Sunoco 2009 Annual Report Download

Download and view the complete annual report

Please find the complete 2009 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sunoco, Inc.

2009 Annual Report

and Form 10-K

Table of contents

-

Page 1

Sunoco, Inc. 2009 Annual Report and Form 10-K -

Page 2

...barrels per day of refining capacity, approximately 4,700 retail sites selling gasoline and convenience items, and an ownership interest in approximately 6,000 miles of crude oil and refined product pipelines and 41 product terminals, Sunoco is one of the largest independent refiner-marketers in the... -

Page 3

... the Eagle Point refinery, and the divestments of the Tulsa refinery and Retail Heating Oil business. We also reached agreement to sell the polypropylene business around the end of the first quarter 2010. We modified our retirement benefit plans effective June 30, 2010 to freeze pension benefits for... -

Page 4

... potential of using the Eagle Point site as a center for biofuels manufacturing. However, we expect it to be some time before market conditions would support the large investment this decision would require. The recent startup of our new cokemaking facility in Granite City, Illinois demonstrates the... -

Page 5

...organization) 23-1743282 (I.R.S. Employer Identification No.) 1735 Market Street, Suite LL, Philadelphia, PA (Address of principal executive offices) 19103-7583 (Zip Code) Registrant's telephone number, including area code (215) 977-3000 Securities registered pursuant to Section 12(b) of the Act... -

Page 6

-

Page 7

...9A. Item 9B. PART III Item 10. Item 11. Item 12. Item 13. Item 14. PART IV Item 15. Exhibits and Financial Statement Schedules ...106 111 112 Directors, Executive Officers and Corporate Governance ...Executive Compensation ...Security Ownership of Certain Beneficial Owners and Management and Related... -

Page 8

-

Page 9

...Management's Discussion and Analysis of Financial Condition and Results of Operations (Item 7) and the business segment information presented in Note 19 to the Consolidated Financial Statements (Item 8). Sunoco owns and operates three refineries which are located in Marcus Hook, PA, Philadelphia, PA... -

Page 10

... and xylene at its Marcus Hook, Philadelphia and Toledo refineries. The Company sells these products to other Sunoco business units and to wholesale and industrial customers. In the fourth quarter of 2009, Sunoco permanently shut down all process units at the Eagle Point refinery in an effort to... -

Page 11

.... The Company also processes limited amounts of discounted highacid sweet crude oils in its Northeast refineries. During 2009, 2008 and 2007, approximately 61, 71 and 62 thousand barrels per day, respectively, of such crude oils were processed. The Philadelphia and Marcus Hook refineries process... -

Page 12

... and Marcus Hook refineries. Finished products are delivered to customers via the pipeline and terminal network owned and operated by Sunoco Logistics Partners L.P. (see "Logistics" below) as well as by third-party pipelines and barges and by truck and rail. During the 2008-2009 period, Refining and... -

Page 13

...sale of gasoline and middle distillates and the operation of convenience stores in 23 states, primarily on the East Coast and in the Midwest region of the United States. The highest concentrations of outlets are located in Connecticut, Florida, Maryland, Massachusetts, Michigan, New Jersey, New York... -

Page 14

...-operated sites providing gasoline, diesel fuel and convenience store merchandise. Distributor outlets are sites in which the distributor takes delivery of fuel products at a terminal where branded products are available. Sunoco does not own, lease or operate these locations. During the 2007-2009... -

Page 15

...are located principally in Florida, New York and Pennsylvania. These stores supplement sales of fuel products with a broad mix of merchandise such as groceries, fast foods, beverages and tobacco products. The following table sets forth information concerning Sunoco's APlus® convenience stores: 2009... -

Page 16

... affected production line. During 2007, Sunoco also recorded a $7 million after-tax loss associated with the sale of its Neville Island, PA terminal facility, which included an accrual for enhanced pension benefits associated with employee terminations and for other required exit costs. These items... -

Page 17

...States transport gasoline, jet fuel, diesel fuel, home heating oil and other products for Sunoco's other businesses and for third-party integrated petroleum companies, independent refiners, independent marketers and distributors. Crude oil pipeline operations, located in Texas, Oklahoma and Michigan... -

