrest Capital. We also... -

Page 8

... we announced a plan to offer banking services to Wal-Mart customers in the United States through our wholly-owned subsidiary, TD Bank USA, FSB, a federally chartered savings bank, subject to regulatory approval. We're planning to offer chequing and savings accounts in as many as 100 Wal-Mart stores... -

Page 9

... bank, a self-directed brokerage and an asset manager advisor and distributor. But we're also much more. We are a team of over 51,000 people with a shared goal: to be the best Canadianbased financial institution in North America. This section of our annual report describes our businesses and... -

Page 10

... customers have better branch hours, access to more branches and ABMs, as well as a broader product line than ever before. Our merger with Canada Trust was the largest financial services merger in Canada and we completed it while increasing operating cash basis net income, revenue and market share... -

Page 11

..., deposit, savings and investment products to Canadian businesses, plus a full range of day-to-day banking, cash management, trade and treasury services. • TD Insurance - provides auto, home, life, critical illness and travel insurance directly to individuals and small businesses. • TD Meloche... -

Page 12

... equity issue for Triax Capital Holdings Ltd., structured for the retail investing market TD Securities is the wholesale banking arm of TD Bank Financial Group. We provide financial products and services to meet the needs of corporate, government and institutional clients. See Segmented financial... -

Page 13

... exchange TD SECURITIES - FIVE KEY AREAS OF EXPERTISE • Investment banking - provides financial advice, capital-raising services and credit to clients in Canada, the U.S., Europe, Asia and Australia. • Debt capital markets - provides trading, sales and origination of money market, investment... -

Page 14

... banking group in Southeast Asia, to provide self-directed investors in that region with access to a multi-channel, multi-market, multi-currency, multi-product platform of global investment services. We enhanced online delivery around the world, launching Hong Kong's first interactive TV trading... -

Page 15

... within TD Bank Financial Group to expand the banking and mutual fund products we offer to our customers. We now provide banking services to our customers in the U.S. and Canada, and are planning to provide them in the U.K. We're working with TD Wealth Management to build mutual fund complexes... -

Page 16

...retail markets. TD Private Investment Counsel, TD Private Asset Management and TD Harbour Capital together manage more than $9 billion in assets, making us Canada's largest high net worth manager. We offer investment products, advice and investment management services to pension funds, corporations... -

Page 17

...national children's programs across Canada through direct donations, sponsorships, gifts-in-kind and employee volunteers, we focus our giving on four main programs: TD Friends of the Environment Foundation, TD Canadian Children's Book Week, Children's Miracle Network and TD Canada Trust Scholarships... -

Page 18

-

Page 19

... of our annual report tells you how TD Bank Financial Group and each of our businesses performed in 2001. Management's discussion and analysis of operating performance (MD&A) gives you management's perspective on the economy, our performance this year, and how we manage risk and capital. We measure... -

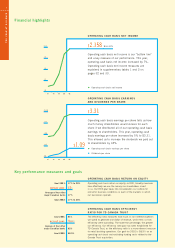

Page 20

... cash basis net income was $2,018 million in 2000, an increase of 37% from 1999. Despite challenging economic conditions, TD Bank Financial Group had a solid performance in 2001, resulting from contributions from TD Canada Trust and TD Securities. Operating cash basis earnings per share were $3.31... -

Page 21

... trading activities, brokerage fees, mutual fund management fees, service fees, income from securitized loans and other revenue. See supplementary information page 34, tables 6 & 7 TD Securities performed well, considering the challenging capital markets environment. While trading income reported... -

Page 22

...in the number of employees needed to support the retail branch conversions and higher business activity at TD Canada Trust. An increase in salaries and employee benefits at TD Wealth Management was offset by a decrease in salaries and employee benefits at TD Waterhouse. The decrease at TD Waterhouse... -

Page 23

... in the personal loan portfolio at TD Canada Trust, which increased by $3 billion in 2001. Residential mortgages, including securitizations, increased by $4 billion or 6% from a year ago. Personal non-term deposits grew by $7 billion or 18% in 2001 to $46 billion, with TD Waterhouse accounting for... -

Page 24

... gains in market share in products such as institutional equities, equity and debt underwritings, and foreign exchange. We achieved these results despite increased provision for credit losses and a general slowdown in capital markets and credit activity. (millions of dollars) 2001 $ 886 2,251... -

