Sunoco 2004 Annual Report Download - page 15

Download and view the complete annual report

Please find page 15 of the 2004 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Refining and Supply

The Refining and Supply business manufactures petroleum products and commodity pet-

rochemicals at its Marcus Hook, Philadelphia, Eagle Point and Toledo refineries and petro-

leum and lubricant products at its Tulsa refinery and sells these products to other Sunoco

businesses and to wholesale and industrial customers. Refining operations are comprised of

Northeast Refining (the Marcus Hook, Philadelphia and Eagle Point refineries) and Mid-

Continent Refining (the Toledo and Tulsa refineries).

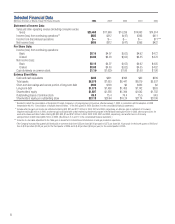

2004 2003 2002

Income (loss) (millions of dollars) $541 $261 $(31)

Wholesale margin* (per barrel):

Total Refining and Supply $6.30 $4.76 $2.83

Northeast Refining $6.36 $4.63 $2.47

MidContinent Refining $6.12 $5.05 $3.69

Throughputs** (thousands of barrels daily):

Crude oil 855.7 708.1 689.9

Other feedstocks 58.8 53.2 58.4

Total throughputs 914.5 761.3 748.3

Products manufactured** (thousands of barrels daily):

Gasoline 442.0 375.6 375.2

Middle distillates 300.3 236.7 231.2

Residual fuel 73.0 59.8 55.9

Petrochemicals 38.1 27.9 30.5

Lubricants 13.6 13.6 13.1

Other 82.0 77.6 73.4

Total production 949.0 791.2 779.3

Less: Production used as fuel in refinery operations 46.2 37.1 37.0

Total production available for sale 902.8 754.1 742.3

Crude unit capacity (thousands of barrels daily) at

December 31*** 890.0 730.0 730.0

Crude unit capacity utilized 97% 97% 95%

Conversion capacity†(thousands of barrels daily) at

December 31 361.7 306.7 306.7

Conversion capacity utilized 98% 98% 95%

* Wholesale sales revenue less related cost of crude oil, other feedstocks, product purchases and terminalling and transportation divided

by production available for sale.

** Data pertaining to the Eagle Point refinery are based on the amounts attributable to the 354-day ownership period (January 13, 2004 –

December 31, 2004) divided by 366 days.

*** Reflects an increase in January 2004 due to the acquisition of the 150 thousand barrels-per-day Eagle Point refinery and a 10 thousand

barrels-per-day adjustment in MidContinent Refining. In January 2005, crude unit capacity increased again to 900 thousands of

barrels daily due to an additional 10 thousand barrels-per-day adjustment in MidContinent Refining.

†Represents capacity to upgrade lower-value, heavier petroleum products into higher-value, lighter products. Reflects an increase in

January 2004 as a result of the Eagle Point refinery acquisition. In January 2005, conversion capacity increased again to 372

thousands of barrels daily due to a 5.0 thousand barrels-per-day adjustment in Northeast Refining and a 5.3 thousand barrels-per-day

adjustment in MidContinent Refining.

The Refining and Supply segment results increased $280 million in 2004. In addition to a

$135 million income contribution from the Eagle Point refinery, the improvement was

primarily due to higher realized margins ($234 million) resulting largely from low industry

inventory levels, particularly for distillate products, and stronger product demand. Also

contributing to the increase were higher production volumes ($15 million). Partially off-

setting these positive factors were higher expenses ($76 million), including fuel, deprecia-

tion and employee-related charges and a higher effective income tax rate ($23 million).

Refining and Supply segment results increased $292 million in 2003 primarily due to sig-

nificantly higher realized margins ($339 million) and a 2 percent increase in total pro-

duction volumes ($13 million). The margin improvement resulted largely from low

13