Sunoco 2005 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2005 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

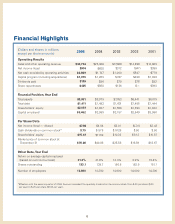

2005 2004 2003

Income (millions of dollars) $94 $94 $53

Margin* (cents per pound):

All products** 12.1¢ 11.0¢ 9.5¢

Phenol and related products 10.9¢ 9.7¢ 8.2¢

Polypropylene** 13.9¢ 13.4¢ 11.5¢

Sales (millions of pounds):

Phenol and related products 2,579 2,615 2,629

Polypropylene 2,218 2,239 2,248

Plasticizers*** —28 591

Other 91 187 173

4,888 5,069 5,641

* Wholesale sales revenue less related cost of feedstocks, product purchases and terminalling and transportation divided by sales

volumes.

** The polypropylene and all products margins include the impact of a long-term supply contract entered into on March 31, 2003 with

Equistar Chemicals, L.P. (“Equistar”) which is priced on a cost-based formula that includes a fixed discount (see below).

*** The plasticizer business was divested in January 2004 (see below).

Chemicals segment income was unchanged in 2005. The favorable impact of higher mar-

gins for both phenol and polypropylene ($34 million) was essentially offset by higher ex-

penses ($19 million), including employee-related charges, and lower sales volumes ($13

million).

During the third quarter of 2005, an arbitrator ruled that Sunoco was liable in an arbi-

tration proceeding for breaching a supply agreement concerning the prices charged to

Honeywell International Inc. (“Honeywell”) for phenol produced at Sunoco’s Philadelphia

chemical plant from June 2003 through April 2005. In January 2006, the arbitrator ruled

that Sunoco should bill Honeywell based on the pricing formula established in the arbi-

tration until a second arbitration, set to begin in the second quarter of 2006, finalizes pric-

ing for 2005 and beyond (see below). After-tax damages of approximately $56 million,

including prejudgment interest, were assessed, of which $16, $28 and $12 million pertained

to 2005, 2004 and 2003, respectively. Such damages were reported as a charge against 2005

earnings and are shown separately as Phenol Supply Contract Dispute under Corporate

and Other in the Earnings Profile of Sunoco Businesses. Sunoco is contesting the finding

of liability and the determination of damages as well as the arbitrator’s authority to estab-

lish 2005 pricing. The phenol supply agreement provides for a reopener for pricing on and

after January 1, 2005 and sets forth specific standards for determining such pricing. The

parties have been unsuccessful in negotiating the post-2004 price, and a new price will be

determined in a second arbitration to be held before a different arbitrator. Sunoco believes

the basis for the post-2004 pricing is substantially different from the basis of the award in

the first arbitration. (See Note 2 to the consolidated financial statements.)

Chemicals segment income increased $41 million in 2004 due largely to higher realized

margins for both phenol and polypropylene ($35 million) and an increased income con-

tribution associated with the March 2003 propylene supply agreement with Equistar ($12

million). Also contributing to the improvement were higher operating earnings from the

BEF joint venture chemical operations divested in 2004 ($6 million). Partially offsetting

these positive factors were higher expenses ($9 million), largely natural gas fuel costs.

In 2004, Sunoco sold its one-third partnership interest in BEF to Enterprise for $15 million

in cash, resulting in an $8 million after-tax loss on divestment. In connection with the

sale, Sunoco has retained one-third of any liabilities and damages exceeding $300 thou-

sand in the aggregate arising from any claims resulting from the ownership of the assets and

liabilities of BEF for the period prior to the divestment date, except for any on-site

environmental claims which are retained by Enterprise. As a result of various gov-

ernmental actions which caused a material adverse impact on MTBE industry demand, in

2003, BEF recorded a write-down of its MTBE production facility to its estimated fair value

at that time. Sunoco’s share of this provision amounted to $15 million after tax. During

14