Page 18

...the Partnership purchased a refined products pipeline system, refined products terminal facilities and certain other related assets located in Texas and Louisiana from affiliates of Exxon Mobil Corporation for $185 million. The Partnership intends to take advantage of additional growth opportunities... -

Page 19

... party to produce electricity; the Haverhill facility produces steam that is sold to Sunoco's Chemicals business and electricity from its associated cogeneration power plant for sale in the regional power market; and the Granite City facility produces steam that is sold to a third party. These coke... -

Page 20

...the Haverhill facility multiplied by an adjustment factor, (ii) actual transportation costs, (iii) an operating cost component indexed for inflation, (iv) a fixed-price component, and (v) applicable taxes (except for property and net income taxes). In July 2009, ArcelorMittal filed a lawsuit in Ohio... -

Page 21

... gas produced at Haverhill during the cokemaking process is used to generate low-cost steam that is sold to the adjacent chemical manufacturing complex owned and operated by Sunoco's Chemicals business and electricity for sale to AK Steel and into the regional power market. The cogeneration plant... -

Page 22

... Sunoco's retail marketing operations include site location, product price, selection and quality, site appearance and cleanliness, hours of operation, store safety, customer loyalty and brand recognition. Sunoco competes by pricing gasoline competitively, combining its retail gasoline business... -

Page 23

... of the Tulsa refinery and the retail heating oil and propane distribution business. Approximately 4,000 of Sunoco's employees as of December 31, 2009 were employed in Company-operated convenience stores and service stations and approximately 22 percent were covered by 39 collective bargaining... -

Page 24

... in our marketing areas and as a result of various logistical factors. In many cases, it is very difficult to increase refined product and chemical prices quickly enough to recover increases in the costs of products being sold. We may experience significant changes in our results of operations also... -

Page 25

...of operations. Weakness in general economic, financial and business conditions can lead to a decline in the demand for the refined products and chemicals that we sell. Such weakness can also lead to lower demand for transportation and storage services provided by us. In addition, the global economic... -

Page 26

... are subject to frequent change, and often become more stringent over time. Of particular significance to us are: • Greenhouse gas emissions: Through the operation of our refineries, chemical plants, marketing facilities, coke plants and coal mines, our operations emit greenhouse gases, or... -

Page 27

... in identification of non-attainment areas throughout the country, including Texas, Pennsylvania, Ohio, New Jersey and West Virginia, where we operate facilities. Areas designated as "moderate" non-attainment, including Philadelphia and Houston, would be required to meet the ozone requirements by... -

Page 28

... in the market for the sale of retail gasoline and merchandise. Our competitors include service stations operated by fully integrated major oil companies and other well-recognized national or regional retail outlets, often selling gasoline or merchandise at aggressively competitive prices. 20 -

Page 29

.... These operations also face competition from trucks for incremental and marginal volumes in areas served by the Partnership's pipelines. The Partnership's refined product terminals compete with terminals owned by integrated petroleum companies, refining and marketing companies, independent terminal... -

Page 30

... supply and customer demand. Any one or more of these factors could have a significant impact on our business. If we were unable to make up the delays associated with such factors or to recover the related costs, or if market conditions change, it could materially and adversely affect our financial... -

Page 31

...our product sales. When the price we pay for crude oil decreases, this typically results in a reduction in cash generated from our operations. Our cash needs also include capital expenditures for infrastructure, environmental and other regulatory compliance, maintenance turnarounds at our refineries... -

Page 32

... a material adverse effect on our financial position. Our ability to meet our debt service obligations depends upon our future performance, which is subject to general economic conditions, industry cycles and financial, business and other factors affecting our operations, many of which are beyond... -

Page 33

... of approximately $50 million after tax in pension expense for 2009 due to lower expected returns on plan assets and higher amortization of actuarial losses. As a result of the workforce reduction, the sale of our Tulsa refinery and the shutdown of our Eagle Point refinery, we also incurred noncash... -

Page 34

... oil refinery locations. OSHA conducted inspections at Sunoco, Inc. (R&M)'s Toledo refinery for a six-month period commencing in November 2007, at the Eagle Point refinery for a six-month period commencing in June 2008 and at the Marcus Hook refinery for a six-month period commencing in January 2009... -

