Sunoco 2005 Annual Report Download - page 3

Download and view the complete annual report

Please find page 3 of the 2005 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

1

To Our Shareholders

2005 was an

extraordinary year

for Sunoco — with

best ever health,

environment and safety

(“HES”) performance

and record fi nancial

results.

We achieved best

historic performance in the areas of employee

and contractor safety as well as air and water

permit exceedences. Operations Excellence

in HES is a top priority within Sunoco and the

foundation of all that we do.

From a fi nancial perspective, it was the

best year in the best three-year period for

Sunoco since the Company focused purely on

downstream manufacturing. The combination

of favorable refi ning margins and an improved

Sunoco asset portfolio and operational

performance have led to three consecutive

years of increases in earnings and share price.

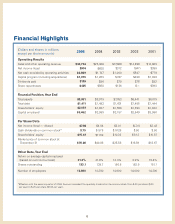

2005 income before special items* was over

$1 billion and earnings per share was a record

$7.36, up 75 percent from 2004. Return on

Capital Employed was a sector-leading 32

percent. We increased our dividend by 33

percent, reduced our shares outstanding

by 4 percent and signifi cantly strengthened

our balance sheet. Share price increased 92

percent for the year.

During the 2003-05 period we have:

• generated approximately $2 billion in

earnings before special items* and

provided a 400 percent total return to

our shareholders;

__________

*Net income for 2005, 2004 and 2003 amounted to $974, $605 and $312 million,

respectively, which includes net charges for special items of $38, $24 and

$23 million, respectively.

• grown each of our businesses and

increased the total assets of the Company

from $6.4 billion to $9.9 billion;

• funded a capital program (including

acquisitions) of approximately $3.1

billion and made over $1.1 billion in

share repurchases...while reducing the

net debt-to-capital ratio (per our revolving

credit agreement) from 45 percent at

December 31, 2002 to 17 percent at

year-end 2005; and

• increased our dividend by 60 percent

(100 percent with our second quarter of

2006 increase) and reduced our net

shares outstanding by 13 percent.

Among the many factors contributing to our

strong performance over this timeframe,

two clearly stand out: (1) the structural

improvement that has occurred in the refi ning

industry, and (2) the continuing gains in

operating performance achieved by Sunoco’s

Refi ning and Supply business.

After many years of overcapacity, growing

refi ned product demand is increasingly

pushing the limits of U.S. and global refi ning

capacity. Refi ned products, which in the

oversupplied market of the 1980s and 90s

were largely priced on a cost basis, are now

selling more on value — how much the market

will pay for an essential but limited product.

While still cyclical and volatile and impacted by

fl uctuations in inventory levels, tightness in the

supply/demand balance for refi ned products

looks likely to continue as demand grows and

signifi cant new supply takes time to bring on-

line. With new, tighter product specifi cations

for gasoline and diesel fuel and the expected

elimination of MTBE from the gasoline pool,

2006 is set to be a particularly challenging year

for the industry.