Sunoco 2004 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2004 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

master limited partnership that is 62.6 percent owned by Sunoco (see “Capital Resources

and Liquidity—Other Cash Flow Information” below).

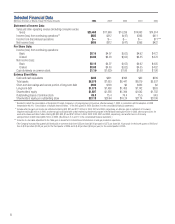

2004 2003 2002

Income (millions of dollars) $31 $26 $33

Pipeline and terminal throughput (thousands of barrels daily)*:

Unaffiliated customers 842 827 768

Affiliated customers 1,525 1,225 1,286

2,367 2,052 2,054

*Consists of 100 percent of the throughput of pipelines and terminals owned and operated by the Partnership.

Logistics segment income increased $5 million in 2004 due to the absence of $12 million of

after-tax charges recognized in 2003 for litigation associated with two pipeline spills that

occurred in prior years. Partially offsetting the positive variance is the reduction in Sunoco’s

ownership interest in the Partnership from 75.3 percent to 62.6 percent as a result of the

April 7, 2004 public offering of 3.4 million limited partnership units and the Partnership’s

related redemption of 2.2 million limited partnership units owned by Sunoco. In 2003,

Logistics segment income decreased $7 million largely due to the litigation accruals recorded

in 2003, partially offset by increased joint-venture income associated with assets acquired in

2002 (see below).

In 2004, the Partnership completed the following acquisitions: in March, certain pipeline

and other logistics assets that had previously been acquired by Sunoco with the Eagle Point

refinery for $20 million; in April, ConocoPhillips’ Baltimore, MD and Manassas, VA re-

fined product terminals for $12 million; in June, an additional one-third interest in the

Harbor Pipeline from El Paso Corporation for $7 million; and in November, a refined

product terminal located in Columbus, OH from a subsidiary of Certified Oil Company for

$8 million. In November 2002, the Partnership completed the acquisition from an affiliate

of Union Oil Company of California (“Unocal”) of interests in three Midwestern and

Western U.S. products pipeline companies, consisting of a 31.5 percent interest in

Wolverine Pipe Line Company, a 9.2 percent interest in West Shore Pipe Line Company

and a 14.0 percent interest in Yellowstone Pipe Line Company, for $54 million. During

September 2003, the Partnership acquired an additional 3.1 percent interest in West Shore

Pipe Line Company for $4 million, increasing its ownership interest in West Shore to 12.3

percent. In November 2002, the Partnership also completed the acquisition of an owner-

ship interest in West Texas Gulf Pipeline for $6 million, which coupled with the 17.3 per-

cent interest it acquired from Sunoco on the same date, gave it a 43.8 percent ownership

interest.

During 2002, Sunoco recorded a $3 million after-tax charge to reflect the Partnership’s

write-off of a pipeline located in Pennsylvania and New York and a related refined prod-

ucts terminal that were idled because they became uneconomic to operate. This amount is

reported as part of the Asset Write-Downs and Other Matters shown separately in Corpo-

rate and Other in the Earnings Profile of Sunoco Businesses (see Note 2 to the con-

solidated financial statements).

Coke

The Coke business, through Sun Coke Company and its affiliates (individually and collec-

tively, “Sun Coke”), currently makes high-quality, blast-furnace coke at its Indiana Harbor

facility in East Chicago, IN and Jewell facility in Vansant, VA and produces metallurgical

coal from mines in Virginia primarily for use at the Jewell cokemaking facility. Additional

cokemaking facilities, which will be operated by Sun Coke, are currently under con-

struction in Haverhill, OH and Vitória, Brazil. Sunoco will wholly own the facility in

Haverhill and have a minority joint-venture interest in the Vitória facility.

18