Ryanair 2011 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2011 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.5

CHIEF EXECUTIVE’S REPORT

Dear Shareholders,

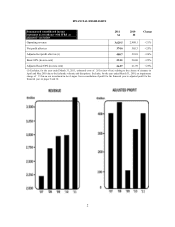

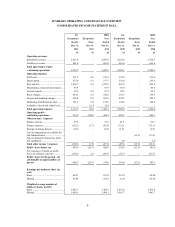

Ryanair’s performance over the past year has demonstrated yet again the strength and robust nature of

Ryanair’s unique “lowest fares/lowest cost” model here in Europe which enabled us to deliver a 26% increase in

profits to 1401m. It is difficult to recall a year with more adverse circumstances, characterised by the economic

slowdown in Europe, a significant rise in oil prices, the extraordinary disruptions in April and May 2010 during

the totally unnecessary EU airspace closures caused by the Icelandic volcanic eruption (almost 2,000 kms

remote from Europe!), widespread Air Traffic Control strikes across major European markets during the

summer 2010 peak, repeated airport closures in November and December due to significant snow falls and

prolonged sub-zero temperatures.

Despite this extraordinary series of regulatory and airport incompetencies, and the continuing failure of the

policy makers to prohibit strikes in protected employment sectors such as ATC, booked passengers across

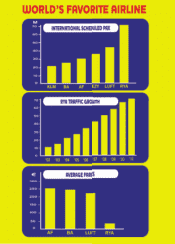

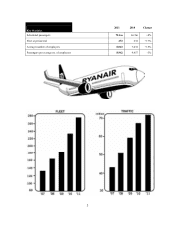

Ryanair’s network grew by 8% to 72m. Load factors improved by 1% to 83%, and average fares (which

includes our optional checked in baggage fees) rose by 12% to 139. Group turnover rose by 21% to 13,630m,

scheduled revenues were up 21% to 12,828m thanks to our 8% traffic growth, allied to our 12% increase in

average fares, while ancillary revenues rose by 21% to 1802m.

Total operating costs rose by 20% to 13,113m, due mainly to a 37% increase in our fuel bill from 1894m to

11,227m and further unjustified price increases at Dublin, where in the face of recession and traffic declines, the

monopoly owners (DAA Dublin) continue to raise airport charges. Only a monopoly can get away with raising

airport charges, even as their routes and traffic volume continue to decline.

We welcome the UK Competition Commission’s recent affirmation of its 2008 decision to break up the

high cost BAA monopoly. We believe that this will deliver more efficient facilities, lower costs and a better

service to airlines and passengers, where in recent years the BAA monopoly under its inadequate regulator, the

CAA, has repeatedly failed airline and passenger users. We continue to campaign for a similar break-up of the

failed DAA airport monopoly in Ireland, where grandiose, unnecessary and profligate building projects

including the new terminal in Cork (cost 1200m), and T2 in Dublin (11.2bn) have delivered excess terminal

capacity at a cost more than six times higher than the DAA’s original forecast (of between 1170m to 1200m for

T2). This wasteful and unnecessary capex has now been used to justify a 40% increase in Dublin’s passenger

charges, making Dublin and Stansted the two most expensive airports in Ryanair’s 150 plus airports.

2011 will be the fourth consecutive year of traffic declines at Dublin Airport, where traffic has fallen by

30% from a peak of 24.5m in 2007 to just over 18m in 2010. Dublin now operates two terminals, both of them

half empty, yet the two main airlines (Ryanair and Aer Lingus) are expected to pay for these expensive and

profligate facilities which we neither wanted nor supported. It is impossible not to agree with Aer Lingus’ recent

description of the Dublin Airport charges as “insane”. Similarly at Stansted, traffic declined in 2010 for the

fourth year in a row. BAA Stansted’s financial statements now clearly demonstrate that the BAA is using the

regulatory system to overcharge Stansted airlines to cross subsidise Heathrow and the BAA, even as the number

of routes and traffic continues to decline. In recent months airlines including easyJet, Air Berlin, Turkish,

Thomson, Cyprus Airlines, Star1, and Air AsiaX have announced plans to reduce capacity further at Stansted, as

the BAA gouges its airline customers. The fact that BAA Stansted has wasted more than £200m on a cancelled

second runway project over the past 8 years is another stunning indictment of the regulatory failure of the CAA,

and the waste and profligacy of the BAA airport monopoly.

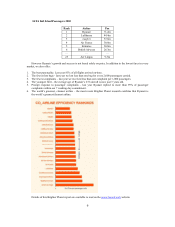

Our Passengers

Despite these regulatory failures, Ryanair continues to grow its business, while delivering lower fares,

better punctuality, fewer lost bags and fewer passenger complaints than any other airline in Europe. We deliver

Europe’s No.1 passenger service for the benefit of our passengers, our people and our shareholders.

When it comes to passenger service, no one beats Ryanair. During the current recession, price continues to

be the key factor in most passengers’ travel decision, and because Ryanair beats every other airline on price, we

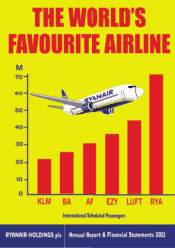

have grown to become the world’s favourite airline, with 72.1m passengers carried in the fiscal year. IATA’s

recent 2010 traffic statistics confirm that Ryanair carries substantially more international passengers than any

other scheduled airline in calendar 2010.