Sunoco 2006 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2006 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

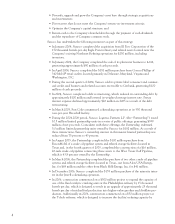

Northeast Refining (the Marcus Hook, Philadelphia and Eagle Point refineries) and

MidContinent Refining (the Toledo and Tulsa refineries).

2006 2005 2004

Income (millions of dollars) $881 $947 $541

Wholesale margin* (per barrel):

Total Refining and Supply $9.09 $8.65 $6.30

Northeast Refining $7.92 $8.35 $6.36

MidContinent Refining $12.46 $9.54 $6.12

Throughputs (thousands of barrels daily):

Crude oil 840.6 881.0 855.7

Other feedstocks 72.8 59.4 58.8

Total throughputs 913.4 940.4 914.5

Products manufactured (thousands of barrels daily):

Gasoline 436.2 443.4 442.0

Middle distillates 305.5 319.5 300.3

Residual fuel 74.0 76.2 73.0

Petrochemicals 35.6 36.8 38.1

Lubricants 13.2 13.2 13.6

Other 82.2 86.6 82.0

Total production 946.7 975.7 949.0

Less: Production used as fuel in refinery operations 43.9 48.6 46.2

Total production available for sale 902.8 927.1 902.8

Crude unit capacity (thousands of barrels daily) at

December 31** 900.0 900.0 890.0

Crude unit capacity utilized 93% 98% 97%

Conversion capacity*** (thousands of barrels daily) at

December 31 392.0 372.0 361.7

Conversion capacity utilized 95% 101% 98%

* Wholesale sales revenue less related cost of crude oil, other feedstocks, product purchases and terminalling and transportation divided

by production available for sale.

** Reflects an increase in January 2005 due to a 10 thousand barrels-per-day adjustment in MidContinent Refining.

*** Represents capacity to upgrade lower-value, heavier petroleum products into higher-value, lighter products. Reflects an increase in

June 2006 attributable to a 20 thousand barrels-per-day expansion project in MidContinent Refining and increases in January 2005

due to a 5 thousand barrels-per-day adjustment in Northeast Refining and a 5.3 thousand barrels-per-day adjustment in MidContinent

Refining.

The Refining and Supply segment results decreased $66 million in 2006 largely due to

lower production volumes ($48 million) and higher expenses ($103 million), partially off-

set by higher realized margins ($73 million), reflecting strong diesel fuel and petrochemical

margins in MidContinent Refining, and a benefit attributable to LIFO inventory profits

($16 million). Strong premiums for ethanol-blended gasoline and low-sulfur diesel fuel

supported the wholesale marketplace during 2006. In addition, margins benefited in 2005

as a result of the supply disruptions on the Gulf Coast caused by Hurricanes Katrina and

Rita. The lower volumes were in part due to scheduled and unscheduled maintenance ac-

tivities, while the higher expenses were mainly the result of higher purchased fuel costs,

expenses associated with maintenance activities and operating costs to produce low-sulfur

fuels.

The Refining and Supply segment results increased $406 million in 2005 largely due to

higher realized margins ($467 million) and higher production volumes ($41 million). The

higher realized margins reflect strong demand, the effect of the supply disruptions on the

Gulf Coast and the use of discounted high-acid crude oils in Northeast Refining. Partially

offsetting these factors were higher expenses ($110 million), primarily fuel and employee-

related charges.

Effective January 13, 2004, Sunoco completed the purchase of the 150 thousand

barrels-per-day Eagle Point refinery and related assets from El Paso Corporation for $250

11