Ryanair 2011 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2011 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10

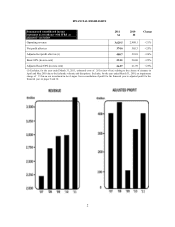

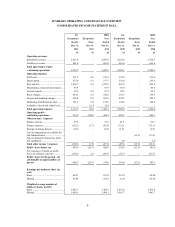

Reconciliation of profit for the year under IFRS to adjusted profit for the financial year

Year ended

March 31,

2011

Year ended

March 31,

2010

1M 1M

Profit for the financial year – IFRS

374.6

305.3

Adjustments

Icelandic volcanic ash related cost ......................................................

26.1

-

Loss on impairment of available for sale financial asset ....................

-

13.5

Adjusted profit for the financial year 400.7

318.8

Exceptional items

The Company presents certain items separately, which are unusual, by virtue of their size and incidence,

in the context of our ongoing core operations, as we believe this presentation represents the underlying

business more accurately and reflects the manner in which investors typically analyse the results. Any

amounts deemed “exceptional” for management discussion and analysis purposes, in the Chairman’s Report

and Chief Executive’s Report, have been classified for the purposes of the income statement in the same way

as non-exceptional amounts of the same nature.

Exceptional items in the year ended March 31, 2011 amounted to 126.1m reflecting the estimated costs

relating to the closure of airspace in April and May 2010 due to the Icelandic volcanic ash disruptions. The

closure of European airspace in April and May 2010, due to the Icelandic volcanic ash disruption, resulted in

the cancellation of 9,400 Ryanair flights. The impact on the Group’s operating results totaled 129.7m (pre tax)

for the year ended March 31, 2011, comprising 115.6m of operating expenses and 11.7m of finance expenses

attributable to the period of flight disruption, together with estimated passenger compensation costs of 112.4m

pursuant to Regulation (EC) No. 261/2004 (‘EU261’). The Company’s estimate of total passenger

compensation costs has been determined based on actual claims received and processed to date together with

probable future compensation payments and other related costs.

Exceptional items in the year ended March 31, 2010 amounted to 113.5m reflecting an impairment of the

Aer Lingus shareholding.

Adjusted profit after tax excluding exceptional items increased by 26% to 1400.7m. Including

exceptional items the profit after tax for the year increased by 23% to 1374.6m compared to a profit of

1305.3m in the year ended March 31, 2010.

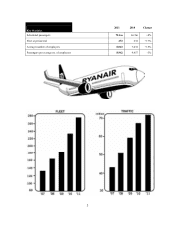

Summary year ended March 31, 2011

Adjusted profit after tax increased by 26% to 1400.7m compared to 1318.8m in the year ended March

31, 2010 primarily due to a 12% increase in average fares and strong ancillary revenues, offset by a 37%

increase in fuel costs. Total operating revenues increased by 21% to 13,629.5m as average fares rose by

12%. Ancillary revenues grew by 21%, faster than the 8% increase in passenger numbers, to 1801.6m due to

an improved product mix and higher internet related revenues. Total revenue per passenger, as a result,

increased by 12%, whilst Load Factor was up 1% to 83% during the year.

Total operating expenses increased by 20% to 13,113.3m, primarily due to an increase in fuel prices,

the higher level of activity, and the higher operating costs associated with the growth of the airline. Fuel,

which represents 39% of total operating costs compared to 35% in the prior year, increased by 37% to

11,226.7m due to the higher price per gallon paid and a 17% increase in the number of hours flown. Unit

costs excluding fuel increased by 3% and including fuel they rose by 11%. Operating margin rose by 1% to

14% whilst operating profit increased by 28% to 1516.2m.

Adjusted net margin was 11%, similar to the prior year.

Adjusted earnings per share for the year were 26.97 euro cent compared to 21.59 euro cent for the

prior year.