Page 35

... relating to the November 2008 product release by Sunoco Pipeline, L.P. in Murrysville, PA. The Partnership has appealed the finding of violation and the proposed penalty. The timing or outcome of this appeal cannot reasonably be determined at this time. (See also the Company's Quarterly Report... -

Page 36

..., Middle District of Florida), was filed in March 2007. The non-MDL Litigation includes the following cases: City of Greenlawn Water District v. Amerada Hess Corporation, et al. (including Sunoco) (Supreme Court of the State of New York, Suffolk County), was filed in March 2009. City of Glen Cove... -

Page 37

...State of New York (State of New York v. LVF Realty, et al.) seeking to recover approximately $57 thousand in investigation costs incurred by the state at a service station located in Inwood, NY, plus interest and penalties. Sunoco owned the property from the 1940s until 1985 and supplied gasoline to... -

Page 38

...Shell Oil Company from June 2003 until March 2005 and President and Chief Executive Officer of Shell Oil Products U.S. from June 2003 until January 2005. Ms. Elsenhans was appointed Chairman of the Board of Sunoco Partners LLC, a subsidiary of Sunoco, Inc. and the general partner of Sunoco Logistics... -

Page 39

... Consolidated Financial Statements under Item 8.) **Consists of income (loss) from the Tulsa refinery which was sold on June 1, 2009. Includes after-tax provisions for asset write-downs and other matters totaling $3 and $95 million in 2009 and 2008, respectively, and a net after-tax gain related to... -

Page 40

... benefited from stringent fuel specifications related to sulfur reductions in gasoline and diesel products, strong premiums for ethanol-blended gasoline, generally tight industry refined product inventory levels on a days-supply basis and strong global refined product demand coupled with refinery... -

Page 41

... the Refining and Supply business: • Permanently shut down all process units at the Eagle Point refinery in the fourth quarter of 2009 in response to weak demand and increased global refining capacity. In connection therewith, the Company shifted production from Eagle Point to its Marcus Hook and... -

Page 42

... cogeneration power plant located at the Company's Haverhill, OH site; and Began operations in 2007 at a 1.7 million tons-per-year cokemaking facility in Vitória, Brazil. SunCoke Energy has a $41 million preferred stock investment in this facility and receives fees for operating the plant as... -

Page 43

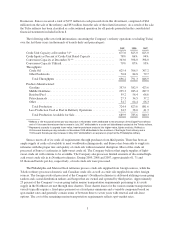

Results of Operations Earnings Profile of Sunoco Businesses (millions of dollars after tax) 2009 2008 2007 Refining and Supply: Continuing operations ...Discontinued Tulsa operations ...Retail Marketing ...Chemicals ...Logistics ...Coke ...Corporate and Other: Corporate expenses ...Net financing ... -

Page 44

... at its Marcus Hook, Philadelphia and Toledo refineries and sells these products to other Sunoco businesses and to wholesale and industrial customers. In the fourth quarter of 2009, Refining and Supply permanently shut down all process units at the Eagle Point refinery in response to weak... -

Page 45

... and Supply at a time when weak demand and increased global refining capacity have created margin pressure on the entire refining industry. As part of this decision, the Company shifted production from the Eagle Point refinery to the Marcus Hook and Philadelphia refineries which are now operating at... -

Page 46

... ($11 million). Retail gasoline margins in the prior-year period benefited from the rapid decrease in wholesale prices during the second half of 2008. During 2009, Sunoco sold its retail heating oil and propane distribution business for $83 million and recognized a $26 million net after-tax gain in... -

Page 47

...related products at chemical plants in Philadelphia, PA and Haverhill, OH; and polypropylene at facilities in LaPorte, TX, Neal, WV and Marcus Hook, PA. The Chemicals business also distributes and markets these products. On February 1, 2010, Sunoco entered into an agreement to sell its polypropylene... -

Page 48

... affected production line. During 2007, Sunoco also recorded a $7 million after-tax loss associated with the sale of its Neville Island, PA terminal facility, which included an accrual for enhanced pension benefits associated with employee terminations and for other required exit costs. These items... -

