Sunoco 2005 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2005 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.• During 2005, the Company continued its Retail Portfolio Management program to se-

lectively reduce its invested capital in Company-owned or leased sites, while retaining

most of the gasoline sales volumes attributable to the divested sites. During the 2003-

2005 period, 323 sites have been divested, with most of the sites converted to contract

dealers or distributors, generating $170 million of divestment proceeds. The Company

expects to generate approximately $60 million of additional proceeds in 2006 under

this program through the divestment/conversion of an additional 75 sites.

• In 2005, construction continued on a 1.7 million tons-per-year cokemaking facility

and associated cogeneration power plant in Vitória, Brazil, which is expected to be

operational in the fourth quarter of 2006. Sun Coke currently has a one percent inter-

est in this venture and expects to purchase an additional 19 percent interest during

2006 or 2007 for approximately $35 million. Sun Coke will be the operator of the

cokemaking facility.

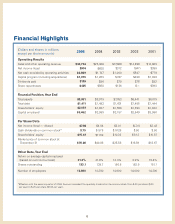

• On August 1, 2005, a two-for-one split of Sunoco’s common stock was effected in the

form of a common stock dividend. (Share and per-share data for all periods reflect the

effect of the stock split.)

• Effective with the second quarter of 2006, Sunoco increased the quarterly dividend on

its common stock to $.25 per share ($1.00 per year), following increases from $.15 per

share to $.20 per share in the second quarter of 2005, from $.1375 per share to $.15 per

share in the third quarter of 2004 and from $.125 per share to $.1375 per share in the

fourth quarter of 2003.

• During 2005, 2004 and 2003, the Company repurchased 6.7, 15.9 and 5.8 million

shares, respectively, of its outstanding common stock for $435, $568 and $136 million,

respectively. In March 2005, the Company announced that its Board of Directors ap-

proved an additional $500 million share repurchase authorization. At December 31,

2005, the Company had a remaining authorization from its Board to purchase up to

$306 million of Company common stock. Sunoco expects to continue to purchase

Company common stock in the open market from time to time depending on prevail-

ing market conditions and available cash.

For additional information regarding the above actions, see Notes 2, 3, 11, 13, 14 and 18

to the consolidated financial statements.

9