Suzuki 1998 Annual Report Download - page 25

Download and view the complete annual report

Please find page 25 of the 1998 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

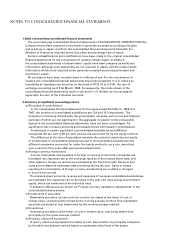

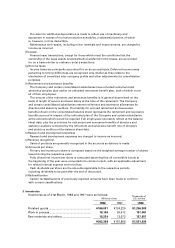

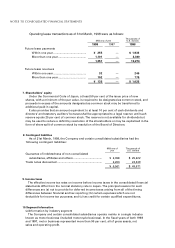

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

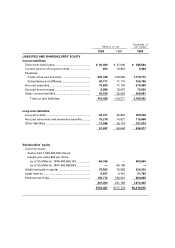

7. Shareholders’ equity

Under the Commercial Code of Japan, at least 50 per cent of the issue price of new

shares, with a minimum of the par value, is required to be designated as common stock, and

proceeds in excess of the amounts designated as common stock may be transferred to

additional paid-in capital.

It also provides that an amount equivalent to at least 10 per cent of cash dividends and

directors' and statutory auditors' bonuses shall be appropriated to a legal reserve until such

reserve equals 25 per cent of common stock. The reserve is not available for dividends but

may be used to reduce a deficit by resolution of the shareholders or may be capitalized in the

form of share split of common stock by resolution of the Board of Directors.

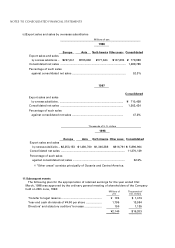

Operating lease transactions as of 31st March, 1998 were as follows:

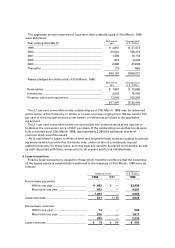

8. Contingent liabilities

As of 31st March, 1998, the Company and certain consolidated subsidiaries had the

following contingent liabilities:

Millions of Thousands of

yen U.S. dollars

Guarantee of indebtedness of non-consolidated

subsidiaries, affiliates and others ..................................... ¥ 3,358 $ 25,422

Trade notes discounted .......................................................... 3,203 24,249

¥ 6,561 $ 49,671

9. Income taxes

The effective income tax rates on income before income taxes in the consolidated financial

statements differ from the normal statutory rate in Japan. The principal reasons for such

differences are (a) not to provide for deferred income taxes arising from all of the timing

differences between financial and tax reporting; (b) certain expenses which are not

deductible for income tax purposes; and (c) tax credit for certain qualified expenditures.

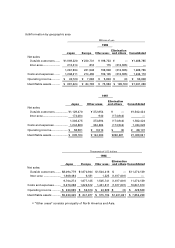

10.Segment Information

(a)Information by industry segment

The Company and certain consolidated subsidiaries operate mainly in a single industry

known as motor business (included motorcycle business). In the fiscal years of both 1998

and 1997, motor business represented more than 90 per cent, all of gross assets, net

sales and operating profit.

Thousands of

Millions of yen U.S. dollars

1998 1997 1998

Future lease payments

Within one year .......................................... ¥ 255 — $ 1,933

More than one year .................................... 1,101 — 8,340

1,357 — 10,274

Future lease revenues

Within one year .......................................... 32 — 246

More than one year .................................... 102 — 779

¥ 135 — $ 1,025