Ryanair 2006 Annual Report Download

Download and view the complete annual report

Please find the complete 2006 Ryanair annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

2 Financial Highlights

4 Chairman’s Report

5 Chief Executive’s Report

8 Operating & Financial Review

16 Directors’ Report

22 Directors

23 Social, Environmental and Ethical Report

25 Report of the Remuneration Committee to the Board

26 Statement of Directors’ Responsibilities

26 Independent Auditors’ Report to the Members of Ryanair Holdings plc

28 Statement of Accounting Policies

35 Consolidated Balance Sheet

36 Consolidated Income Statement

37 Consolidated Cash Flow Statement

38 Consolidated Statement of Recognised Income and Expense

39 Company Balance Sheet

40 Company Cash Flow Statement and Statement of Changes in Shareholders’ Equity

41 Notes Forming Part of the Consolidated Financial Statements

75 Directors and Other Information

CONTENTS

1

ANNUAL REPORT & FINANCIAL STATEMENTS 2006

Financial Statements

Certain information included in these statements are forward looking and are subject to important risks and uncertainties that could cause actual results to differ materially.

It is not reasonably possible to itemise all of the many factors and specific events that could affect the outlook and results of an airline operating in the European economy.

Among the factors that are subject to change and could significantly impact the group’s expected results are the airline pricing environment, the availability and cost of fuel,

competition from new and existing carriers, market prices for replacement aircraft, costs of compliance with environmental issues and emission standards, safety and security

measures, actions of the Irish, UK, European Union (“EU”) and other governments and their respective regulatory agencies, fluctuations in currency exchange rates and interest

rates, airport access and charges, labour relations, terrorist acts, the economic environment of the airline industry, the general economic environment in Ireland, the UK and

Continental Europe, the general willingness of passengers to travel and other economic, social and political factors.

Table of contents

-

Page 1

...'s Report Operating & Financial Review Directors' Report Directors Social, Environmental and Ethical Report Report of the Remuneration Committee to the Board Statement of Directors' Responsibilities Independent Auditors' Report to the Members of Ryanair Holdings plc Statement of Accounting Policies... -

Page 2

...stated after a release of 11.9m due to a change in the accounting treatment for business combinations following the adoption of IFRS. ** Throughout this document "IFRS" refers to International Financial Reporting Standards as adopted in the EU and as adopted by Ryanair for the first time in the year... -

Page 3

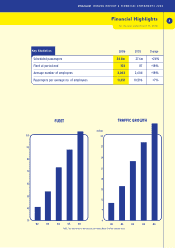

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Financial Highlights for the year ended March 31, 2006 3 Key Statistics 2006 2005 Change Scheduled passengers Fleet at period end Average number of employees Passengers per average no. of employees 34.8m 103 3,063 11,351 27.6m 87 2,604 10,596 +26... -

Page 4

... priority remains the safety of our passengers, crew and aircraft, and the Board is focused on extending our 21 year unblemished safety record. Customer service performance continues to improve thanks to the efforts of our staff as we maintained our number 1 position in Europe with the best on time... -

Page 5

...% 72% 67% Customer Service Ryanair's customer service consists of offering our passengers the lowest air fares, a no fuel surcharge guarantee, the youngest fleet of aircraft in Europe, the best punctuality, the fewest cancellations and the fewest lost bags. No other airline in Europe comes close to... -

Page 6

...to an annual limit of 900 flying hours which equates to approximately 18 hours per week. All of our pilots operate a roster which guarantees them 5 days off in every fourteen day cycle and we have agreed improved rosters at certain bases and for new recruits which guarantees them four days off after... -

Page 7

... on these savings in the form of lower fares to the travelling public of Europe. Ryanair is the only airline in Europe which commits to offer the lowest fares in every market in which we operate, and it is this commitment to lowest fares and our guarantee of no fuel surcharges that will enable us... -

