Sunoco 2004 Annual Report Download

Download and view the complete annual report

Please find the complete 2004 Sunoco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2004 Annual Report

Table of contents

-

Page 1

2004 Annual Report -

Page 2

... markets. Utilizing a unique, patented technology, Sunoco also currently manufactures approximately two million tons annually of high-quality metallurgical-grade coke for use in the steel industry. Contents: Financial Highlights ...1 Letter to Shareholders...2 Health, Environment and Safety Report... -

Page 3

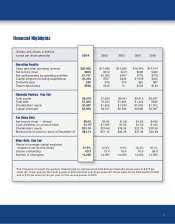

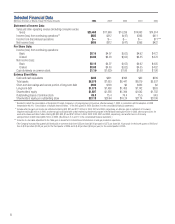

... Year End Return on average capital employed (based on net income (loss)) Shares outstanding Number of employees 21.0% 69.3 14,200 12.4% 75.4 14,900 0.9% 76.4 14,000 15.4% 75.5 14,200 18.1% 84.8 12,300 *The Company increased the quarterly dividend paid on common stock from $.25 per share ($1.00 per... -

Page 4

...-per-day "refinery within our refineries" at little or no capital cost. Refining and Supply results were substantially enhanced by cost-advantaged marine time charters, programs that expanded our crude oil mix, particularly the use of heavily discounted high-acid crude oils, and sales strategies... -

Page 5

... Employed of 21.7 percent (based on income before special items)** • Share price increase of 60 percent, reaching new record highs • Best overall operating and Health, Environment and Safety performance • From 2000 to 2004, refinery production up 18 million barrels, excluding Eagle Point... -

Page 6

... supportive when appropriate. This year, I offer a special thanks to Bob Kennedy and Norm Matthews who will be retiring from our Board after 10 and 6 years, respectively, of service to Sunoco. They have had an impact, and they will be missed. The Company's value and prospects have never been better... -

Page 7

... are established by the business units for improvement in key health, environment, and safety (HES) performance elements. These include, but are not limited to, the safety of employees and contractors working in our facilities and the reduction of releases into the environment, whether into the air... -

Page 8

... and Marcus Hook, PA refineries and the Eagle Point refinery in Westville, NJ) and MidContinent Refining (comprised of refineries in Toledo, OH and Tulsa, OK). With a combined 900,000 barrels per day of crude oil processing capacity, Sunoco's Refining and Supply business has the capacity to annually... -

Page 9

... master limited partnership. Sunoco Logistics Partners aims to grow distributable cash flow through internal growth and acquisitions. Coke Sun Coke Company manufactures high-quality coke for use in the production of blast furnace steel. From facilities in East Chicago, IN and Vansant, VA, annual... -

Page 10

...international oil and gas production operations. †The Company increased the quarterly dividend paid on common stock from $.25 per share ($1.00 per year) to $.275 per share ($1.10 per year) for the fourth quarter of 2003 and then to $.30 per share ($1.20 per year) for the third quarter of 2004 and... -

Page 11

...conditions on product supply and demand. The Company's future operating results and capital spending plans will also be impacted by environmental matters (see "Environmental Matters" below). Strategic Actions Sunoco is committed to improving its performance and enhancing its shareholder value while... -

Page 12

... retail sites in Michigan and the southern Ohio markets of Columbus, Dayton and Cincinnati, generating $46 million of cash proceeds. • In January 2004, Sunoco completed the acquisition from El Paso Corporation of the 150 thousand barrels-per-day Eagle Point refinery and related assets located... -

Page 13

...located primarily in Delaware, Maryland, Virginia and Washington, D.C. The income contribution from these sites amounted to $15 million after tax in 2004. • During the second quarter of 2004, Sunoco sold its private label consumer and commercial credit card business and related accounts receivable... -

Page 14

... were higher expenses across the Company ($109 million), primarily refinery fuel and utility costs and employee-related expenses, including pension and performancerelated incentive compensation; lower chemical sales volumes ($15 million); higher net financing expenses ($8 million), primarily due... -

Page 15

... its Tulsa refinery and sells these products to other Sunoco businesses and to wholesale and industrial customers. Refining operations are comprised of Northeast Refining (the Marcus Hook, Philadelphia and Eagle Point refineries) and MidContinent Refining (the Toledo and Tulsa refineries). 2004 2003... -