Page 49

... which were placed into service in 2007, three in 2008 and four in 2009. In November 2008, the Partnership purchased a refined products pipeline system, refined products terminal facilities and certain other related assets located in Texas and Louisiana from affiliates of Exxon Mobil Corporation for... -

Page 50

... return periods, the thirdparty investor's share of net income is now recognized as expense by the Coke business. With respect to the Jewell operation, beginning in January 2008, the price of coke from this facility (700 thousand tons per year) changed from a fixed price to an amount equal to... -

Page 51

... June 30, 2010. During 2008, Sunoco recorded a $95 million after-tax provision to write down Refining and Supply's Tulsa refinery, which was sold on June 1, 2009; recorded a $35 million after-tax provision to write down Chemicals' Bayport, TX polypropylene plant; recorded a $19 million after... -

Page 52

...of the Eagle Point refinery. Sale of Discontinued Tulsa Operations-During 2009, Sunoco recognized a $41 million net after-tax gain related to the divestment of the discontinued Tulsa operations (see Note 2 to the Consolidated Financial Statements under Item 8). Sale of Retail Heating Oil and Propane... -

Page 53

... of the Tulsa refinery and related inventory and the retail heating oil and propane distribution business in 2009 as well as the sale of retail gasoline outlets throughout the 2007-2009 period. In 2009, Sunoco Logistics Partners L.P. issued 2.25 million limited partnership units in a public... -

Page 54

... fund its pension obligations (see "Retirement Benefit Plans" below) and to pay cash dividends on Sunoco's common stock. However, from time to time, the Company's short-term cash requirements may exceed its cash generation due to various factors including reductions in margins for products sold and... -

Page 55

... at the Toledo refinery and coal handling services at the Indiana Harbor cokemaking facility. Sunoco's operating leases include leases for marine transportation vessels, service stations, office space and other property and equipment. Operating leases include all operating leases that have initial... -

Page 56

... to properties, plants and equipment as well as the Company's acquisitions and other capital outlays (in millions of dollars): 2010 Plan 2009 2008 2007 Refining and Supply: Continuing operations ...Discontinued Tulsa operations ...Retail Marketing ...Chemicals ...Logistics ...Coke ...Consolidated... -

Page 57

..., OH and $21 million for various other income improvement projects in Retail Marketing. The $185 million of outlays for acquisitions related to the purchase by the Logistics business of a refined products pipeline system and related storage facilities located in Texas and Louisiana. The Company... -

Page 58

... currently no planned changes in benefits for any employees who retire prior to this date or for current retirees. As a result of these changes, the Company's pension and postretirement benefits liability declined approximately $95 million in the fourth quarter of 2009. The benefit of this liability... -

Page 59

... of non-attainment areas throughout the country, including Texas, Pennsylvania, Ohio, New Jersey and West Virginia, where Sunoco operates facilities. Areas designated by EPA as "moderate" non-attainment for ozone, including Philadelphia and Houston, would be required to meet the ozone requirements... -

Page 60

...for trading purposes. Sunoco is at risk for possible changes in the market value of all of its derivative contracts; however, such risk would be mitigated by price changes in the underlying hedged items. At December 31, 2009, Sunoco had accumulated net derivative deferred losses, before income taxes... -

Page 61

... benefit plans (see "Critical Accounting Policies-Retirement Benefit Liabilities" below). Sunoco generally does not use derivatives to manage its market risk exposure to changing interest rates. Dividends and Share Repurchases The Company has paid cash dividends regularly on a quarterly basis... -

Page 62

... of pension liabilities settled in a given year is greater than the service and interest cost components of its defined benefit plans expense. In 2009, as a result of the workforce reduction, the sale of the Tulsa refinery and the permanent shutdown of the Eagle Point refinery, the Company incurred... -

Page 63

... or in end-use goods manufactured by others utilizing the Company's products as raw materials; changes in the Company's business plans or those of its major customers, suppliers or other business partners; changes in competition and competitive practices; uncertainties associated with the United... -

Page 64

... 2009; goodwill related to the Company's polypropylene business; and certain retail marketing properties held for sale in the Company's Retail Portfolio Management program. The impairment in 2007 related to the permanent shutdown of a previously idled phenol line at the Company's Haverhill, OH plant... -

