Rayovac 2014 Annual Report Download - page 5

Download and view the complete annual report

Please find page 5 of the 2014 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

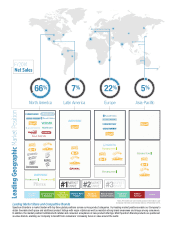

Our Company is well-balanced seasonally and geographically. Our diverse,

value-based and market-leading products compete in multiple, large

and stable categories with attractive growth prospects. Our brands are

widely trusted, enduring and provide better value. We have long-term

relationships with a diverse and loyal base of customers globally. This

gives us timely and clear insight into consumer trends and needs. We have

a very experienced and proven senior management team with a record

of achievement not only here at Spectrum Brands, but also in previous

executive roles at other leading consumer companies.

Acquisitions, both tuck-in and transformational in nature, have been and

will continue to be a powerful engine for accelerated sales, profi t and free

cash fl ow growth. We seek accretive, bolt-on acquisitions primarily in

our Pet, Home and Garden, and HHI divisions that bring quick and major

manufacturing and SG&A cost synergies, along with commercial benefi ts

such as new customer channels and geographies. Our acquisitions of

Liquid Fence and Tell Manufacturing in January and

October of 2014, respectively, are excellent

examples. We believe we buy businesses

at attractive multiples and are a proven

integrator. As this report goes to press,

we expect to complete an accretive

acquisition in our Pet division – the

IAMS® and Eukanuba® European pet

food business – in the fi rst quarter of

calendar 2015. With annual revenues

of about $200 million, this acquisition

will signifi cantly expand the product

breadth and geographic balance of our

global pet business.

Two key metrics drive our daily decision-making – growing adjusted

EBITDA and free cash fl ow. Our long-term and short-term management

incentive compensation programs are based largely on these metrics,

aligning us with investor priorities. We also have a mandatory stock

ownership program for senior management. During fi scal 2014, our

Board of Directors increased the quarterly common stock dividend by

20 percent. Our large and growing free cash fl ow gives us signifi cant,

uncommitted optionality for value creation activities, including debt

reduction, acquisitions, dividend increases and share repurchases. We have

signifi cant strength, liquidity and fl exibility to continue to execute against

our Spectrum Value Model.

Several major executive management changes occurred in fi scal 2014.

Andreas Rouvé, our President, International, was promoted to Chief

Operating Offi cer last February, and on September 1 we welcomed Doug

Martin as our new Chief Financial Offi cer. Doug joins us after a 27-year

career with consumer products company Newell Rubbermaid. Their

strong leadership skills, deep operating experience and extensive industry

knowledge are evident across the organization. The Spectrum Brands

family joins me in extending deep gratitude and appreciation to Tony

Genito for his seven years as our CFO. Tony has made innumerable and

lasting contributions to Spectrum Brands. We wish him much success and

happiness in his future endeavors.

In closing, I want to thank our Board of Directors for their valuable guidance

and steadfast commitment. We salute our talented and resourceful

13,500 employees around the world for their dedication, productivity and

enthusiasm in building an even stronger Spectrum Brands. They stay on

course, execute the plan, and deliver consistent, solid performance. Thank

you for your support as we continue to strive to grow our adjusted EBITDA

and maximize sustainable free cash fl ow for our stakeholders.

Sincerely,

David R. Lumley

Chief Executive Offi cer

December 19, 2014