Page 16

... and related assets from El Paso Corporation for $250 million, including inventory. In connection with this transaction, Sunoco also assumed certain environmental and other liabilities. The Eagle Point refinery is located in Westville, NJ, near the Company's existing Northeast refining operations... -

Page 17

... for employee terminations and other exit costs. In addition, the two companies signed a seven-year agreement for the operation and servicing of the Sunoco private label credit card program. In April 2004, Sunoco completed the purchase of 340 retail outlets operated under the Mobil® brand from... -

Page 18

... primarily related to employee terminations in connection with a productivity improvement plan. In 2004, Sunoco sold its one-third partnership interest in BEF to Enterprise for $15 million in cash, resulting in an $8 million after-tax loss on divestment. In connection with the sale, Sunoco has... -

Page 19

... fair values less costs to sell and to establish accruals for employee terminations and other required exit costs. Sunoco sold this business and related inventory in January 2004 to BASF for approximately $90 million in cash. The sale included the Company's plasticizer facility in Pasadena, TX. The... -

Page 20

...the Harbor Pipeline from El Paso Corporation for $7 million; and in November, a refined product terminal located in Columbus, OH from a subsidiary of Certified Oil Company for $8 million. In November 2002, the Partnership completed the acquisition from an affiliate of Union Oil Company of California... -

Page 21

...to the Indiana Harbor East Chicago plant. The Company also could be required to make cash payments to the third-party investors if the tax credit is reduced as a result of increased domestic crude prices. The domestic wellhead price averaged $36.75 per barrel for the year ended December 31, 2004 and... -

Page 22

by sales volumes and prices, raw material and operating costs, capital expenditure levels and the ability to recognize tax benefits under the current tax law. Better-than-expected cash flows and tax benefits will shorten the investors' preferential return periods, while lower-than-expected cash ... -

Page 23

... income tax rate ($6 million) and higher capitalized interest ($5 million). In the third quarter of 2004, the Company repurchased outstanding debt with a par value of $352 million through a series of tender offers and open market purchases utilizing the net proceeds from the issuance of $250 million... -

Page 24

..., Virginia and Washington, D.C. and the Speedway® retail sites located primarily in Florida and South Carolina. Also contributing to the increase were higher consumer excise taxes, higher selling, general and administrative expenses, higher refinery operating costs and higher crude oil costs in... -

Page 25

..., and petroleum and chemical products, are readily marketable at their current replacement values. Management believes that the current levels of cash and working capital are adequate to support Sunoco's ongoing operations. Cash Flows from Operating Activities-In 2004, Sunoco's cash generation was... -

Page 26

... future cash generation will be sufficient to satisfy Sunoco's ongoing capital requirements, to fund its pension obligations (see "Pension Plan Funded Status" below) and to pay the current level of cash dividends on Sunoco's common stock. However, from time to time, the Company's short-term cash 24 -

Page 27

... 31, 2004, the New Facility is being used to support $100 million of commercial paper and $103 million of floating-rate notes due 2034. In November 2004, Sunoco Logistics Partners L.P. replaced its three-year $250 million revolving credit facility with a new $250 million revolving credit facility... -

Page 28

... determinable obligations to secure wastewater treatment services at the Toledo refinery and coal handling services at the Indiana Harbor cokemaking facility. Sunoco's operating leases include leases for marine transportation vessels, service stations, office space and other property and equipment... -

Page 29

... 31, 2004. At this time, management does not believe that it is likely that the Company will have to perform under any of these guarantees. A wholly owned subsidiary of the Company, Sunoco Receivables Corporation, Inc., is a party to an accounts receivable securitization facility that terminates in... -

Page 30

...the Philadelphia refinery and to upgrade various catalytic cracker units. Planned spending also includes capital for production upgrades in certain chemical facilities. In addition to the purchase of the Eagle Point refinery and related chemical and logistics assets and the 340 service stations from... -

Page 31

... of the change in market value of the investments in Sunoco's defined benefit pension plans: December 31 (Millions of Dollars) 2004 2003 Balance at beginning of year Increase (reduction) in market value of investments resulting from: Net investment income Company contributions Plan benefit payments... -

