SanDisk 2000 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2000 SanDisk annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

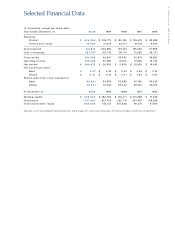

14 . Sa n D is k C o r p o ra t io n . 2 0 0 0 A n n ua l Re p o r t

Sale s a nd M arke ting . Sales and m arketing

exp ense s inc lud e salarie s, sale s co m m issions, b e ne fits

and trave l expenses fo r o ur sales, m arke ting, c usto m er

se rvice and ap p licatio ns e ng inee ring p ersonne l. These

exp ense s also inc lude o ther selling and m arke ting

exp ense s, suc h as ind e p end ent m anufac ture r’s rep re -

se ntative c o m m is sio ns, ad vertising and tradesho w

exp ense s. Sales and m arketing expenses in c reased to

$49 .3 m illio n in 20 00 fro m $25 .3 m illio n in 1999 and

$16.9 m illio n in 19 98. The inc re ases in b o th 2 000 and

19 99 w ere prim arily d u e to inc re ased salaries and p ay-

ro ll- re late d expenses and inc re ase d com m ission

exp ense s d ue to hig her p ro d uc t revenues and

inc re ase d m arke ting e xp e nses. Sales and m arke ting

exp ense s rep re se nted 8% o f to tal re venues in 2 0 00

c o m p are d to 10% in 1999 and 12 % in 19 98. W e expec t

sale s and m arketing expenses to c o ntinue to inc rease

as sales o f o ur p ro d uc ts gro w, as w e c o ntinue to

d eve lo p the re tail c hannel and b rand aw areness fo r o u r

p ro d uc ts and as w e inc re ase o ur m arke ting ac tivities

fo r o ur Sec ure Dig ital Card p ro d uc ts.

General and Ad m inis trative. General and ad m in-

istrative exp ense s inc lude the c o st o f o ur financ e , info r-

m ation syste m s, hum an re so urc e s, s hare ho ld e r re la-

tio ns , legal and ad m inistrative functio ns. General and

ad m inistrative exp ense s w ere $2 4 .8 m illion in 2 000

c o m p are d to $ 12 .6 m illio n in 19 99 and $7.5 m illio n in

19 98. The inc re ases for b o th 2 000 and 1999 w ere pri-

m arily due to inc re ased salary and re late d expenses

asso c iate d w ith ad d itional p erso nne l, inc re ased legal

fe es and an inc re ase in the allow anc e fo r doub tful

ac c o unts relate d to higher trade ac c o unts receivable

b alan c es fro m inc reased re ven ues. Ge ne ral and

ad m inistrative exp ense s rep re se nted 4% o f to tal re v-

enue s in 20 00 c o m p are d to 5% in 199 9 and 6 % in

19 98. W e expec t g e ne ral and ad m inistrative exp ense s

to inc rease as w e exp and an d d e velop o ur infrastruc -

ture to sup p o rt o ur anticipate d future g ro w th. Ge ne ral

and ad m inistrative exp ense s c o uld also inc re ase sub -

stantially in the future if w e pursue ad d itio nal litig ation

to defend our p atent p o rtfolio. See “ Fac to rs That M ay

Affe c t Future Results – Risks Asso c iated w ith Pate nts,

Pro p rie tary Rig hts and Re lated Litig atio n.”

Given the c urrent m arket c ond itio ns and e xp ec te d

d ecline in p ro d uc t re venues in the first q uarter o f 200 1,

w e have instituted stric t e xp e nse c o ntro l m e asures.

The se m easures in the first q uarter o f 200 1 inc luded a

red uc tio n in o ur w o rk fo rc e and sig nificant c uts in d is-

c retio nary sp e nd ing. How eve r, w e are c o ntinuing to

invest in research and deve lo p m e nt o f ad vanc ed tec h-

no lo g ie s and future produc ts.