Page 65

.... At some smaller or less impacted facilities and some previously divested terminals, the focus is on remediating discrete interior areas to attain regulatory closure. Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws... -

Page 66

... and business conditions which could affect Sunoco's financial condition and results of operations; Changes in refining, marketing and chemical margins; Changes in coal and coke prices; Variation in crude oil and petroleum-based commodity prices and availability of crude oil and feedstock supply or... -

Page 67

... markets impacting pension expense and funding requirements; Risks related to labor relations and workplace safety; Nonperformance or force majeure by, or disputes with or changes in contract terms with, major customers, suppliers, dealers, distributors or other business partners; Changes in, or new... -

Page 68

... about Market Risk on pages 52-53 of this report. ITEM 8. FINANCIAL STATEMENTS AND SUPPLEMENTARY DATA Page No. Index to Consolidated Financial Statements Management's Report on Internal Control Over Financial Reporting ...Report of Independent Registered Public Accounting Firm on Internal Control... -

Page 69

..., has issued an audit report on the effectiveness of the Company's internal control over financial reporting as of December 31, 2009, which appears on page 62. Lynn L. Elsenhans Chairman, Chief Executive Officer and President Brian P. MacDonald Senior Vice President and Chief Financial Officer 61 -

Page 70

... Management's Report on Internal Control Over Financial Reporting. Our responsibility is to express an opinion on the effectiveness of the Company's internal control over financial reporting based on our audit. We conducted our audit in accordance with the standards of the Public Company Accounting... -

Page 71

...'s management. Our responsibility is to express an opinion on these financial statements and schedule based on our audits. We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the... -

Page 72

... 31 2009 2008* 2007* Revenues Sales and other operating revenue (including consumer excise taxes) ...Interest income ...Gain related to issuance of Sunoco Logistics Partners L.P. limited partnership units (Note 15) ...Other income, net (Notes 2 and 3) ...Costs and Expenses Cost of products sold and... -

Page 73

... Cash and cash equivalents ...Accounts and notes receivable, net ...Inventories (Note 6) ...Income tax refund receivable ...Deferred income taxes (Note 4) ...Total current assets ...Investments and long-term receivables (Note 7) ...Properties, plants and equipment, net (Note 8) ...Deferred charges... -

Page 74

...to reconcile net income (loss) to net cash provided by operating activities: Gain on divestment of discontinued Tulsa operations ...Gain on divestment of retail heating oil and propane distribution business ...Gain related to issuance of Sunoco Logistics Partners L.P. limited partnership units (Note... -

Page 75

... ...Purchases for treasury ...Issued under management incentive plans . . Net increase in equity related to unissued shares under management incentive plans ...Gain recognized in income related to prior issuance of Sunoco Logistics Partners L.P. limited partnership units (Note 15) ...Other ...Total... -

Page 76

... on available-for-sale securities (net of related tax expense of $1) ...Cash dividends and distributions ...Issued under management incentive plans ...Net increase in equity related to unissued shares under management incentive plans ...Net proceeds from Sunoco Logistics Partners L.P. public equity... -

Page 77

..., fast foods and beverages at its convenience stores, operates common carrier pipelines and provides terminalling services through a publicly traded limited partnership and provides a variety of car care services at its retail gasoline outlets. Revenues related to the sale of products are recognized... -

Page 78

...chemical product inventories is determined using the last-in, first-out method ("LIFO"). The cost of materials, supplies and other inventories is determined using principally the average-cost method. Depreciation and Retirements Plants and equipment are generally depreciated on a straight-line basis... -

Page 79

acceptable margins for various refined products and to lock in the price of a portion of the Company's electricity and natural gas purchases or sales and transportation costs. Sunoco Logistics Partners L.P., the 33-percent owned consolidated master limited partnership through which Sunoco conducts a... -

Page 80

...Cash payments, representing the distributions of the investors' share of cash generated by the cokemaking operations, are recorded as a reduction in noncontrolling interests. Issuance of Partnership Units Prior to January 1, 2009, in accordance with accounting guidance in effect at that time, Sunoco... -