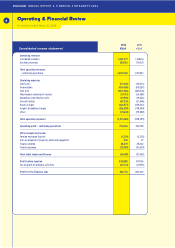

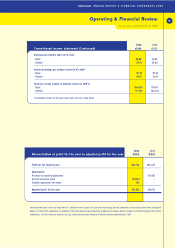

Page 8

... Marketing & distribution costs Aircraft rentals Route charges Airport & handling charges Other Total operating expenses Operating profit - continuing operations Other (expenses)/income Foreign exchange (losses) Gain on disposal of property, plant and equipment Finance income Finance expense Total... -

Page 9

... 31, 2006 consist of a receipt of 5.2m (net of tax) arising from the settlement of an insurance claim for the scribing of 6 Boeing 737-200 aircraft. Additionally, on adoption of IFRS (International Financial Reporting Standards) the company opted to change its accounting treatment for business... -

Page 10

... increase in average fares. Ancillary revenues increased by 36% to 259.2m, a faster growth rate than passenger volumes, reflecting a strong performance in non-flight scheduled revenues (primarily car hire, hotels and travel insurance), on board sales and other ancillary products. Ancillary revenues... -

Page 11

... US Dollar exchange rates against the Euro compared to last year. During the year the group's capital expenditure amounted to 534.7m. The majority of this related to the purchase of 21 Boeing 737-800 "next generation" aircraft and deposits relating to the future acquisition of additional new Boeing... -

Page 12

...Our operating performance continues to make Ryanair the No. 1 customer service airline in Europe. No other major or low cost airline can match Ryanair's record for consistently high punctuality, with fewest lost bags and least flight cancellations. Ryanair's inexorable growth in aircraft, routes and... -

Page 13

...undergo a conversion training process to enable them to fly the new Boeing 737-800 aircraft. Starting in the Autumn of 2004, Ryanair made a number of written offers to its Dublin based pilots to enable them to participate in a re-training process in order to obtain the correct type rating for flying... -

Page 14

... the Board of Directors has responsibility for setting the treasury policies and objectives of the group which include controls over the procedures used to manage the main financial risks arising from the group's operations which comprise of commodity price, foreign exchange and interest rate risks... -

Page 15

... of: • Business combinations • Share based payments • Pensions & employee benefits • Financial instruments; and • Property, plant and equipment Further details on the financial impact of these items has been set out in note 27 to the financial statements. Additional Performance Measures... -

Page 16

... books of account of the company are maintained at its registered office, Corporate Headquarters, Dublin Airport, Co. Dublin. Staff At March 31, 2006, the group employed 3,453 people. This compares to 2,717 staff at March 31, 2005. The increase in staff levels consisted mainly of pilots and cabin... -

Page 17

... in the share capital of the company which represent more than 3% of the issued share capital. At March 31, 2006 the free float in shares was 94%. NAME SHARES HELD % OF ISSUED SHARE CAPITAL good governance contained in the Combined Code in relation to: • Directors and the Board, • Directors... -

Page 18

...FINANCIAL STATE MENTS 2006 18 Directors' Report (Continued) Directors' Independence The Board has considered Mr. Kyran McLaughlin's independence given his role as Deputy Chairman and Head of Capital Markets at Davy Stockbrokers. Davy Stockbrokers are one of Ryanair's brokers and provide corporate... -

Page 19

...Officer, the Director of Engineering, Director of Personnel and In-flight, Quality Assurance Manager-Maintenance, Deputy Director of Safety and the Health and Safety Manager. The Air Safety Committee meets regularly to discuss relevant issues and reports to the Board on a quarterly basis. The number... -

Page 20

... and which is ultimately approved at Board level; Board approved capital expenditure and treasury policies which clearly define authorisation limits and procedures; an internal audit function which reviews key financial/ business processes and controls, and which has full and unrestricted... -