Inte re st Inc o m e . Inte rest inc o m e w as $22 .8 m il-

lio n in 20 00 c o m p are d to $8 .3 m illio n in 1999 and $5 .3

m illio n in 1998 . The inc re ase in 2 0 00 is prim arily d ue to

a full year o f higher intere st inc om e resulting from the

investm ent o f the p ro c e eds fro m the sale o f c o m m on

sto c k in o ur N o vem b er 19 99 fo llo w - o n p ub lic o ffering ,

as w e ll as inc reased c ash flo w s as a result o f the

inc re ase in re venue and operating m arg in. The

inc re ase in 1999 is p rim arily d ue to hig he r interest

inc o m e in the fourth q uarter d ue to the inve stm ent of

the procee d s fro m the sale of c o m m o n stock in o ur

N o vem ber 19 99 fo llo w - o n p ub lic o ffering . W e e xp e c t

inte rest inc o m e to d ec line in 20 01 re lative to 20 0 0 d ue

to low er c ash and investm e nt b alanc es resulting fro m

o ur investm e nts in FlashVisio n and Tow er, c o m b ined

w ith the d ro p in risk- free inte rest rate s due to recent

ac tions taken b y the U.S. Federal Re se rve Board .

Gain o n inve stm e nt in foundry. In the first q uar-

te r o f 2 000 , w e re c o g nized a g ain o f $ 344 .2 m illio n as

a result of the exchange o f o ur investm e nt o f $ 51.2

m illio n in Unite d Silic on, Inc ., o r USIC, fo r an investm e nt

in Unite d M icroele c tro nics C o rp o ratio n, or UM C. We

rec eived 111 m illio n shares o f UM C in exc hang e for o ur

USIC share s. These shares w ere valued at $ 396 m illion

at the tim e o f the e xc hang e and w ere sub je c t to trad -

ing restric tio ns im posed b y UM C and the Taiw an Sto c k

Exc hang e . The trad ing restric tions exp ired o n o ne - half

o f the shares o n July 3, 2 0 00. The rem aining shares

w ill b ec o m e availab le fo r sale o ve r a tw o- year p erio d

b eginning in January 2 0 02. W hen the shares are ulti-

m ately so ld , it is like ly that w e w ill recognize ad d itio nal

g ains o r lo sse s. In M ay 2 000 , w e re c eived a sto c k d ivi-

d end o f 20 0 UM C shares fo r e very 1,000 share s o f

UM C o w ne d , resulting in o ur o w ne rship o f 2 2 m illio n

ad d itional UM C share s.

At Decem b er 31, 20 0 0, the m arket value o f b o th

o ur sho rt- te rm and long - term inve stm ent in UM C had

d eclined $ 201.9 m illion b e lo w its c arrying b asis. It w as

d eterm ined that this d e c line w as related to the d o w n-

turn in the se m ic o nd uc to r ind ustry as a w hole and w as

te m p o rary in nature d ue to the histo ric ally cyclic al

nature o f the ind ustry. The available- fo r- sale p o rtion o f

o ur investm e nt w as m arked- to - m arke t thro ugh othe r

c o m p rehensive inc o m e as re q uire d b y SFAS 115 .

As o f M arc h 2 2, 20 0 1, the m arket value o f o ur

investm ent in UM C rem aine d sig nific antly b e lo w our

c o st. The d o w nturn in the sem icond uc tor ind ustry and

the ec o no m y in g e ne ral ap p ears to be m o re seve re

than previo usly antic ip ated. There is a g reat d eal o f

unc ertainty reg arding w hen the sem ic o n d uc tor ind us-

try w ill reco ver fro m this d o w n c yc le . B ecause of the

c o ntinue d d o w nturn in the econo m y, w e b e lie ve that

the dec lin e in the m arke t value of our investm e nt in

UM C at M arc h 2 2, 20 01 is o ther than te m p o rary, and

w e w ill rep o rt a lo ss in o ther inc o m e and expense in

the first q uarter o f 2 001. This lo ss w ill b e b ased up o n

the fair m arket value o f the investm e nt at the end of

the first q uarter o f fisc al 200 1, as com p ared to the

investm ent’s cost b asis.

Othe r Inc o m e , Net. Other incom e, net w as

$572 ,00 0 in 200 0 c o m pared to $1.3 m illion in 1999 and

$374 ,00 0 in 19 98. The fluc tuatio ns largely relate to fo r-

eign c urrency transactio n g ains. In 20 00, 1999 , and

19 98 w e had net fore ig n c urre nc y transac tion g ains o f

$42 8,0 00, $ 1.1 m illio n and $412,000 , resp e c tively.

Provisio n fo r Inc o m e Taxe s. Our 200 0 , 19 99 and

19 98 effe c tive tax rates w e re ap p ro xim ate ly 3 9 %, 33 %

and 36% , resp ectively. Our 20 0 0 effec tive tax rate w as

hig her than o ur 19 9 9 rate d ue p rim arily to effec ts o f

state incom e taxes o n signific antly inc rease d inc o m e

and a red uc ed p ro p o rtio nal rate b e nefit fro m fed e ral