Sunoco 2006 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2006 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

To Our Shareholders

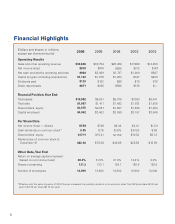

From a fi nancial

perspective, 2006 was

another successful year

for Sunoco. Income

before special items*

was $979 million, with

earnings per share of

$7.59, up 3 percent from

the record 2005 level.

This was our fourth

consecutive year of earnings per share growth.

Refi ning and Supply earned $881 million

in 2006 and continued to be the primary

source of income for the Company. Refi ning

margins remained healthy, particularly in

the MidContinent region and for the diesel

part of the barrel. Strong summer gasoline

margins, in part due to the 2006 transition

from MTBE to ethanol-based gasoline, also

benefi ted earnings. Sunoco’s non-refi ning

business earnings totaled $205 million, up 6

percent from 2005. Retail Marketing, Logistics

and Coke each improved; but rising feedstock

prices and weak demand growth resulted in

lower Chemicals earnings.

Pursuing high returns on the Company’s

capital investments while returning cash to our

shareholders has been our consistent strategy.

Return on Capital Employed remained strong

at over 28 percent for the year. We increased

our dividend 25 percent in 2006 and recently

announced another 10 percent increase. We

continued to repurchase shares and reduce the

Company’s outstanding share base. We enter

2007 with 9 percent fewer shares outstanding

than a year ago and 20 percent less than just

three years ago.

After three years of sustained upward

momentum, exceptionally warm winter

weather and moderating refi ning expectations

contributed to a 20 percent share price decline

during the year. While disappointed in the

2006 share price performance, the longer-term

returns have been strong (total shareholder

return of 269 percent over the past fi ve years).

We believe our businesses can continue to add

value to Sunoco shares.

Operationally, results were mixed. Overall

health, environment and safety (HES)

performance was the best ever for the

Company with best historic and/or top

quartile performance achieved in most areas.

Signifi cant capital investment and a priority

focus on Operations Excellence have resulted

in sustained improvements in HES over the

past several years. We will strive to do better.

Health, environment and safety are musts and

the foundation of all that we do.

Two major operational challenges for 2006,

namely the MTBE-to-ethanol conversion and

the transition to the new ultra-low-sulfur

diesel specifi cations, were well planned and

executed across the organization. Total refi ning

production, however, fell short of our 2006

targets and 2005 levels. This was, in part, due

to several shutdowns associated with a crude

unit at our Philadelphia refi nery. While we

have planned signifi cant refi nery maintenance

in 2007, our goal is to continue to improve

production and reduce unplanned downtime.

With asset acquisition opportunities scarce

and expensive, strategic efforts were largely

directed at executing a signifi cant Refi ning

and Supply capital program and continuing to

pursue growth in Sunoco Logistics Partners

L.P. (SXL) and Sun Coke.

––––––––––––––

* Net income for 2006, 2005 and 2004 amounted to $979, $974 and $605 million,

respectively, which includes net charges for special items of $0, $38 and $24 million,

respectively.