Page 32

...) Refineries Marketing Sites Chemicals Facilities Pipelines and Terminals Hazardous Waste Sites Other Total At December 31, 2001 Accruals Payments Other* At December 31, 2002 Accruals Payments Other* At December 31, 2003 Accruals Payments Acquisitions and divestments Other* At December 31, 2004... -

Page 33

...Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws and regulations require that contamination caused by such releases at these sites and at formerly owned sites be assessed and remediated to meet the applicable standards... -

Page 34

... under the Clean Air Act (which relates to emissions of materials into the air) that phase in limitations on the sulfur content of gasoline beginning in 2004 and the sulfur content of on-road diesel fuel beginning in 2006 ("Tier II"). The rules include banking and trading credit systems, which could... -

Page 35

... and trading credits, timing uncertainties created by permitting requirements and construction schedules and any effect on prices created by changes in the level of gasoline and diesel fuel production. In July 1997, the EPA promulgated new, more stringent National Ambient Air Quality Standards... -

Page 36

... "safe harbor" liability provisions, ethanol and renewable fuels mandates and other issues that could impact gasoline production. Sunoco uses MTBE and ethanol as oxygenates in different geographic areas of its refining and marketing system. While federal action is uncertain, California, New York and... -

Page 37

... benefit plans (see "Critical Accounting Policies-Retirement Benefit Liabilities" below). Sunoco generally does not use derivatives to manage its market risk exposure to changing interest rates. Cash Dividends and Share Repurchases The Company has paid cash dividends on a regular quarterly basis... -

Page 38

...the determination of expense and benefit obligations for Sunoco's postretirement health care plans. The discount rates used to determine the present value of future pension payments and medical costs are based on a portfolio of high-quality (AA rated) corporate bonds with maturities that reflect the... -

Page 39

... for both equity and debt securities. In determining pension expense, the Company applies the expected rate of return to the market-related value of plan assets at the beginning of the year, which is determined using a quarterly average of plan assets from the preceding year. The expected rate... -

Page 40

...capacity; market value declines; technological developments resulting in obsolescence; changes in demand for the Company's products or in end-use goods manufactured by others utilizing the Company's products as raw materials; changes in the Company's business plans or those of its major customers or... -

Page 41

... related to the shutdown of a polypropylene line at the Company's LaPorte, TX plant, an aniline and diphenylamine production facility in Haverhill, OH, certain processing units at the Toledo refinery and a refined products pipeline and terminal owned by Sunoco Logistics Partners L.P. The chemical... -

Page 42

...Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws and regulations require that contamination caused by such releases at these sites and at formerly owned sites be assessed and remediated to meet the applicable standards... -

Page 43

... capital, operating or remediation expenditures; • Delays related to construction of or work on facilities and the issuance of applicable permits; • Changes in product specifications; • Availability and pricing of oxygenates such as MTBE and ethanol; • Phase-outs or restrictions on the use... -

Page 44

...Risks related to labor relations and workplace safety; • Nonperformance by major customers, suppliers, dealers, distributors or other business partners; • General economic, financial and business conditions which could affect Sunoco's financial condition and results of operations; • Changes in... -

Page 45

...financial statements in accordance with generally accepted accounting principles. The Company's management assessed the effectiveness of the Company's internal control over financial reporting as of December 31, 2004. In making this assessment, the Company's management used the criteria set forth in... -

Page 46

..., in accordance with the standards of the Public Company Accounting Oversight Board (United States), the 2004 consolidated financial statements of Sunoco, Inc. and subsidiaries and our report dated March 3, 2005 expressed an unqualified opinion thereon. Philadelphia, Pennsylvania March 3, 2005 44 -

Page 47

... of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the... -

Page 48

... December 31 2004 Sunoco, Inc. and Subsidiaries 2003* 2002 Revenues Sales and other operating revenue (including consumer excise taxes) Interest income Other income, net (Notes 2, 3 and 4) Costs and Expenses Cost of products sold and operating expenses Consumer excise taxes Selling, general and... -

Page 49

...-200,000,000 shares; Issued, 2004-139,124,438 shares; Issued, 2003-136,801,064 shares Capital in excess of par value Earnings employed in the business Accumulated other comprehensive loss Common stock held in treasury, at cost 2004-69,796,598 shares; 2003-61,420,158 shares Total Shareholders' Equity... -

