SanDisk 2000 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2000 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

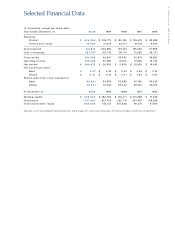

11 . Sa n D is k C o r p o ra t io n . 2 0 0 0 A n n ua l Re p o r t

Management’s Discussion and Analysis

of Financial Conditions and Results of Operations

Ce rtain state m e nts in this d isc ussion and analysis are

fo rw ard lo o king statem e nts b ased o n c urre nt exp e c ta-

tio ns , and entail vario us risks and uncertaintie s that

c o uld c ause ac tual results to d iffer m aterially from

tho s e exp resse d in suc h fo rw ard lo o king statem e nts.

Suc h risks and unc e rtainties are se t fo rth in “ Facto rs

That M ay Affe c t Future Re sults” and e lse w he re in this

rep ort. Th e follow ing disc ussio n should b e read in c o n-

junc tio n w ith o ur c o nso lidated financ ial statem ents and

the no te s the reto .

O v e r v ie w

SanDisk w as fo und ed in 19 88 to d eve lo p and m arket

flash d ata sto rag e system s. W e sell o ur p ro d uc ts to

the consum er elec tronic s and ind ustrial/ c om m unic a-

tio ns m arkets. In fisc al 200 0, ap p ro xim ately 77% of our

p ro d uc t sales w e re attrib utab le to the c o nsum er elec -

tro nic s m arket, p articularly sale s of Co m p actFlash and

M ultiM ed iaCard p ro d uc ts fo r use in d ig ital c am era

ap p lic atio ns. Our Co m p ac tFlash p ro d ucts have low er

averag e selling p ric es and g ross m arg ins than o ur

hig her cap ac ity FlashDisk and FlashDrive p ro d ucts. In

ad d ition, a sub stantial p o rtio n o f o ur Co m p actFlash

and M ultiM ediaCard p ro d uc ts are so ld into the retail

c hanne l, w hic h usually has sho rte r c usto m e r ord er

lead - tim es than o ur o the r channels. A m ajo rity o f o ur

sale s to the retail c hannel are turns b usiness, w ith

o rd ers re c eive d and fulfille d in the sam e q uarter, the re-

b y d e c reasing o ur ab ility to ac c urately forec ast future

p ro d uc tion nee d s. We b elieve sales to the c o nsum e r

m arket w ill co ntinue to represent a m ajority o f o ur

sale s, and inc rease as a p e rc e ntage o f sales in future

years, as the p o p ularity o f c o nsum er ap p lic ations,

inc luding d igital cam eras, increases.

Our o p erating results are affe c te d b y a num ber of

facto rs inc lud ing the vo lum e of p rod uc t sales, com p eti-

tive p ric ing p re ssures, availab ility o f found ry c ap acity,

variations in m anufac turing c yc le tim es, fluc tuations in

m anufacturing yields and m anufacturing utilization, the

tim ing o f signific ant o rd ers, o ur ab ility to m atc h sup p ly

w ith d e m and, changes in p ro d uc t and c usto m er m ix,

m arket ac c e p tanc e o f new o r e nhanc e d versions of

o ur produc ts, c hanges in the c hanne ls thro ugh w hic h

o ur produc ts are distrib uted, tim ing o f ne w produc t

anno unc e m e nts and intro d uctio ns b y u s and o ur com -

p etito rs, the tim ing of license an d ro yalty re venues,

fluctuatio ns in p ro d uc t c o sts, incre ased researc h and

d eve lo p m e nt e xp e nse s, and exc hang e rate fluctua-

tio ns . W e have exp erie nc ed seaso nality in the p ast. As

the proportio n o f o ur p rod uc ts sold for use in c o n-

sum er ele c tro nic s ap p lic ations inc re ases, our re venue s

m ay b ec om e sub jec t to se aso nal dec lines in the first

q uarter o f eac h year. See “ Fac tors That M ay Affect

Future Re sults – Our Op e rating Re sults M ay Fluc tuate

Sig nific antly W hic h M ay Ad vers ely Affe c t Our Sto c k

Pric e ” and “ – There is Se asonality in Our Business.”

