Suzuki 1998 Annual Report Download - page 22

Download and view the complete annual report

Please find page 22 of the 1998 Suzuki annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

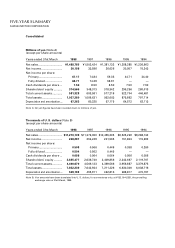

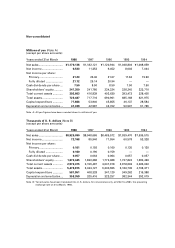

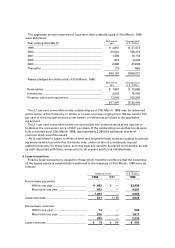

Thousands of

Millions of yen U.S. dollars

1998 1997 1998

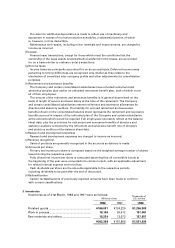

Finished goods ...................................................... ¥166,037 ¥124,220 $1,256,908

Work in process ..................................................... 18,106 20,512 137,067

Raw materials and others ..................................... 18,224 13,072 137,957

¥202,368 ¥157,805 $1,531,933

3. Inventories

Inventories as of 31st March, 1998 and 1997 were as follows:

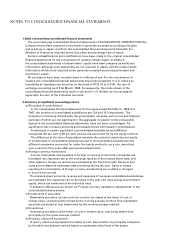

Provision for additional depreciation is made to reflect use of machinery and

equipment in excess of normal production schedules, a substantial portion of which

is, however, not tax deductible.

Maintenance and repairs, including minor renewals and improvements, are charged to

income as incurred.

(f)Leases

Finance lease transactions, except for those which meet the conditions that the

ownership of the lease assets is substantially transferred to the lessee, are accounted

for on a basis similar to ordinary rental transactions.

(g)Income taxes

Income taxes are principally accounted for on an accrual basis. Deferred income taxes

pertaining to timing differences are recognized only insofar as they relate to the

elimination of unrealized inter-company profits and other adjustments for consolidation

purposes.

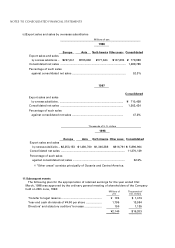

(h)Retirement and severance benefits

The Company and certain consolidated subsidiaries have a funded retirement and

severance pension plan and/or an unfunded retirement benefit plan, both of which cover

all of their employees.

The amount of the retirement and severance benefits is in general determined on the

basis of length of service and basic salary at the time of the retirement. The Company

and certain consolidated subsidiaries reserve retirement and severance allowances for

directors and statutory auditors. The liability for accrued retirement and severance

benefits shown on the consolidated balance sheet represents the retirement and severance

benefits accrued in respect of the unfunded plan of the Company and certain subsidiaries

at the amounts which would be required if all employees voluntarily retired at the balance

sheet date, plus the provisions for retirement and severance benefits of directors and

statutory auditors computed by the retirement and severance benefit rule of directors

and statutory auditors at the balance sheet date.

(i)Research and development expenses

Research and development expenses are charged to income as incurred.

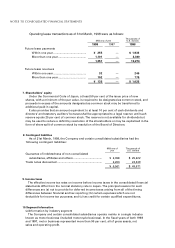

(j)Revenue recognition

Sales of products are generally recognized in the accounts as delivery is made.

(k)Amounts per share

Primary net income per share is computed based on the weighted average number of shares

issued during the respective years.

Fully diluted net income per share is computed assuming that all convertible bonds at

the beginning of the year were converted into common stock, with an applicable adjustment

for related interest expense and net of tax.

Cash dividends per share are the amounts applicable to the respective periods

including dividends to be paid after the end of the period.

(l)Reclassification

Certain reclassifications of previously reported amounts have been made to conform

with current classifications.