Page 21

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Directors' Report (Continued) 21 Code of Business Conduct Ryanair's standards of integrity and ethical values have been established and are documented in Ryanair's Code of Business Conduct. This code is applicable to all Ryanair employees. There are ... -

Page 22

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 22 Directors David Bonderman (Chairman-USA*) James R. Osborne (Director) A director of Ryanair Holdings plc since August 1996 and Chairman of the Board since December 1996. He also serves on the Board of the following public companies: CoStar Group,... -

Page 23

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Social, Environmental and Ethical Report 23 Social The group's aim is that employees understand the group's strategy and are committed to Ryanair. The motivation and commitment of our people is key to our performance. The group's policy is that training... -

Page 24

... to the Code of Business Conduct and Ethics the employees are also bound by the business principles contained in their terms and conditions of employment. The management of the company are responsible to the Board for ensuring adherence to the code. The code is renewed annually and any amendments to... -

Page 25

... basic salary, performance bonus and pension. Full details of the executive director's remuneration are set out in note 19(a) on page 58 of the financial statements. Executive Director's Service Contract Ryanair entered into a new employment agreement with the only executive director of the Board... -

Page 26

... Ryanair Holdings plc Statement of Directors' Responsibilities in respect of the Annual Report and the Financial Statements The directors are responsible for preparing the Annual Report and the group and parent company financial statements, in accordance with applicable law and regulations. Company... -

Page 27

... 2006 Independent Auditor's Report to the Members of Ryanair Holdings plc (Continued) 27 Respective Responsibilities of Directors and Auditors The directors responsibilities for preparing the Annual Report and the financial statements in accordance with applicable law and International Financial... -

Page 28

... of Accounting Policies Ryanair Holdings plc is a public limited company incorporated and domiciled in the Republic of Ireland, (also referred to hereafter as "we", "our", "us", "Ryanair", "the company" or "the group") and is a low fares airline headquartered in Dublin, Ireland. The financial... -

Page 29

...be recoverable. No impairment to the carrying values of the group's intangible assets has been recorded to date. Revenues Scheduled revenues comprise the invoiced value of airline and other services, net of government taxes. Revenue from the sale of flight seats is recognised in the period in which... -

Page 30

...Fair value of such options is determined consistently with the accounting policy of the group. Derivative Financial Instruments* Ryanair is exposed to market risks relating to fluctuations in commodity prices, interest rates and currency exchange rates. The objective of financial risk management at... -

Page 31

... it sells the rights to acquire aircraft to a third party and subsequently leases the aircraft back, by way of operating lease. Any profit on the disposal, where the price achieved on the disposal of the aircraft is not considered to be at fair value, is spread over the period the asset is expected... -

Page 32

.... The discount rates employed in determining the present value of each scheme's liabilities are determined by reference to market yields at the balance sheet date of high quality corporate bonds in the same currency and term that is consistent with those of the associated pension obligations. The... -

Page 33

... & FINANCIAL STATE MENTS 2006 Statement of Accounting Policies Continued 33 Property, Plant & Equipment AIRCRAFT TYPE NO OF OWNED AIRCRAFT USEFUL LIFE RESIDUAL VALUE AVERAGE AGE Boeing 737-800 86 23 years from date of manufacture 15% of original cost 2.4 yrs RATES OF DEPRECIATION On... -

Page 34

... presented in the accounts. Business Combinations The purchase method of accounting is employed in accounting for the acquisition of businesses. In accordance with IFRS 3, the cost of a business combination is measured as the aggregate of the fair values at the date of exchange of assets given and... -

Page 35

...at March 31, 2006 2006 000 2005 000 35 Note Non-current assets Property, plant and equipment Intangible assets Derivative financial instruments Total non-current assets Current assets Inventories Other assets Trade receivables Derivative financial instruments Restricted cash Financial assets: cash... -

Page 36

... Marketing & distribution costs Aircraft rentals Route charges Airport & handling charges Other Total operating expenses Operating profit - continuing operations Other (expenses)/income Foreign exchange (losses) Gain on disposal of property, plant and equipment Finance income Finance expense Total... -