Page 25

... can be attributed to declining full-service brokerage activity, a shift in overall assets to money market from equity assets, and strategic investments in our global funds and financial planning initiatives. (millions of dollars) 2001 $ 80 618 698 - 523 175 75 $ $ 100 119 78 2,952 61% 75... -

Page 26

...affect cross-border payments for goods and services, loans, trade-related finance and dividends, as well as the repatriation of TD's capital from the foreign country. We currently have exposure in 70 countries, with the largest portion in North America. We establish country exposure guidelines based... -

Page 27

... special addition to the general allowance, from $480 million in 2000 to $620 million in 2001. This level of specific provision represents .48% of net average loans and customer's liability under acceptances compared to .39% in the prior year. During the year, TD increased the general allowance... -

Page 28

... compared with the approved limits • approving all new trading products • independent testing of all pricing models and trading systems • approving all market rates and prices used in valuing TD's trading positions and estimating market risk • stress testing the portfolio to determine the... -

Page 29

... liability management deals with managing the market risks of our traditional banking activities. These transactions primarily include interest rate risk and foreign exchange risk. We are exposed to market risk when we enter into non-trading banking transactions with our TD Canada Trust customers... -

Page 30

... positions. It is also affected by new business volumes, renewals of loans and deposits, and how actively customers exercise options like prepaying or redeeming a loan or deposit before its maturity date. We manage interest rate risk within limits set by our interest rate risk management policies... -

Page 31

... internal business activities and from activities we outsource. Managing operational risk is a key objective of TD Bank Financial Group. It is essential for protecting, enhancing and creating shareholder value, operating efficiency and providing a safe working environment for staff and customers... -

Page 32

...medium term notes • exchanging $350 million of subordinated debt and $225 million of preferred shares of Canada Trust (previously classified as non-controlling interest in subsidiaries on the consolidated balance sheet) into respective amounts of TD Bank debt and preferred shares, on substantially... -

Page 33

... after adjusting for new issues and retiring subordinated debt amounted to $327 million for the year ended October 31, 2001. Our reported net income before interest and income tax and after deducting non-controlling interest in TD Waterhouse Group, Inc. for the year ended October 31, 2001 was $1,557... -

Page 34

... (TD Securities in 2001, TD Waterhouse Group, Inc. in 2001, the acquisition of Newcrest in 2001 and the acquisition of Canada Trust in 2000), the effects of future tax rate reductions on future tax balances in 2001, the net effect of real estate gains and general provision increases in 2001 and... -

Page 35

... (TD Securities in 2001, TD Waterhouse Group, Inc. in 2001, the acquisition of Newcrest in 2001 and the acquisition of Canada Trust in 2000), the effects of future tax rate reductions on future tax balances in 2001, the net effect of real estate gains and general provision increases in 2001 and... -

Page 36

... Full service brokerage and other securities services Mutual fund management Credit fees Net investment securities gains1 Trading income Service charges Loan securitizations Card services Insurance Trust fees Gains on sale of investment real estate Foreign exchange - non-trading Property rental... -

Page 37

... Pension and other employee benefits Salaries and employee benefits total Occupancy Rent Depreciation Other Occupancy total Equipment Rent Depreciation Other Equipment total General Marketing and business development Brokerage related fees Professional and advisory services Communications Capital... -

Page 38

...the net effect of real estate gains and general provision increases in 2001, goodwill and intangibles gross-up and benefits in 2001 and 2000 as well as the special gain on the sale of TD Waterhouse Group, Inc. in 1999. T A B L E 10 Loans to small and mid-sized business customers Loans authorized... -

Page 39

... WE PERFORMED IN 2001 T A B L E 11 Loans and customers' liability under acceptances at year end Canada1 United States 1 Other international 1 Total (millions of dollars) By sector Residential mortgages Consumer instalment and other personal Total residential and personal Real estate development... -

Page 40

... % of common equity By location 1 Canada Atlantic Québec Ontario Prairies British Columbia Total Canada United States Other international Total net impaired loans before general allowances Less: general allowances Total net impaired loans Net impaired loans as a % of net loans 2 $ $ 2001 82 94 176... -

Page 41

... Asia and Latin America Total other international Special general provision Total Provision for credit losses as a % of net average loans 2 Canada Residential mortgages Personal Business and other Total Canada United States Other international Special general provision Total 1 2 2001 $ 3 248 251... -