Beg inning in late 1995 , w e adopted a strate g y o f

lic ensing o ur flash te c hnology, inc lud ing o ur p atent

p o rtfolio, to third p arty m anufacture rs of flas h prod-

uc ts. To d ate, w e have entered into p atent c ro ss-

lic ense agree m e nts w ith seve ral c o m p anies, and

inte nd to p ursue o p p o rtunitie s to enter into ad d itional

lic ense s. Under our c urrent lic e nse ag re em ents,

lic ense es p ay lic e nse fe es, ro yaltie s, o r a c o m b inatio n

the reof. In so m e c ase s, the c o m pensatio n to us m ay

b e p artially in the fo rm o f g uarantee d ac c ess to flash

m em o ry m anufac turing c ap ac ity fro m the lic ense e

c o m p any. The tim ing and am o unt o f ro yalty p aym e nts

and the rec o g nitio n o f lic ense fees c an vary substan-

tially fro m q uarter to q uarter d epending o n the te rm s

o f eac h ag reem ent and , in so m e case s, the tim ing o f

sale s o f p ro d uc ts by the o ther partie s. As a re sult,

lic ense and ro yalty re venue s have fluc tuate d sig nifi-

c antly in the p ast and are like ly to c o ntinue to fluc tuate

in the future. Given the relative ly high g ro ss m arg ins

asso c iate d w ith lic ense and royalty reve nues, gross

m arg ins and net incom e are likely to fluctuate m o re

w ith c hang e s in lic ense and ro yalty reve nu es than w ith

c hang es in p ro d uct re venue s.

W e m arket o ur p ro d uc ts u sing a d irect sales

o rg anizatio n, distrib uto rs, m anufac turers’ repre se nta-

tives, p rivate lab e l p artne rs, OEM s and retailers. W e

exp ect that sales throug h the retail channel w ill co m -

p rise an inc reasing share o f o ur p ro d uc t revenues in

the future, and that a sub stantial p o rtion of our sales

into the retail channel w ill b e m ad e to p artic ip ants that

w ill have the rig ht to return unso ld p ro d ucts. Our p o licy

is to defer recognitio n o f re venues fro m the se sales

until the p ro d uc ts are so ld to the end c usto m e rs.

H istoric ally, a m ajo rity of o ur sale s have b een to a

lim ite d num b e r o f custom ers. Sales to o ur to p 10 c us-

to m e rs ac c o unte d fo r approxim ately 48% , 57% , an d

59% , resp ectively, of our p ro d uct re venue s fo r 200 0,

19 99, and 1998 . In 200 0, no sing le custom er ac c o unt-

ed for g reate r than 10 % o f o ur to tal re venue s. In 19 9 9

and 19 98, re venue s fro m o ne c usto m er excee d e d 10%

o f to tal re venue s. W e e xp e c t that sale s o f o ur p rod -

uc ts to a lim ite d num b er of custom ers w ill c o ntinue to

ac c o unt fo r a sub stantial portio n o f o ur produc t rev-

enue s fo r the fo reseeable future . W e have also exp eri-

enc ed sig nific ant c hanges in the c o m p o sitio n of o ur

c usto m er b ase fro m year to year and expec t this pat-

te rn to c ontinue as m arket d e m and for o ur c usto m ers’

p ro d uc ts fluc tuate s. The lo ss o f, or a sig nific ant re d uc-

tio n in p urc hase s by any o f o ur m ajo r c usto m ers, c o uld

harm o ur b usiness, financial c ond itio n and results o f

o p eratio ns. See “ Facto rs That M ay Affec t Future

Results – Sales to a Sm all N um b e r o f Custom ers

Represent a Sig nific ant Po rtio n o f Our Re venue s.”

All of our pro du c ts require silic o n w afe rs, the

m ajo rity o f w hic h are currently m anufac tured fo r us b y

UM C in Taiw an. Ind ustry- w id e dem and fo r sem ic o n-

d uc tors increased sig nific antly in 1999 and the first nine