Sunoco 2004 Annual Report Download - page 18

Download and view the complete annual report

Please find page 18 of the 2004 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Hook, PA Epsilon Products Company, LLC joint venture facility (“Epsilon”). This busi-

ness also distributes and markets these products. In September 2004, Sunoco sold its one-

third interest in its Mont Belvieu, TX Belvieu Environmental Fuels (“BEF”) MTBE

production facility to Enterprise Products Operating L.P. (“Enterprise”). In addition, a fa-

cility in Pasadena, TX, which produces plasticizers, was sold to BASF in January 2004,

while a facility in Neville Island, PA continues to produce plasticizers exclusively for BASF

under a three-year tolling agreement.

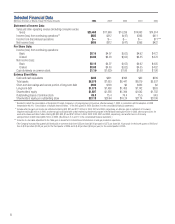

2004 2003* 2002

Income (millions of dollars) $94 $53 $28

Margin** (cents per pound):

All products*** 11.0¢ 9.5¢ 6.3¢

Phenol and related products 9.7¢ 8.2¢ 6.6¢

Polypropylene*** 13.4¢ 11.5¢ 9.0¢

Sales (millions of pounds):

Phenol and related products 2,615 2,629 2,831

Polypropylene†2,239 2,248 1,346

Plasticizers†† 28 591 615

Propylene††† —— 774

Other 187 173 178

5,069 5,641 5,744

* Restated to reflect the consolidation of Epsilon, effective January 1, 2003, in connection with the adoption of FASB Interpretation No.

46 in the first quarter of 2004.

** Wholesale sales revenue less the cost of feedstocks, product purchases and related terminalling and transportation divided by sales

volumes.

*** The polypropylene and all products margins include the impact of a long-term supply contract entered into on March 31, 2003 with

Equistar Chemicals, L.P. (“Equistar”) which is priced on a cost-based formula that includes a fixed discount (see below).

†Includes amounts attributable to the Bayport facility subsequent to its purchase effective March 31, 2003 (see below) and the Epsilon

joint venture subsequent to its consolidation effective January 1, 2003.

†† The plasticizer business was divested in January 2004 (see below).

††† Effective with the consolidation of Epsilon beginning January 1, 2003, excludes refinery-grade propylene sold to Epsilon which is now

eliminated in consolidation.

Chemicals segment income increased $41 million in 2004 due largely to higher realized

margins for both phenol and polypropylene ($35 million) and an increased income con-

tribution associated with the March 2003 propylene supply agreement with Equistar ($12

million). Also contributing to the improvement were higher operating earnings from the

recently divested BEF joint venture chemical operations ($6 million) (see below). Partially

offsetting these positive factors were higher expenses ($9 million), largely natural gas fuel

costs.

Chemicals segment income increased $25 million in 2003 due largely to higher margins for

both phenol and polypropylene ($50 million) and $14 million of after-tax income related

to the supply agreement with Equistar. Partially offsetting the positive variances were

higher expenses ($8 million), including natural gas fuel costs; lower sales volumes ($15

million); and lower equity income from BEF ($10 million), due to weakness in MTBE de-

mand. Also included in 2003 results were $4 million of after-tax charges primarily related

to employee terminations in connection with a productivity improvement plan.

In 2004, Sunoco sold its one-third partnership interest in BEF to Enterprise for $15 million

in cash, resulting in an $8 million after-tax loss on divestment. In connection with the

sale, Sunoco has retained one-third of any liabilities and damages exceeding $300 thou-

sand in the aggregate arising from any claims resulting from the ownership of the assets and

liabilities of BEF for the period prior to the divestment date, except for any on-site

environmental claims which are retained by Enterprise. As a result of various gov-

ernmental actions which caused a material adverse impact on MTBE industry demand, in

2003, BEF recorded a write-down of its MTBE production facility to its estimated fair value

at that time. Sunoco’s share of this provision amounted to $15 million after tax. During

16