Ryanair 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Stansted Second Runway

The BAA airport monopoly continues to pursue its plan to

waste £4bn building a second runway and second terminal at

Stansted when these facilities could and should be built for one

quarter of that figure. The recent Ferrovial takeover has

exposed the feather bedding in the BAA's accounts. Just

months after the BAA was telling the Regulator that it couldn't

pay for a second runway at Stansted without doubling

passenger charges (many years in advance of its delivery) they

were able to find a “spare” £1bn of cash which were offered in

special dividends to shareholders if they rejected the Ferrovial

bid. The BAA clearly has the money to build these facilities

at Stansted in a low cost, efficient manner which would have

the support of all users at Stansted, yet they persist in trying

to waste £4bn so that they can boost their capital expenditure

and future income under a regulatory regime that has patently

failed to meet the reasonable requirements of users.

Ryanair continues to call on the Civil Aviation Authority (the

regulator of the BAA) to put a stop to this profligate madness.

The BAA airport monopoly has been delivering abject airport

facilities, at excessive cost, for many years. At Stansted they

continue to ignore the expressed views of their airline users.

Yet because of the cowardice of the regulator, the BAA

continues to treat the Stansted airlines with derision and

contempt. Since regulation has failed, we believe that the BAA

airport monopoly should be broken up, in a manner which

would encourage the three London airports Gatwick, Heathrow

and Stansted to compete against each other. This competition

would bring about improved facilities and lower costs for the

travelling public as well as the development of airports that

the airlines actually want and are willing to pay for. In this

regard, we welcome the investigation recently announced in

OFT into this monopoly ownership of airports in London. In the

meantime we hope that the CAA - which has been captured for

many years by the BAA - will begin firstly to tackle this over-

charging monopoly and secondly to comply with its legal

obligation to meet the reasonable requirements of users, an

obligation it has repeatedly ignored over recent years.

Conclusion

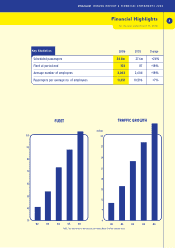

Ryanair has over the past nine years as a public company seen

its traffic mushroom from 3 million to over 35 million

passengers per annum. During that time our route network

has grown from 19 in 1998 to 262 routes at March 31, 2006.

Our employee numbers over that period have more than

tripled from just under 1,000 to over 3,450 today. Most

importantly however, our average fare has fallen by almost

20% from 50 in 1997 to just over 40 today. Ryanair will

continue to pursue lower costs, and pass on these savings in

the form of lower fares to the travelling public of Europe.

Ryanair is the only airline in Europe which commits to offer the

lowest fares in every market in which we operate, and it is this

commitment to lowest fares and our guarantee of no fuel

surcharges that will enable us to grow successfully, safely and

profitably for the benefit of our passengers, our people and

our shareholders.

Michael O'Leary

Chief Executive

for the year ended March 31, 2006

Chief Executive’s Report 7

ANNUAL REPORT & FINANCIAL STATEMENTS 2006