Page 81

...Partnership purchased a refined products pipeline system, refined products terminal facilities and certain other related assets located in Texas and Louisiana from affiliates of Exxon Mobil Corporation for $185 million. The purchase price of these acquisitions has been included in properties, plants... -

Page 82

... 25 are Company-operated locations. These sites are expected to be divested or converted to contract dealers or distributors primarily over the next two years. Retail Heating Oil and Propane Distribution Business-In 2009, Sunoco sold its retail heating oil and propane distribution business for $83... -

Page 83

... accepted accounting principles. Sunoco also recognized a $92 million LIFO inventory gain ($55 million after tax) from the liquidation of refined product inventories in connection with the shutdown of the Eagle Point refinery (Note 6). In 2009, management implemented a previously announced business... -

Page 84

..., net, are as follows (in millions of dollars): 2009 2008 2007 Gain on divestments (Note 2) ...Equity income (loss): Pipeline joint ventures (Notes 2 and 7) ...Other ...Other ... $ 69 26 (3) 24 $116 $ 9 23 (1) 22 $53 $38 28 3 29 $98 4. Income Taxes The components of income tax expense (benefit... -

Page 85

... during 2010 for the carryback of its 2009 net operating loss. During 2008, Sunoco recorded a $16 million after-tax gain related primarily to tax credits claimed on amended federal income tax returns filed for certain prior years and a $10 million after-tax gain due to the settlement of economic... -

Page 86

... includes $25 million after tax attributable to discontinued Tulsa refining operations. In 2008, Sunoco also recorded a $20 million provision ($12 million after tax) to write down its chemical products inventory to market value. In 2009, Sunoco reversed this lower of cost or market adjustment as the... -

Page 87

... $3,887 842 844 1,387 839 $7,799 Refining and supply ...Retail marketing ...Chemicals ...Logistics ...Coke ... $ 6,153 1,544 1,233 1,978 1,105 $12,013 9. Retirement Benefit Plans Defined Benefit Pension Plans and Postretirement Health Care Plans Sunoco has both funded and unfunded noncontributory... -

Page 88

... currently no planned changes in benefits for any employees who retire prior to this date or for current retirees. As a result of these changes, the Company's pension and postretirement benefits liability declined approximately $95 million in the fourth quarter of 2009. The benefit of this liability... -

Page 89

... of dollars): Defined Benefit Plans 2009 2008 2007 Postretirement Benefit Plans 2009 2008 2007 Reclassifications to earnings of: Actuarial loss amortization ...Prior service cost (benefit) amortization ...Settlement and curtailment losses (gains) ...Retirement benefit plan funded status adjustments... -

Page 90

... Funded Unfunded Plans Plans Plans Plans Plans Plans Postretirement Benefit Plans 2009 2008 2007 Cumulative amounts not yet recognized in net income (loss): Prior service costs (benefits) ...$ 2 Actuarial losses ...486 Accumulated other comprehensive loss (before related tax benefit) ...$488... -

Page 91

... shares of Sunoco common stock valued at $90 million. The Company may make additional contributions to its funded defined benefit plans during the remainder of 2010 if it has available cash. The asset allocations attributable to the assets of the funded defined benefit plans at December 31, 2009... -

Page 92

... defined contribution pension plans which provide retirement benefits for most of its employees. Sunoco's contributions, which are principally based on a percentage of employees' annual base compensation and are charged against income as incurred, amounted to $28, $28 and $27 million in 2009, 2008... -

Page 93

... Company, Sunoco Receivables Corporation, Inc. ("SRC"), executed an agreement with two participating banks, extending an existing accounts receivable securitization facility that was scheduled to expire in August 2009, by an additional 364 days. The updated facility permits borrowings and supports... -

Page 94

... $210 $524 2013 ...2014 ...$1 $426 Cash payments for interest related to short-term borrowings and long-term debt (net of amounts capitalized) were $91, $69 and $86 million in 2009, 2008 and 2007, respectively. The following table summarizes Sunoco's long-term debt (including current portion) by... -

Page 95

... and Contingent Liabilities Leases and Other Commitments Sunoco, as lessee, has noncancelable operating leases for marine transportation vessels, service stations, office space and other property and equipment. Total rental expense for such leases for the years 2009, 2008 and 2007 amounted... -