Page 42

... management 2001 2000 1999 (millions of dollars) Assets under administration TD Canada Trust Retail custody and other Loans securitized Total TD Canada Trust TD Waterhouse - Customer assets Retail brokerage - Canada - United States and other international Total TD Waterhouse TD Wealth Management... -

Page 43

... who are not officers or employees of the Bank, oversees management's responsibilities for the financial reporting and internal control systems. The Bank's Chief Internal Auditor, who has full and free access to the Audit and Risk Management Committee, conducts an extensive program of audits in... -

Page 44

... deposits with other banks Securities purchased under resale agreements Securities (Note 2) Investment Trading Loans (net of allowance for credit losses) (Note 3) Residential mortgages Consumer instalment and other personal Business and government Other Customers' liability under acceptances Trading... -

Page 45

... Service charges Loan securitizations Card services Insurance Trust fees Gains on sale of investment real estate (Note 18) Other Net interest and other income Gain on sale of TD Waterhouse Group, Inc. Net interest and other income, including gain Non-interest expenses Salaries and employee benefits... -

Page 46

...Foreign currency translation adjustments, net of income taxes Stock options settled in cash, net of income taxes Obligations arising from adoption of new accounting standard for employee future benefits, net of income taxes (Note 1) Other Balance at end of year Total common equity Total shareholders... -

Page 47

... losses Restructuring costs Depreciation Amortization of goodwill and intangible assets from business combinations Gains on sale of investment real estate Gain on sale of TD Waterhouse Group, Inc. Net investment securities gains Changes in operating assets and liabilities Future income taxes Current... -

Page 48

... dollars at prevailing year-end rates of exchange. Foreign currency income and expenses are translated into Canadian dollars at the average exchange rates prevailing throughout the year. Unrealized translation gains and losses related to the Bank's investment positions in foreign operations, net... -

Page 49

... the need to cover market, liquidity and credit risks, as well as the cost of capital and administrative expenses over the life of each contract. Non-trading derivatives are entered into by the Bank in order to meet the Bank's funding, investing and credit portfolio management strategies. This is... -

Page 50

... in salaries and employee benefits. (o) Employee future benefits The Bank's principal pension plan is The Pension Fund Society of The Toronto-Dominion Bank, a defined benefit plan for which membership is voluntary. As a result of the acquisition of CT Financial Services Inc. (CT), the Bank sponsors... -

Page 51

...No specific maturity 2001 Total 2000 Total N O T E 2 Securities Securities maturity schedule at year end (millions of dollars) Investment securities Government and governmentinsured securities Canada Mortgage-backed securities1 Total Canada Provinces Total Other debt securities Canadian issuers... -

Page 52

... losses 2001 Estimated market value Book value Gross unrealized gains Gross unrealized losses 2000 Estimated market value Investment securities Issued or guaranteed by Canada Provinces U.S. federal government Other debt Equity Total investment securities Trading securities Total securities $ 14... -

Page 53

...sale, net of transaction fees and expenses, of $38 million was recognized in income. The Bank retained the responsibility for servicing the (millions of dollars) 2001 $ 3,253 5,144 9,859 200 $ 2000 5,776 5,724 9,873 200 Residential mortgages Conventional Mortgage-backed securities Personal loans... -

Page 54

...currency swaps to modify the related interest rate and foreign currency risks. The notes and debentures are direct unsecured obligations of the Bank or its subsidiaries and are subordinated in right of payment to the claims of depositors and certain other creditors of the Bank (millions of dollars... -

Page 55

... the same terms. CT Financial Services Inc. First Preference Shares, Series 5 On December 12, 2000, the Bank exchanged the Series 5 shares for Bank preferred shares, Series L, with substantially the same terms. TD Capital Trust Securities - Series 2009 The TD Capital Trust Securities (TD CaTS) are... -

Page 56

... Bank may convert the outstanding Series H shares in whole or in part into common shares, determined by dividing the then applicable redemption price per Series H share together with declared and unpaid dividends to the date of conversion by the greater of $1.00 and 95% of the average trading price... -

Page 57

... holder, be exchanged into common shares of the Bank, determined by dividing $1,000.00 plus the declared and unpaid dividends to the date of exchange by the greater of $1.00 and 95% of the average trading price of such common shares at that time. By giving at least two business days of notice prior... -

