Ryanair 2006 Annual Report Download - page 14

Download and view the complete annual report

Please find page 14 of the 2006 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

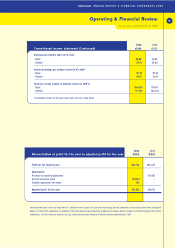

Critical Accounting Policies (Continued)

In accounting for long-lived assets(principally aircraft and

related parts), Ryanair must make estimates about the

expected useful lives of the assets, the expected residual

values of the assets and the potential for impairment based on

the fair value of the assets and the cash flows they generate.

In estimating the lives and expected residual values of its

aircraft, Ryanair has primarily relied on industry experience

and recommendations from Boeing, the manufacturer of all of

the company's owned aircraft. Subsequent revisions to these

estimates, which can be significant, could be caused by

changes to Ryanair's maintenance program, changes in

utilization of the aircraft, governmental regulations on ageing

of aircraft and changing market prices for new and used

aircraft of the same or similar types. Ryanair evaluates its

estimates and assumptions in each reporting period, and when

warranted adjusts these assumptions. Generally, these

adjustments are accounted for on a prospective basis, through

depreciation expense.

Ryanair periodically evaluates its long-lived assets for

impairment. Factors that would indicate potential impairment

would include, but are not limited to, significant decreases in

the market value of aircraft, a significant change in an

aircraft’s physical condition, and operating or cash-flow losses

associated with the use of the aircraft. While the airline

industry as a whole has experienced many of these factors

from time to time, Ryanair has not yet been seriously impacted

and continues to record positive cash flows from these long-

lived assets. Consequently, Ryanair has not yet identified any

impairments related to its existing aircraft fleet. The company

will continue to monitor its aircraft and the general airline

operating environment.

An element of the cost of an acquired aircraft is attributed on

acquisition to its service potential, reflecting the maintenance

condition of the engines and airframe. Additionally, where

Ryanair has a lease commitment to perform aircraft

maintenance, a provision is made during the lease term for this

obligation. Both of these accounting policies involve the use

of estimates in determining the quantum of both the initial

maintenance asset and/or the amount of provision to be set

aside and the respective periods over which such amounts are

charged to income. In making such estimates, Ryanair has

primarily relied on industry experience, industry regulations

and recommendations from Boeing; however, these estimates

can be subject to revision, depending on a number of factors,

such as the timing of the planned maintenance, the ultimate

utilization of the aircraft, changes to government regulations

and increases and decreases in the estimated costs. Ryanair

evaluates its estimates and assumptions in each reporting

period and, when warranted, adjusts these assumptions, which

generally impact on maintenance and depreciation expense in

the income statement, on a prospective basis.

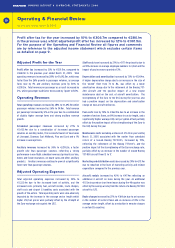

Treasury Policy, Fuel, Currency and

Interest Rate Risk Management

The Audit Committee of the Board of Directors has

responsibility for setting the treasury policies and objectives

of the group which include controls over the procedures used

to manage the main financial risks arising from the group’s

operations which comprise of commodity price, foreign

exchange and interest rate risks. The group uses financial

instruments to manage exposures arising from these risks.

These instruments include borrowings, cash deposits and

derivatives (principally jet fuel derivatives, interest rate swaps

and forward foreign exchange contracts). It is the group’s

policy that no speculative trading in financial instruments

takes place.

The group’s historical fuel risk management policy has been to

hedge between 70% and 90% of the forecasted rolling annual

volumes required to ensure that the future cost per gallon of

fuel is locked in. This policy was adopted to prevent the group

being exposed, in the short term, to adverse movements in

world jet fuel prices. However, when deemed to be in the best

interests of the group, it may deviate from this policy. In more

recent times, due to fundamental changes in the

world fuel markets, the group has adopted a more short term

and strategic approach to fuel hedging. At August, 2006 the

group had hedged 90% of its fuel exposures for the period

June to December 2006 inclusive.

Foreign currency risk in relation to the group’s trading

operations largely arises in relation to non-Euro currencies.

These currencies are primarily Sterling pounds and US dollar.

The group manages this risk by matching Sterling revenues

against Sterling costs. Any unmatched Sterling revenues are

used to fund forward foreign exchange contracts to hedge US

dollar currency exposures that arise in relation to fuel,

maintenance, aviation insurance, and capital expenditure costs

- including advance payments to Boeing for future aircraft

deliveries.

for the year ended March 31, 2006

Operating & Financial Review

14

ANNUAL REPORT & FINANCIAL STATEMENTS 2006