Ryanair 2011 Annual Report Download - page 6

Download and view the complete annual report

Please find page 6 of the 2011 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.4

CHAIRMAN’S REPORT

Dear Shareholders,

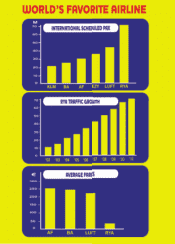

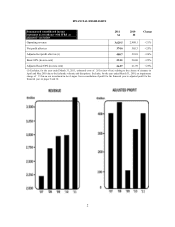

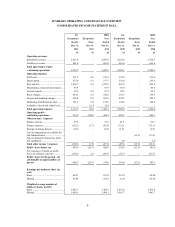

I am pleased to report a 26% increase in profit after tax to 1401m. This was a robust performance during

a year when we suffered a 37% increase in fuel costs which we partially offset with a 12% rise in average

fares, almost in line with the 10% increase in average sector length.

During the year Ryanair delivered a number of milestones:

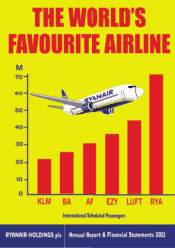

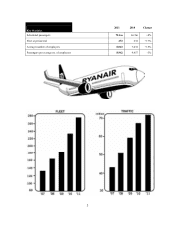

• Traffic grew by 8% to 72m passengers.

• We took delivery of 40 (net) new aircraft bringing the total fleet to 272.

• We opened 328 new routes.

• We opened 8 new bases at El Prat, Gran Canaria, Kaunas, Lanzarote, Malta, Seville, Tenerife and

Valencia, bringing the total number of bases to 44. The opening of the Manchester base in October

2011 will bring the total number of bases to 45.

• Our Customer Service further improved and Ryanair continues to be the No. 1 on time major airline in

Europe.

• We paid a dividend of 1500m in October bringing the total returned to shareholders over the past 3

years to 1846m.

As noted, our fuel bill rose by 37% to 11.2bn as oil prices rose from $62 per barrel to $73 per barrel.

Fuel now accounts for 40% of our cost base. Next year our fuel bill will rise by over 1350 million, even

though we are 90% hedged at $82 per barrel. Higher oil prices will inevitably force many of our high fare

competitors to further increase fuel surcharges thus making Ryanair’s low fares even more attractive.

Higher oil prices have led us to tactically ground up to 80 aircraft during the winter (40 last winter),

mainly at Dublin, Stansted and Spanish airports, as it is more profitable to ground these aircraft rather than

suffer losses operating them to high cost airports at low winter yields. As a result in the coming year we expect

our rate of passenger growth to slow to 4% and to deliver approximately 75 million passengers. Due to the

winter grounding of aircraft our traffic will decline during the winter months.

Last year volcanic ash disruptions, airport snow closures and repeated ATC strikes resulted in 14,000

Ryanair flights being cancelled. The volcanic ash disruptions resulted in exceptional costs of 129 million as

airlines are required under the unreasonable and discriminatory EU261 regulations to pay “right to care”

and/or compensation during such force majeure events even though they are clearly completely beyond the

control of the airline. We believe it is unacceptable that other transport providers or travel insurers are not

obliged to reimburse the expenses of disrupted passengers during such force majeure events.

The year ahead will be challenging as we face rising fuel prices, and the continuing impact of recession,

austerity measures, and falling European confidence. Ryanair is well positioned to cope with these potential

headwinds as slowing growth will enhance yields and our fuel is well hedged, albeit at higher prices. We will

continue to work hard to reduce costs and further improve customer service, while delivering the lowest fares

in Europe to our passengers. This is the real strength of Ryanair and our outstanding people who continue to

deliver robust profitability for shareholders even during difficult economic conditions.

Yours sincerely,

David Bonderman

Chairman