Page 37

... costs Share based payments Income tax Net cash provided by operating activities Investing activities Capital expenditure (purchase of property, plant and equipment) Proceeds from sale of property, plant and equipment (Investment) in restricted cash Reduction/(investment) in financial assets: cash... -

Page 38

... of first time adoption of IAS 39 New movements into cash flow hedge reserve Movements from cash flow hedge reserve Net movements into cash flow hedge reserve Issue of ordinary equity shares Profit for the financial year Share-based payments Retirement benefits Balance at March 31, 2006 115 9,790... -

Page 39

...Loans and receivables from subsidiaries Total assets 2006 000 2005 000 12 75,403 72,482 6 569,831 645,234 539,241 611,723 Non-current liabilities Amounts due to subsidiaries Shareholders' equity Issued share capital Share premium account Retained earnings Other reserves Shareholders' equity... -

Page 40

... in Shareholders' Equity Share premium account 000 560,406 5,350 565,756 30,475 596,231 Ordinary shares 000 Balance at April 1, 2004 Issue of ordinary equity shares Share based payments Balance at March 31, 2005 Issue of ordinary shares Share-based payments Balance at March 31, 2006 9,643 32 9,675... -

Page 41

...Consolidated Financial Statements (Continued) 41 1 PROPERTY, PLANT AND EQUIPMENT GROUP March 31, 2006 Aircraft 000 Cost At beginning of year Additions in year Disposals in year At end of year Depreciation At beginning of year Charge for year Eliminated on disposals At end of year Net book value At... -

Page 42

... in the landing rights carrying amounts exceeding their recoverable amounts. These projections have been discounted using a rate that reflects management's estimate of the long term pre tax return on capital employed for its scheduled airline business, estimated to be 5.0% for 2006 and 5.5% for... -

Page 43

... to be highly effective in offsetting fair value changes in the fair value of committed aircraft purchases in US dollars. • Forecast Sterling and Euro revenue receipts are also converted into US dollars to hedge against forecasted US dollar payments principally for jet fuel, insurance and other... -

Page 44

... follows: 2006 000 Current income tax liabilities Corporation tax provision Total current tax 2005 000 15,247 15,247 17,534 17,534 Deferred income tax liabilities (non-current) Temporary differences on property, plant and equipment, derivatives and pensions Total non current Total tax liabilities... -

Page 45

... pension obligations Derivative financial instruments Total tax charge in equity At March 31, 2006 and 2005 the group had unused net operating losses carried forward of 20.3m, and the resultant deferred tax asset has been netted off against the group's deferred income tax liability. The company... -

Page 46

...In the view of the directors, there are no material differences between the replacement cost of inventories and the balance sheet amounts. 6 OTHER ASSETS AND AMOUNTS DUE FROM SUBSIDIARIES GROUP 2006 000 Prepayments Interest receivable Value Added Tax recoverable Due from Ryanair Limited (subsidiary... -

Page 47

...in previous years. • The present value of the net pension obligation of 8.7m (2005: 10.6m) in Ryanair Limited. See note 21 for further details. • Gain on fair value movement in firm commitments to acquire aircraft - maturing within one year of 7.5m (2005: Nil). Ryanair has taken advantage of the... -

Page 48

...,172 At March 31, 2006, Ryanair Holdings plc had borrowings of 35,171,745 (2005: free and is repayable on demand. 35,171,745) from Ryanair Limited. The loan is interest 14 ISSUED SHARE CAPITAL, SHARE PREMIUM ACCOUNT AND SHARE OPTIONS SHARE CAPITAL ACCOUNT GROUP AND COMPANY Authorised 840,000,000... -

