Ryanair 2006 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2006 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

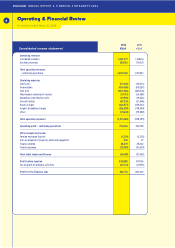

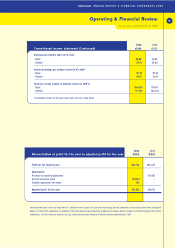

Operating Expenses (Continued)

Airport and handling charges increased by 21% to 216.3m,

which was slower than the growth in passenger volumes and

reflects the impact of increased costs at certain existing

airports, offset by lower costs at new airports and bases.

Other expenses increased by 8% to 85.6m, which is lower

than the growth in ancillary revenues due to improved margins

on some existing products, and cost reductions achieved on

indirect costs.

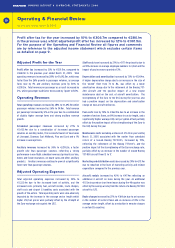

Adjusted Operating Profits

Operating margins have declined by 3 points to 22% due to

the reasons outlined above whilst operating profits have

increased by 12% to 369.1m during the year.

Interest Receivable

Interest receivable has increased by 35% to 38.2m for the

year due to the combined impact of higher levels of cash and

cash equivalents and increases in average deposit rates

earned compared to last year.

Foreign Exchange (Losses)

Foreign exchange losses have decreased during the year to

1.2m due to the positive impact of changes in the Sterling and

US Dollar exchange rates against the Euro compared to last

year.

Disposal of Fixed Assets

The gain on disposal of fixed assets of 0.8m arises from the

disposal of the remaining 9 Boeing 737-200 aircraft during the

year.

Adjusted Earning per Share (EPS)

Adjusted earnings per share has increased by 11% to 39.32

Euro cent for the year and is based on 766,832,502 shares

which represents the weighted average of ordinary shares in

issue during the year.

Balance Sheet

The group’s balance sheet continues to reflect the significant

capital expenditure programme being undertaken by the

group. An additional 21 aircraft were delivered during the year

which, in conjunction with the payment of deposits on future

deliveries, accounted for the bulk of 546.2m spent on capital

expenditure during the year. During the same period the

company generated cash from operating activities of 599.0m

that part funded the capital expenditure programme with the

balance reflected in total cash of 1,972.0m. The exercise of

share options, primarily by pilots generated a further 30.6m

cash for the group. Total debt, net of repayments, increased

by 262.9m during the year.

Shareholders’ Equity

Shareholders’ equity at March 31, 2006 has increased by

257.5m to 1,992.0m, compared to March 31, 2005

reflecting the 306.7m increase in profitability during the

year, and the exercise of share options which increased equity

by 30.6m, offset by a reduction of 79.9m resulting from

changes in the accounting treatment for derivative financial

instruments, pensions and stock options following the

adoption of IFRS.

Capital Expenditure

During the year the group’s capital expenditure amounted to

534.7m. The majority of this related to the purchase of 21

Boeing 737-800 “next generation” aircraft and deposits

relating to the future acquisition of additional new Boeing 737-

800’s. Four new Boeing 737-800 “next generation” aircraft

were financed by way of operating lease during the year

bringing the increase in total new aircraft operated to 25.

Further details are given in note 11.

Review of Cash Flow

Net cash provided from operating activities was 610.6m,

reflecting the overall profitability of the group and working

capital movements including advance revenues. This has

enabled the group to increase its cash and liquid resources by

366.3m to 1,972.0m despite part funding capital

expenditure of 159.4m from internal cash resources. At

March 31, 2006 the group had advance purchase deposits with

Boeing of 301.5m for future aircraft deliveries.

(Continued)

Operating & Financial Review 11

ANNUAL REPORT & FINANCIAL STATEMENTS 2006