Page 96

..., Sunoco has sold thousands of retail gasoline outlets as well as refineries, terminals, coal mines, oil and gas properties and various other assets. In connection with these sales, the Company has indemnified the purchasers for potential environmental and other contingent liabilities related to... -

Page 97

... table summarizes the changes in the accrued liability for environmental remediation activities by category (in millions of dollars): Retail Sites Chemicals Facilities Pipelines and Terminals Hazardous Waste Sites Refineries Other Total At December 31, 2006 ...Accruals ...Payments ...Other ...At... -

Page 98

.... At some smaller or less impacted facilities and some previously divested terminals, the focus is on remediating discrete interior areas to attain regulatory closure. Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws... -

Page 99

... quarter or year. However, management does not believe that any additional liabilities which may arise pertaining to such matters would be material in relation to the consolidated financial position of Sunoco at December 31, 2009. 15. Noncontrolling Interests Cokemaking Operations Sunoco received... -

Page 100

... Internal Revenue Service review. Although the Company believes the possibility is remote that it will be required to do so, at December 31, 2009, the maximum potential payment under these tax indemnifications would have been approximately $90 million. Logistics Operations The Partnership's issuance... -

Page 101

...): Cokemaking Operations Logistics Operations Other Operations Total At December 31, 2006 ...Noncontrolling interests share of income (loss) ...Cash distributions ...Gain recognized in income related to prior issuance of limited partnership units ...Acquisition of third-party investor's interest... -

Page 102

... Plan ("EIP") and the LongTerm Performance Enhancement Plan II ("LTPEP II"). The EIP provides for the payment of annual cash incentive awards while the LTPEP II provides for the award of stock options, common stock units and related rights to directors, officers and other key employees of Sunoco... -

Page 103

.... For service-based awards to be settled in common stock, the grant-date fair value is based on the closing price of the Company's shares on the date of grant. For performance-based awards to be settled in common stock, the payout of which is determined by market conditions related to stock price... -

Page 104

...are required since the original grants of these awards were at 100 percent of the targeted amounts. ***Cash payments for vested awards are made in the first quarter of the following year. †Includes 102,490 awards attributable to retirement-eligible employees for whom no further service is required... -

Page 105

...the total compensation cost related to nonvested awards not yet recognized reflect the Company's estimates of performance factors pertaining to performance-based common stock unit awards. In addition, equity-based compensation expense attributable to Sunoco Logistics Partners L.P. for 2009, 2008 and... -

Page 106

... operations. **Included in cost of products sold and operating expenses in the consolidated statement of operations. ***Included in interest cost and debt expense in the consolidated statement of operations. 19. Business Segment Information Sunoco is a petroleum refiner and marketer, and chemicals... -

Page 107

... the Eagle Point refinery and the sale of the Tulsa refinery, Refining and Supply manufactured petroleum products at these facilities as well as lubricants at Tulsa, which were sold to other Sunoco businesses and to wholesale and industrial customers. The Retail Marketing segment sells gasoline and... -

Page 108

Segment Information (millions of dollars) Refining and Supply Retail Marketing Chemicals Logistics Corporate and Other Consolidated Coke 2009 Sales and other operating revenue (including consumer excise taxes)*: Unaffiliated customers ...$12,305 $11,458 $1,616 Intersegment ...$9,384 $- $- Pretax ... -

Page 109

... Tulsa refining operations (Note 2). **Consists of $46 million of after-tax corporate expenses, $22 million of after-tax net financing expenses and other, a $14 million after-tax gain related to the prior issuance of Sunoco Logistics Partners L.P. limited partnership units, $26 million of after-tax... -

Page 110

...discontinued Tulsa refining operations) (in millions of dollars): 2009 2008 2007 Gasoline: Wholesale ...Retail ...Middle distillates ...Residual fuel ...Petrochemicals ...Other refined products ...Convenience store merchandise ...Other products and services ...Resales of purchased crude oil ...Coke... -

