SanDisk 2000 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2000 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

15 . Sa n D is k C o r p o ra t io n . 2 0 0 0 A n n ua l Re p o r t

and state c re d its and tax exem pt intere st incom e d ue

to the sig nific ant incre ase in taxab le incom e o ver 19 99.

Our 19 99 effec tive tax rate w as lo w e r than o ur 19 98

rate due to the p ro p o rtio nal rate b enefits from federal

and state tax c red its.

L iq u id it y a n d C a p it a l R e s o u r c e s

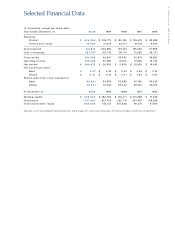

As o f Decem ber 31, 200 0, w e had w o rking c ap ital o f

$52 6.0 m illio n, w hic h inc luded $106.3 m illio n in c ash

and c ash e q uivalents and $373.3 m illio n in sho rt- te rm

investm ents. Op e rating ac tivitie s p ro vid ed $ 84.9 m illio n

o f c ash in 2 000 prim arily from net inc o m e, increases in

d eferred taxes o f $ 114.5 m illio n larg e ly due to the g ain

o n UM C, inc om e taxes p ayab le o f $ 39.8 m illio n as a

result o f hig her taxab le incom e than in 1999 , ac c o unts

p ayab le of $3 6 .4 m illion prim arily fro m inc reased inve n-

to ries, and d e fe rred re venue o f $ 21.4 m illio n related to

lic ense fees, w hic h w e re p artially o ffset b y an inc rease

in invento ry of $6 0 .9 m illion and an inc re ase in

ac c o unts receivable o f $52 .2 m illio n asso c iate d w ith

hig her reve nues. C ash p ro vid e d b y o p eratio ns w as

$17.0 m illio n in 1999 and $15.1 m illio n in 1998 .

N et c ash used in investing ac tivities o f $ 13 7.9 m il-

lio n in 20 00 inc luded $134.7 m illion investe d in

FlashVision LLC, our fo undry jo int venture w ith

To shib a, $2 6 .6 m illion of cap ital e q uip m e nt p urc h ase s,

a $2 0 .0 m illion d e p o sit in an e sc ro w ac c o unt fo r o ur

investm ent in Tow e r Sem ic ond uc to r, and our $ 7.2 m il-

lio n investm e nt in Divio , p artially o ffset b y p ro c e e d s

fro m ne t sale s o f inve stm ents o f $51.5 m illion. In 1999 ,

ne t cash used in investing ac tivities o f $2 14 .4 m illio n

c o nsiste d $ 2 1.4 m illio n o f c ap ital e q uipm ent p urchases

and ne t p urc hases of investm e nts o f $ 19 3 .0 m illion. In

19 98, net c ash use d in inve sting ac tivities o f $23 .0 m il-

lio n c o nsisted o f a se c o nd inve stm ent in the USIC

fo und ry o f $ 10 .9 m illio n, $ 7.5 m illio n o f c ap ital eq uip-

m ent p urc hases and ne t purc hases o f investm e nts o f

$4.6 m illio n.

In 20 0 0, financ ing ac tivities p ro vid e d $ 13 .6 m illio n,

p rim arily fro m the sale o f c o m m on sto c k throug h the

o ur sto c k o p tion and em p lo ye e sto c k p urc hase p lans.

During 19 99, c ash p ro vid ed b y financ ing ac tivities o f

$32 8.2 m illio n w as p rim arily fro m $32 0 .3 m illion fro m

the net p ro c e ed s of the sale o f c o m m on sto c k in o ur

N o vem ber 19 99 fo llo w - o n sto c k o ffe ring and $7.9 m il-

lio n fro m the sale o f com m o n sto c k thro ug h the

SanDisk s to c k o p tio n and e m p lo ye e stock purc hase

p lans. During 19 98, c ash p ro vid ed b y financ ing ac tivi-

tie s of $2 .4 m illio n w as p rim arily fro m the sale of c o m -

m o n sto ck thro ug h the SanDisk sto c k o p tio n and

em ployee sto c k p urc hase plans.

