Sunoco 2009 Annual Report Download - page 21

Download and view the complete annual report

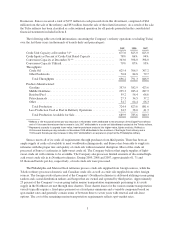

Please find page 21 of the 2009 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.The flue gas produced at Haverhill during the cokemaking process is used to generate low-cost steam that is

sold to the adjacent chemical manufacturing complex owned and operated by Sunoco’s Chemicals business and

electricity for sale to AK Steel and into the regional power market. The cogeneration plant, which includes a 67

megawatt turbine, will provide, on average, 46 megawatts of power.

During 2007, SunCoke Energy commenced operations on behalf of the local project company at a

1.7 million tons-per-year cokemaking facility and associated cogeneration power plant located in Vitória, Brazil.

It also increased its investment in the Vitória coke plant during 2007 by becoming the sole subscriber of

preferred shares in the project company for a total equity interest of $41 million. Originally, under a series of

agreements with the local project company, in which ArcelorMittal Brasil is the major shareholder (“AMB”),

AMB agreed to purchase all of the coke and steam produced at the cokemaking facility under a long-term tolling

arrangement and SunCoke Energy agreed to operate the cokemaking facility for a term of not less than 15 years

and receive fees for operating the plant as well as for the licensing of SunCoke Energy’s proprietary technology.

SunCoke Energy is also entitled to a $9 million annual dividend for 15 years beginning in 2008, assuming certain

minimum production levels are achieved at the Vitória coke plant. In addition, AMB and SunCoke Energy have a

call and put option, respectively, on SunCoke Energy’s investment in the project company, which can be

exercised in 2024. The option price is $41 million, plus any unpaid dividends and related interest. In the fourth

quarter of 2009, the commercial and investment structure was modified to allow the local project company to

lease the coke facility to AMB rather than enter into a long-term tolling agreement for coke. As part of this

restructuring, the long-term operating and maintenance agreement with SunCoke Energy was assigned and

restated with AMB and AMB has guaranteed the dividend payable by the local project company to SunCoke

Energy.

In February 2008, SunCoke Energy entered into a coke purchase agreement and related energy sales

agreement with US Steel under which SunCoke Energy would build, own and operate a 650 thousand

tons-per-year cokemaking facility adjacent to US Steel’s steelmaking facility in Granite City, IL. Operations

from this cokemaking facility commenced in the fourth quarter of 2009. Capital outlays for the project totaled

$320 million. Under the agreement, US Steel has agreed to purchase on a take-or-pay basis, over a 15-year

period, all coke production as well as the steam generated from the heat recovery cokemaking process at this

facility. The coke price under the coke agreement with US Steel reflects the pass through of coal and

transportation costs as well as an operating cost and fixed cost component.

In March 2008, SunCoke Energy entered into a coke purchase agreement and related energy sales

agreement with AK Steel under which SunCoke Energy will build, own and operate a cokemaking facility and

associated cogeneration power plant adjacent to AK Steel’s Middletown, OH steelmaking facility subject to

resolution of all contingencies, including necessary permits. In February 2010, the Ohio EPA issued a final air

permit which is subject to a 30-day appeal period. These facilities are expected to cost in aggregate

approximately $380 million and be completed in the second half of 2011. The plant is expected to produce

approximately 550 thousand tons of coke per year and, on average, 46 megawatts of power. In connection with

this agreement, AK Steel has agreed to purchase, over a 20-year period, all of the coke and available electrical

power from these facilities. Expenditures through December 31, 2009 totaled $76 million. In the event

contingencies (including permit issues) to constructing the project cannot be resolved, AK Steel is obligated to

reimburse substantially all of this amount to Sunoco.

SunCoke Energy is currently discussing other opportunities for developing new heat recovery cokemaking

facilities with domestic and international steel companies. Such cokemaking facilities could be either wholly

owned or developed through other business structures. As applicable, the steel company customers would be

expected to purchase coke production under long-term contracts. The facilities would also generate steam, which

would typically be sold to the steel customer, or electrical power, which could be sold to the steel customer or

into the local power market. SunCoke Energy’s ability to enter into additional arrangements is dependent upon

market conditions in the steel industry.

13