Page 111

...the discontinued Tulsa operations), a $16 million after-tax gain related to income tax matters and a $14 million after-tax gain related to the prior issuance of Sunoco Logistics Partners L.P. limited partnership units. @@The Company's common stock is principally traded on the New York Stock Exchange... -

Page 112

...over financial reporting during the fourth quarter of 2009 that have materially affected, or are reasonably likely to materially affect, the Company's internal control over financial reporting. ITEM 9B. OTHER INFORMATION None. PART III ITEM 10. DIRECTORS, EXECUTIVE OFFICERS AND CORPORATE GOVERNANCE... -

Page 113

... principal financial officer, the principal accounting officer or persons performing similar functions. Sunoco's Corporate Governance Guidelines and the Charters of its Audit, Compensation, Corporate Responsibility, Executive and Governance Committees are available on its website (www.SunocoInc.com... -

Page 114

... as a part of this report: 1. Consolidated Financial Statements: The consolidated financial statements are set forth under Item 8 of this report. 2. Financial Statement Schedules: Schedule II-Valuation Accounts is included on page 110 of this report. Other schedules are omitted because the required... -

Page 115

... 10.12 of the Company's Quarterly Report on Form 10-Q for the quarterly period ended June 30, 2008 filed August 7, 2008, File No. 1-6841). -Amended Schedule 2.1 of Directors' Deferred Compensation and Benefits Trust Agreement, by and among Sunoco, Inc., Mellon Trust of New England, N.A. and Towers... -

Page 116

... 8, 2002, among Sunoco, Inc., Sunoco, Inc. (R&M), Sun Pipe Line Company of Delaware, Atlantic Petroleum Corporation, Sunoco Texas Pipe Line Company, Sun Pipe Line Services (Out) LLC, Sunoco Logistics Partners L.P., Sunoco Logistics Partners Operations L.P., and Sunoco Partners LLC (incorporated by... -

Page 117

.... -Consent of Independent Registered Public Accounting Firm. -Power of Attorney executed by certain officers and directors of Sunoco, Inc. -Certified copy of the resolution authorizing certain officers to sign on behalf of Sunoco, Inc. -Certification Pursuant to Exchange Act Rule 13a-14(a) or Rule... -

Page 118

Sunoco, Inc. and Subsidiaries Schedule II-Valuation Accounts For the Years Ended December 31, 2009, 2008 and 2007 (Millions of Dollars) Additions Balance at Beginning of Period Charged to Costs and Expenses Charged To Other Accounts Deductions Balance at End of Period For the year ended December ... -

Page 119

... by the undersigned, thereunto duly authorized. SUNOCO, INC. By /s/ BRIAN P. MACDONALD Brian P. MacDonald Senior Vice President and Chief Financial Officer Date February 24, 2010 Pursuant to the requirements of the Securities Exchange Act of 1934, this report has been signed below by or on behalf of... -

Page 120

... and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Lynn L. Elsenhans Chairman, Chief Executive Officer and President February 24... -

Page 121

... and report financial information; and Any fraud, whether or not material, that involves management or other employees who have a significant role in the registrant's internal control over financial reporting. b) Brian P. MacDonald Senior Vice President and Chief Financial Officer February... -

Page 122

... respects, the financial condition and results of operations of Sunoco, Inc. Lynn L. Elsenhans Chairman, Chief Executive Officer and President February 24, 2010 I, Brian P. MacDonald, Senior Vice President and Chief Financial Officer of Sunoco, Inc., certify that the Annual Report on Form 10... -

Page 123

... total return (i.e., based on common stock price and dividends), plotted on an annual basis, with Sunoco's performance peer group's cumulative total returns and the S&P 500 Stock Index (a performance indicator of the overall stock market). **Western was included in the Peer Group commencing... -

Page 124

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 125

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 126

[THIS PAGE INTENTIONALLY LEFT BLANK] -

Page 127

...Earnings announcements, press releases and copies of reports filed with the Securities and Exchange Commission are available at our website or by leaving your full name, address and phone number on voice mail at 215-977-6440. Health, Environment and Safety Sunoco's Corporate Responsibility Report is... -

Page 128

Sunoco, Inc., 1735 Market Street, Suite LL, Philadelphia, PA 19103-7583 Printed on recycled paper