Rayovac 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Rayovac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

David R. Lumley

Chief Executive Officer

Douglas L. Martin

Executive Vice President and

Chief Financial Officer

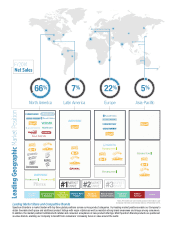

Spectrum Brands reported a fi fth consecutive year of record performance

in fi scal 2014 with results meeting or exceeding our fi nancial targets.

Our reported sales increased 8.4 percent in fi scal 2014 and, including

our HHI business for all of fi scal 2013 on a pro forma basis, sales grew

3.5 percent – and consistently at that rate in all four quarters. Adjusted

EBITDA growth of 7 percent was twice the rate of our sales increase.

Gross and adjusted EBITDA margins both expanded, the latter to 16.4

percent from 15.8 percent, which includes HHI for all of fi scal 2013 on

a pro forma basis. This was our seventh consecutive year of adjusted

EBITDA margin expansion and a 340 basis point improvement since fi scal

2009. Free cash fl ow increased to a record $359 million, or nearly $7

per share, up from $254 million and $208 million in the past two years.

Term debt was reduced by approximately $250 million, resulting in lower

total leverage of about 4.1 times at the end of fi scal 2014. Continuous

improvement savings reached a record annual amount for the fourth

straight year.

We plan for a sixth consecutive year of record performance in fi scal 2015

despite some new and signifi cant pressures. Our Company continues

to execute well and, as in recent years, overcome such challenges as

sluggish spending by cautious consumers, tighter retailer inventory

levels, stagnant store traffi c, and increased competitor discounting in

some of our businesses. This is a testament to the resilience of our

businesses and our brand strength and diversity, and a clear recognition

that value is winning in the marketplace.

How are we able to do this? Our strategy for consistently better

performance year after year remains the same. We focus on driving

high cash-generating consumer products businesses by maximizing

our Spectrum Value Model, global new product development and

shared services infrastructures to minimize operating costs, increase

distribution/shelf space at key retailers, add new retail customers,

expand e-commerce, leverage cross-selling opportunities, and

grow our international footprint. We maintain a strong continuous

improvement culture and a lean and effi cient operating structure to

ensure a nimbleness to move quickly and decisively to counteract

market changes and challenges.

We deploy a powerful weapon in our strategic arsenal – a Spectrum

Value Model that connects strongly with retailers and consumers. Our

“Same or Better Performance/Less Price”, value-branded and largely

non-discretionary replacement products are an ideal match for smart,

value-focused shoppers. Buoyed by a stream of innovative products

launching globally in all segments (some of which are highlighted

in this report), our Spectrum Value Model enables us to continue to

take market share despite competitor price discounting. Our

Spectrum Value Model redefi nes the value proposition

for retailers and consumers. It provides higher

margins and lower acquisition costs to our

retail customers, with retail category growth,

market share gains, and excellent category

management and merchandising. We

concentrate on winning at point of sale

and not through brand advertising.

This allows us to invest in product

performance, R&D and cost

improvement. This is our model

and it is working.

With record fiscal 2014 results and solid prospects for improvement again in fiscal 2015, Spectrum Brands remains a company

on the move, with momentum to build an even stronger platform for sustained global growth and increased shareholder value

creation by following our plan, staying in formation and executing our strategy.

TO OUR

SHAREHOLDERS