Page 58

...Financial Institutions Canada. The Bank's ability to pay dividends on its preferred or common shares is also restricted in the event that TD Capital Trust fails to pay semi-annual distributions in full to holders of TD Capital Trust Securities. In addition, the ability to pay common share dividends... -

Page 59

... of service and the final five years' average salary of the employees. The following table presents the financial position of the Bank's principal pension plan. Pension benefit plan The Bank's principal pension plan, The Pension Fund Society of The Toronto-Dominion Bank, is a defined benefit plan... -

Page 60

... benefit plans In addition to the Bank's pension plans, the Bank also provides certain health care, life insurance and dental benefits to retired employees. The following table presents the financial position of the Bank's non-pension post-retirement benefit plans. (millions of dollars) 2001... -

Page 61

... amortization Dividends Rate differentials on international operations Future federal and provincial tax rate reductions Federal large corporations tax Financial institutions temporary surcharge Gains on sale of investment real estate Non-taxable gain on sale of TD Waterhouse Group, Inc. Other - net... -

Page 62

... not listed above. Details of the estimated fair value of derivative financial instruments are provided in Note 14. The estimated fair value of securities is determined as the estimated market values reported in Note 2. The estimated fair value of loans reï¬,ects changes in general interest rates... -

Page 63

... 2001 Assets Cash resources Effective yield Securities purchased under resale agreements Effective yield Investment securities Effective yield Trading securities Loans Effective yield Other Total assets Liabilities and shareholders' equity Deposits Effective yield Obligations related to securities... -

Page 64

... of a financial instrument at a price agreed when the option is arranged. The writer receives a premium for selling this instrument. The Bank also transacts equity, commodity and credit derivatives in both the exchange and over-the-counter markets. Notional principal amounts, upon which payments are... -

Page 65

...in the derivatives and cash markets relating to movements in interest rates, foreign exchange rates, equity prices and credit spreads. This risk is managed by senior officers responsible for the Bank's trading business and is monitored separately by the Bank's Risk Management Division. The estimated... -

Page 66

... contracts Cross-currency interest rate swaps Total foreign exchange contracts Other contracts 2 Fair value - non-trading Total fair value 1 $ 25,247 2 $ 25,052 $ 16,381 $ 14,378 The average fair value of trading derivative financial instruments for the year ended October 31, 2000 was: Positive... -

Page 67

... 4,661 1 Exchange traded instruments and forward foreign exchange contracts maturing within 14 days are excluded in accordance with the guidelines of the Office of the Superintendent of Financial Institutions Canada. The total positive fair value of the excluded contracts at October 31, 2001 was... -

Page 68

... to extend credit in the form of loans, customers' liability under acceptances, guarantees and letters of credit. (b) The premises and equipment net rental expense charged to net income for the year ended October 31, 2001 was $489 million (2000 - $391 million). The Bank has obligations under long... -

Page 69

... investment management services to institutional and retail investors. TD Securities provides a full range of services, including investment banking, merchant banking, mergers and acquisitions, fixed income, foreign exchange, derivative products, high yield, money market, equities, and corporate... -

Page 70

...business segment (millions of dollars) TD Canada Trust TD Waterhouse TD Wealth Management TD Securities 2001 Net...net of tax Net income - accrual basis Total assets 1999 Net interest income (on a taxable equivalent basis) Provision for credit losses Other income Gain on sale of TD Waterhouse Group...100... -

Page 71

... the TD Waterhouse shares, the Bank announced in October 2001, that it will issue common shares to partially fund the transaction. On November 1, 2001, approximately 11 million common shares were issued for cash proceeds of $400 million. (d) Acquisition of Canada Life Casualty Insurance Company On... -

Page 72

... and employee support costs, branch closures, rationalization of regional and head office space requirements, lease termination, and other expenses. The Bank expects the restructuring related to the acquisition of CT to be substantially complete by the end of fiscal 2002. As at October 31, 2001, the... -

Page 73

... based on Canadian GAAP Stock-based compensation Employee future benefits Restructuring costs Loan securitizations Non-controlling interest in TD Mortgage Investment Corporation Future income taxes Available for sale securities Derivative instruments and hedging activities Other Net income based on... -