On June 30 , 2 000 , w e c lo s ed a transac tion w ith

To shib a p ro vid ing for the jo int d evelo p m ent and m anu-

facture o f 5 12 m egab it and 1 g ig ab it flash m e m o ry

c hip s and Se c ure Dig ital Card contro lle rs. As p art o f

this transactio n, SanDisk and Toshib a fo rm ed

FlashVision LLC, a jo int ve nture to equip and o p erate a

silic o n w afer m anufac turing line at Do m inio n

Sem icond uc tor in Virg in ia. The c o st o f eq uip p ing the

Virg inia w afe r m anufac turing line is estim ated at

b etw een $ 700 m illio n and $ 800 m illion. As p art o f o ur

50% o w nership of the joint venture w e had inve ste d

$134.7 m illion as o f De c e m b er 3 1, 2 000 , and in January

200 1, w e investe d the rem aining $ 15 .3 m illio n. W e have

also g uarantee d up to $ 215 m illio n in equip m e nt lease

line s to eq uip Toshib a’s Do m inion Se m ic o nduc to r m an-

ufac turing c lean ro o m w ith ad vanc ed w afe r p ro c e ssing

equip m ent. As of January 26, 2 0 01, $20 m illion of this

am o unt had b een b o rro w e d by FlashVisio n.

On July 4, 2 0 00, w e entered into a share p urc hase

ag re em ent to m ake a $75 m illio n investm e nt in To w er

Sem icond uc tor, o r Tow er, in Israel, re p resenting

ap p ro xim ate ly 10% ow ne rship o f Tow e r. In exc hang e

fo r o ur investm e nt, w e receive d o ne se at o n the b o ard

o f d irecto rs of Tow er and a g uarante e d p o rtion of the

w afer o utput fro m the ad vanced fabricatio n fac ility

To w er has started to build in M igd al Haem ek, Israe l.

Und e r the te rm s o f the ag reem ent, w e w ill m ake o ur

investm ent o ve r a p e riod o f approxim ately 18 m onths if

ke y m ile stones re lated to the construc tio n, eq uipp ing

and w afer p ro d uc tion at the new w afer fab ric ation

facility are m et. On January 26 , 200 1, Tow er satisfie d

the closing c o nd itio ns o f the share p urc hase agree -

m ent, and w e transfe rred the first $ 2 0 m illio n o f o ur

investm ent from an e sc ro w ac c o u nt to p urc hase

866 ,5 5 1 ordinary share s and o b tain $8 .8 m illio n in p re-

p aid w afer c redits. On M arch 1, 200 1, w e p aid Tow er

$11 m illio n up o n its c o m p le tio n o f m ile stone o ne, to

p urc hase 3 66,690 ordinary share s and o b tain ad d itio n-

al prep aid w afe r c re d its. Ad d itio nal c o ntrib utions w ill

take the fo rm o f m andato ry w arrant e xe rc ise s fo r o rd i-

nary shares at an e xe rc ise pric e of $3 0 .0 0 p e r share if

o the r m ilesto ne s are m e t. The w arrants w ill expire five

years fro m the d ate o f g rant, an d in the event the ke y

m ilesto nes are n o t ac hie ved, the exerc ise o f the se

w arrants w ill n o t be m andato ry. W e expec t first w afer

p ro d uc tion to c o m m ence at the ne w fab ric atio n facility

in late 2 0 02.

On August 9, 200 0, w e ente red into a jo int ve n-

ture , Dig ital Portal Inc , or DPI, w ith Photo - M e

Inte rnatio nal, or PM I, fo r the m anufac ture, installation,

m arketing and s ervic e of self- servic e , d ig ital p hoto

p rinting labs, o r kiosks, b earing the SanDisk b rand

nam e in locatio ns in the U.S. and Canad a. These

kio sks em p loy hig h- q uality, lo w - cost, silve r halid e

p ho to p ro c e ssing tec hno lo g y deve lo p ed b y PM I. Under

the ag reem e nt, SanDisk and PM I w ill e ac h m ake an ini-

tial inve stm ent o f $ 4 m illio n in the DPI jo int venture , and

se c ure le ase financ ing for the p urc hase o f the kiosks.

The total value of the le ase fin anc ing w ill d epend o n

the num b e r of kio sks d ep lo ye d b y the joint venture .

W e e stim ate that w e w ill g uarante e e q uip m ent le ase

arrangem e nts of ap p ro xim ately $ 40 m illio n o ver the

first tw o ye ars o f the ag re em ent. PM I w ill m anufacture

the kio sks fo r the jo int ve nture and w ill install and

m aintain the kio sks und e r c on trac t w ith the jo int ve n-

ture . W e e xp e c t to d eploy the first kio sks in p ilo t p ro -

g ram s in se lected retail store s in the Unite d State s

starting in the first half of 20 0 1.

On N o vem b er 2, 20 0 0, w e m ad e a strateg ic

investm ent o f $ 7.2 m illio n in Divio, Inc . Divio is a

p rivate ly- held m anufac ture r o f d ig ital im ag ing