Page 50

... to investors in cokemaking operations Cash distributions to investors in Sunoco Logistics Partners L.P. Cash dividend payments Purchases of common stock for treasury Proceeds from issuance of common stock under management incentive and employee option plans Other Net cash provided by (used in... -

Page 51

... Value Par Value Business Loss Common Stock Held in Treasury Shares Cost Sunoco, Inc. and Subsidiaries Comprehensive Income (Loss) At December 31, 2001 Net loss Other comprehensive loss: Minimum pension liability adjustment (net of related tax benefit of $94) Net hedging gains (net of related... -

Page 52

...oil gathering and marketing activities of its logistics operations. In addition, the Company sells a broad mix of merchandise such as groceries, fast foods and beverages at its convenience stores and provides a variety of car care services at its retail gasoline outlets. Revenues related to the sale... -

Page 53

...-line basis over their estimated useful lives. Gains and losses on the disposals of fixed assets are generally reflected in net income. Impairment of Long-Lived Assets Long-lived assets held for sale are recorded at the lower of their carrying amount or fair market value less cost to sell. Long... -

Page 54

...Properties, plants and equipment, net Accrued liabilities Other deferred credits and liabilities Cash paid for acquisition $159 108 (3) (14) $250 Service Stations-In the second quarter of 2004, Sunoco completed the purchase of 340 retail outlets operated under the Mobil® brand from ConocoPhillips... -

Page 55

...® sites were re-branded as Sunoco® locations during the 2003-2004 period. The Company believes these acquisitions fit its long-term strategy of building a retail and convenience store network designed to provide attractive long-term returns. The purchase prices for the service stations acquired... -

Page 56

...the Harbor Pipeline from El Paso Corporation for $7 million; and in November, a refined product terminal located in Columbus, OH from a subsidiary of Certified Oil Company for $8 million. In November 2002, the Partnership completed the acquisition from an affiliate of Union Oil Company of California... -

Page 57

..., Sunoco shut down a polypropylene line at its LaPorte, TX plant, an aniline and diphenylamine production facility in Haverhill, OH, certain processing units at its Toledo refinery and a pipeline located in Pennsylvania and New York and a related refined products terminal. The chemical facilities... -

Page 58

...income taxes net of Federal income tax effects 51 14 2 weighted-average number of common shares used to compute basic earnings per share ("EPS") to those used to Dividend exclusion for affiliated companies (3) (4) (3) compute diluted EPS: Nonconventional fuel credit (1) (1) - (In Millions) 2004 2003... -

Page 59

... due Sunoco, as lessor, on noncancelable operating leases at December 31, 2004 for retail sites are as follows (in millions of dollars): Net Investment (Millions of Dollars) December 31 2004 Refining and supply Retail marketing* Chemicals Logistics Coke 2003 Refining and supply Retail marketing... -

Page 60

... retiree contributions to postretirement benefit plans are adjusted periodically, and the plans contain other cost-sharing features, such as deductibles and coinsurance. In addition, in 1993, Sunoco implemented a dollar cap on its future contributions for its principal postretirement health care... -

Page 61

... Actual return on plan assets Employer contributions Benefits paid from plan assets Fair value of plan assets at end of year*** Unfunded accumulated obligation Provision for future salary increases Benefit obligations in excess of plan assets at end of year Unrecognized prior service cost (benefit... -

Page 62

... used at December 31, 2004 and 2003 to determine benefit obligations for the plans: Defined Benefit Plans (In Percentages) 2004 2003 Postretirement Benefit Plans 2004 2003 Discount rate Rate of compensation increase 5.75% 4.00% 6.00% 4.00% 5.50% 6.00% The health care cost trend assumption used... -

Page 63

...being used to support $100 million of commercial paper (with a weightedaverage interest rate of 2.13 percent) and $103 million of floating-rate notes due in 2034 (Note 11). In November 2004, Sunoco Logistics Partners L.P. replaced its three-year $250 million revolving credit facility with a new $250... -

Page 64

...at December 31, 2004. At this time, management does not believe that it is likely that the Company will have to perform under any of these guarantees. Over the years, Sunoco has sold thousands of retail gasoline outlets as well as refineries, terminals, coal mines, oil and gas properties and various... -