Page 74

... Cash resources Securities purchased under resale agreements Securities Investment Trading Loans Derivatives' market revaluation Goodwill and intangible assets from business combinations Other assets Total assets Liabilities Deposits Derivatives' market revaluation Other liabilities Subordinated... -

Page 75

... , the Bank accounts for substantially all investment securities as available for sale. Under Canadian GAAP , investment securities are carried at cost or amortized cost, with other than temporary declines in value recognized based upon expected net realizable values. Loan securitizations U.S. GAAP... -

Page 76

...impact on reported earnings per share. The effective dates noted below are the dates on which new accounting standards must be implemented. Earlier implementation is permitted and the Bank will assess each standard separately to determine the year of adoption. Business combinations Two new related... -

Page 77

... . TD Capital Group Limited TD Capital Trust TD Direct Insurance Inc. TD Futures Inc. TD Investment Management Inc. TD Life Insurance Company TD MarketSite Inc. TD Mortgage Corporation Canada Trustco Mortgage Company TD Waterhouse Bank N.V. Canada Trustco International Limited CT Corporate Services... -

Page 78

... 31, 2001 Head office Book value of all shares owned by the Bank United States TD North American Limited Partnership TD Waterhouse Holdings, Inc. CTUSA, Inc. TD Bank USA, FSB TD Waterhouse Bank, N.A. Waterhouse Mortgage Services, Inc. TD Waterhouse Group, Inc. (89.3%)1 Marketware International, Inc... -

Page 79

... Securities in Q4, 2001, TD Waterhouse Group, Inc. in Q3, 2001, the acquisition of Newcrest in Q1, 2001 and the acquisition of Canada Trust in Q2, 2000), the effects of future tax rate reductions on future tax balances in 2001 and the net effect of real estate gains and general provision increases... -

Page 80

... gains Trading income Service charges Loan securitizations Card services Insurance Trust fees Gains on sale of investment real estate Other Net interest and other income Special gains 3 Net interest and other income, including special gains Non-interest expenses Salaries and employee benefits... -

Page 81

... been restated to reflect the separate reporting of trading derivatives' market revaluation. 2 Commencing in 1997 the Bank adopted operating cash basis measurements. See tables 1 and 2 on pages 32 and 33 for details. 3 Special gains on the sale of TD Waterhouse Group, Inc. and Knight/Trimark in 1999... -

Page 82

... price Closing market price to book value Closing market price appreciation Total market return Cash return on common shareholders' equity excluding special items 3 Return on risk-weighted assets - cash basis excluding special items 3 Efficiency ratio 4 Net interest rate margin (TEB) Common dividend... -

Page 83

...general provision increases in 2001 and special gains on the sale of TD Waterhouse Group, Inc. and Knight/Trimark in 1999. Efficiency ratio excluding non-cash goodwill/intangible amortization and all special items. Dividends paid during the year divided by average of high and low common share prices... -

Page 84

... financial institutions. TD's corporate governance practices are consistent with The Toronto Stock Exchange's Corporate Governance Guidelines. A detailed chart explaining how the corporate governance practices of TD align with these guidelines is contained in the Management Proxy Circular issued... -

Page 85

... policies and procedures relating to certain Canada Deposit Insurance Corporation (CDIC) Standards • Monitors TD's risk management systems, and performance and regulatory compliance program • Reviews procedures for and approves transactions with related parties to TD, as defined by the Bank... -

Page 86

..., Group Risk Management Nadine M. Gilchrist Toronto Credit Portfolio Management, TD Securities Elizabeth Gile 1,3 New York, New York Group Human Resources Brian J. Haier Toronto TD Waterhouse Bank, North America, e.Bank, TD Canada Trust Robert A. Hamilton Toronto TD Waterhouse Investor Services (USA... -

Page 87

... Canada Trust, 24 hours a day, seven days a week 1-866-567-8888 French: 1-800-895-4463 Cantonese/Mandarin: 1-800-387-2828 Telephone device for the deaf: 1-800-361-1180 General and financial: Contact Corporate and Public Affairs, (416) 982-8578 Internet web site: www.td.com Internet e-mail: customer... -

Page 88

... Financial Group." TD Bank Financial Group is one of the top online financial service providers in the world. We serve more than 3.5 million customers over the internet. On October 31, 2001, TD was the second largest bank in Canada in terms of market capitalization. TD Bank is a Schedule 1 chartered...