Page 49

... ORT & FINANCIAL STATE MENTS 2006 Notes (Continued) 49 14 ISSUED SHARE CAPITAL, SHARE PREMIUM ACCOUNT AND SHARE OPTIONS (Continued) Share options and share purchase arrangements The group has adopted a number of share option plans, which allow current or future employees or executive directors to... -

Page 50

...agreements with a value which reflects price movements in an underlying asset. The group uses derivative financial instruments, principally jet fuel derivatives, interest rate swaps and forward foreign exchange contracts, to manage commodity risks, interest rate risks, currency exposures and achieve... -

Page 51

... will mature over each of the periods between 2011 and 2018. Analysis of changes in borrowings during the year 2006 000 Balance at start of year Loans raised to finance aircraft/simulator purchases Repayments of amounts borrowed Balance at end of year 1,414,857 386,809 (123,938) 1,677,728 2005 000... -

Page 52

... fund forward foreign exchange contracts to hedge the US dollar currency exposures that arise in relation to fuel, maintenance, aviation insurance and capital expenditure costs - including advance payments to Boeing for future aircraft deliveries. Further details of the hedging activity are carried... -

Page 53

... forward contracts as at March 31, 2006 and at March 31, 2005: CURRENCY FORWARD CONTRACTS US dollar currency forward contracts - for aircraft purchases - for fuel and other purchases GBP currency forward contracts - for other airline costs GBP £000 2006 US$ $000 Euro Equiv 000 GBP £000... -

Page 54

... Derivative - currency forward and aircraft fuel contracts: a comparison of the contracted rate to the market rate for contracts providing similar risk management profile at March 31, 2006 and at March 31, 2005 has been made. The fair value of the group's financial instruments at March 31, 2006 and... -

Page 55

...the carrying value of the relevant financial instrument. The group's revenues derive principally from airline travel on scheduled services, car hire, inflight and related sales. Revenue is wholly derived from European routes. No individual customer accounts for a significant portion of total revenue... -

Page 56

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 56 Notes (Continued) 16 ANALYSIS OF OPERATING REVENUES AND SEGMENTAL ANALYSIS All revenues derive from the group's principal activity and business segment as a low fares airline and includes scheduled services, car hire, internet income, inflight and ... -

Page 57

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Notes (Continued) 57 18 AIRCRAFT RENTALS AND OTHER EXPENSES (a) Aircraft rentals-Purchase Accounting Adjustment Subsequent to the acquisition of Buzz Stansted Ltd. in April 2003 Ryanair renegotiated the terms and conditions of certain onerous leases and... -

Page 58

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 58 Notes (Continued) 19 STATUTORY AND OTHER INFORMATION (Continued) DIRECTORS EMOLUMENTS (a) Fees and emoluments - Executive Director Basic salary Performance related bonus Pension contributions 2006 000 579 200 58 837 2005 000 505 127 49 681 During ... -

Page 59

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Notes (Continued) 59 19 STATUTORY AND OTHER INFORMATION (Continued) DIRECTORS' EMOLUMENTS (Continued) (d) Shares and share options (i) Shares Ryanair Holdings plc is listed on the Irish, London and Nasdaq Stock Exchanges. At March 31, 2006 and March 31,... -

Page 60

... were carried out at December 31, 2003 in accordance with local regulatory requirements in Ireland using the projected unit credit method and the valuation reports are not available for public inspection. The actuarial report showed that at the valuation date the market value of the scheme's assets... -

Page 61

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 61 21 PENSIONS (Continued) The amount recognised in the consolidated balance sheet in respect of our defined benefit plans is as follows: 2006 000 Present value of benefit obligations Fair value of plan assets Present value of net obligations Related ... -

Page 62

... of the plans' assets are as follows: 2006 000 Fair value of the plan assets at begnning of year Opening fair value of UK scheme assets Actual gain on plan assets Employer contribution Plan participants' contributions Benefits paid Foreign exchange rate changes Fair value of plan assets at end of... -