Page 65

... for polypropylene and phenol exceed certain agreedcrued liability for environmental remediation activities upon thresholds through 2006. As of December 31, 2004, by category: no such payments have been earned. Since the $167 milMarketing Sites Chemicals Facilities Pipelines and Terminals Hazardous... -

Page 66

...Sunoco owns or operates certain retail gasoline outlets where releases of petroleum products have occurred. Federal and state laws and regulations require that contamination caused by such releases at these sites and at formerly owned sites be assessed and remediated to meet the applicable standards... -

Page 67

...Philadelphia. Sunoco has completed its responses to the EPA. In 2003, Sunoco received an additional information request at its phenol plant in Philadelphia. Sunoco has received Notices of Violation and Findings of Violation from the EPA relating to its Marcus Hook, Philadelphia and Toledo refineries... -

Page 68

... "safe harbor" liability provisions, ethanol and renewable fuels mandates and other issues that could impact gasoline production. Sunoco uses MTBE and ethanol as oxygenates in different geographic areas of its refining and marketing system. While federal action is uncertain, California, New York and... -

Page 69

... are impacted by sales volumes and prices, raw material and operating costs, capital expenditure levels and the ability to recognize tax benefits under the current tax law (see below). Better-than-expected cash flows and tax benefits will shorten the investors' preferential return periods, while... -

Page 70

... thirdparty investors' interests in Sunoco Logistics Partners L.P.: 14. Shareholders' Equity Each share of Company common stock is entitled to one full vote. The $9 million of outstanding 6 3â„ 4 percent subordinated debentures are convertible into shares of Sunoco common stock at any time prior... -

Page 71

...the Long-Term Performance Enhancement Plan II ("LTPEP II"). The EIP provides for the payment of annual cash incentive awards while the LTPEP II provides for the award of stock options, common stock units and related rights to directors, officers and other key employees of Sunoco. The options granted... -

Page 72

...charge to the capital in excess of par value component of shareholders' equity at December 31, 2003. At December 31, 2004, 416,735 of the outstanding common stock unit awards were payable in cash and 83,640 were payable in Company common stock. The following table summarizes information with respect... -

Page 73

... customers. Refinery operations are comprised of Northeast Refining (the Marcus Hook, Philadelphia and Eagle Point refineries) and MidContinent Refining (the Toledo and Tulsa refineries). The Retail Marketing segment sells gasoline and middle distillates at retail and operates convenience stores... -

Page 74

... of Marathon Ashland Petroleum LLC of 193 Speedway® retail gasoline sites located primarily in Florida and South Carolina, which includes inventory (Note 2). ††Excludes $198 million associated with the formation of a propylene partnership with Equistar Chemicals, L.P. and a related supply... -

Page 75

... retirement costs and $353 million attributable to corporate activities. †After elimination of intersegment receivables. The following table sets forth Sunoco's sales to unaffiliated customers and other operating revenue by product or service: (Millions of Dollars) 2004 2003 2002 Gasoline... -

Page 76

... at Sunoco's Marcus Hook, Philadelphia, Eagle Point and Toledo refineries, excluding cumene, which is included in the Chemicals segment. Retail Sales* Gasoline Middle distillates * Thousands of barrels daily. 2004 2003 2002 Terminal Throughputs* Refined product terminals Nederland, TX marine... -

Page 77

...with a retail marketing divestment program in the Midwest and a $17 million after-tax provision primarily for write-down of the assets of the plasticizer business to their estimated fair values less costs to sell. ††The Company's common stock is principally traded on the New York Stock Exchange... -

Page 78

... Officers Terence P. Delaney Vice President, Investor Relations and Planning Robert W. Owens Senior Vice President Marketing Robert D. Kennedy Retired Chairman and CEO Union Carbide Corporation Ross S. Tippin, Jr. General Auditor Michael H. R. Dingus Senior Vice President, Sunoco, Inc. President... -

Page 79

... 1-800-SUNOCO1. Certifications Sunoco's Health, Environment and Safety Review and CERES Report is available at our Web Site or by writing the Company. Shareholders seeking non-financial information about Sunoco may write to the Company at its principal office address, call 215-977-6082 or e-mail... -

Page 80

Sunoco, Inc. Ten Penn Center 1801 Market Street Philadelphia, PA 19103-1699