Page 63

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Notes (Continued) 63 21 PENSIONS (Continued) The fair value of the plans' assets at March 31 is analysed as follows: 2006 000 2005 000 Equities Bonds Property Other Assets Total fair value of plan assets 20,147 2,469 1,012 1,062 24,690 14,359 2,498... -

Page 64

...85 (1.57) 35.28 35.09 Basic EPS Adjusted by: Purchase accounting adjustment Aircraft insurance claim Adjusted basic EPS Adjusted diluted EPS Number of ordinary shares (in 000's) used for EPS and adjusted EPS -Basic -Diluted Details of share options in issue have been described more fully in note 14... -

Page 65

...a formula which reflects increases in the published US employment Cost and Producer Price indices between the time the Basic Price was set and the period of six months prior to the delivery of such aircraft. Boeing has granted Ryanair certain price concessions with regard to the Boeing 737-800 "next... -

Page 66

...financial position. (e) The company has provided 30.5m in letters of guarantee to secure obligations of subsidiary undertakings in respect of loans and bank advances (see also note 15). (f) In order to avail of the exemption contained in Section 17 of the Companies (Amendment) Act, 1986, the holding... -

Page 67

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Notes (Continued) 67 24 RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET FUNDS 2006 000 Net funds at beginning of year Increase in cash and cash equivalents in year Movement in financial assets > 3 months Movement in restricted cash Net cash flow from... -

Page 68

... of Ryanair Holdings plc: Effective date of acquisition/incorporation August 23, 1996 Name Ryanair Limited Registered Office Corporate Headquarters Dublin Airport Co Dublin Corporate Headquarters Dublin Airport Co Dublin Corporate Headquarters Dublin Airport Co Dublin Nature of Business Airline... -

Page 69

... to return the aircraft to the lessors in late 2005, thereby releasing Ryanair from any remaining lease obligations at that time. Irish GAAP permitted that such an adjustment could be made to the provisional value of the assets and liabilities acquired as part of the original business combination... -

Page 70

...amortised cost dependant on the nature of the financial asset or financial liability. Derivatives are measured at fair value with changes in value arising from fluctuations in interest rates, foreign exchange rates or commodity prices. Under Irish GAAP, where the derivatives formed part of a hedging... -

Page 71

...Business GAAP Benefits Combination 000 000 000 Non-current assets Property, plant and equipment Intangible assets Total non-current Assets Current assets Inventories Other assets Trade receivables Restricted Cash Financial assets - cash > 3 months Cash and cash equivalents Total current assets Total... -

Page 72

... Shareholders' equity Issued share capital Share premium account Retained earnings Other reserves Shareholders' equity Total liabilities and shareholders' equity Apr 01 04 000 Retirement Business Benefits Combination 000 000 Share Stock of Based A/C Spare Payment Parts 000 000 Total Effect 000 Mar31... -

Page 73

... (expenses)/income Foreign exchange (losses) Gain on disposal of property, plant and equipment Finance income Finance expense Total other (expenses)/ income PY Adj Apr 01 04 000 Retirement Business Benefits Combination 000 000 Share Stock of Based A/C Spare Payment Parts 000 000 Total Effect 000... -

Page 74

... dealt with in the Statement of Accounting Policies on pages 28 to 34. The key risks and uncertainties relating to the business are also dealt with on pages 14 and 15 of the Operating and Financial Review. 29 DATE OF APPROVAL The financial statements were approved by the Board on August 21, 2006. -

Page 75

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 Directors and Other Information 75 DIRECTORS D. Bonderman M. O'Leary E. Faber M. Horgan K. Kirchberger R. MacSharry K. McLaughlin J. Osborne P. Pietrogrande T. A. Ryan J. Callaghan Corporate Headquarters Dublin Airport Co. Dublin Ireland KPMG Chartered... -

Page 76

ANNUAL REP ORT & FINANCIAL STATE MENTS 2006 76 Notes This page is purposely left blank