Quest Diagnostics 2014 Annual Report Download - page 100

Download and view the complete annual report

Please find page 100 of the 2014 Quest Diagnostics annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

QUEST DIAGNOSTICS INCORPORATED AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS – CONTINUED

(in millions unless otherwise indicated)

)

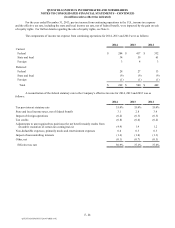

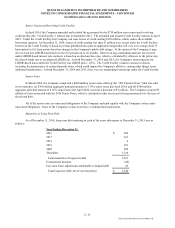

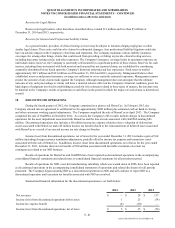

14. FINANCIAL INSTRUMENTS

Interest Rate Derivatives – Cash Flow Hedges

)URPWLPHWRWLPHWKH&RPSDQ\KDVHQWHUHGLQWRYDULRXVLQWHUHVWUDWHORFNDJUHHPHQWVDQGIRUZDUGVWDUWLQJLQWHUHVW

UDWHVZDSDJUHHPHQWVWRKHGJHSDUWRIWKH&RPSDQ\VLQWHUHVWUDWHH[SRVXUHDVVRFLDWHGZLWKWKHYDULDELOLW\LQIXWXUHFDVKIORZV

DWWULEXWDEOHWRFKDQJHVLQLQWHUHVWUDWHV$VXPPDU\RIWKHRXWVWDQGLQJQRWLRQDODPRXQWVRILQWHUHVWUDWHGHULYDWLYHV–FDVKIORZ

KHGJHVDVRI'HFHPEHUDQGLVDVIROORZV

Notional Amount

2014 2013

)RUZDUG6WDUWLQJ,QWHUHVW5DWH6ZDSV

7KHIRUZDUGVWDUWLQJLQWHUHVWUDWHVZDSVRXWVWDQGLQJDVRI'HFHPEHUDQGDUHWRPRQWKIRUZDUG

DJUHHPHQWVWKDWFRYHUDWHQ\HDUKHGJLQJSHULRGDQGZHUHHQWHUHGLQWRWRKHGJHSDUWRIWKH&RPSDQ\VLQWHUHVWUDWHH[SRVXUH

DVVRFLDWHGZLWKIRUHFDVWHGQHZGHEWLVVXDQFHVUHODWHGWRWKHUHILQDQFLQJRIFHUWDLQGHEWPDWXULQJWKURXJK7KHIRUZDUG

VWDUWLQJLQWHUHVWUDWHVZDSVKDYHIL[HGLQWHUHVWUDWHVUDQJLQJIURPWR

,Q0DUFKWKH&RPSDQ\HQWHUHGLQWRLQWHUHVWUDWHORFNDJUHHPHQWVZLWKVHYHUDOILQDQFLDOLQVWLWXWLRQVIRUDWRWDO

QRWLRQDODPRXQWRIPLOOLRQWKH7UHDVXU\/RFN$JUHHPHQWV7KH7UHDVXU\/RFN$JUHHPHQWVZKLFKKDGDQRULJLQDO

PDWXULW\GDWHRI0DUFKZHUHHQWHUHGLQWRWRKHGJHSDUWRIWKH&RPSDQ\VLQWHUHVWUDWHH[SRVXUHDVVRFLDWHGZLWKWKH

YDULDELOLW\LQIXWXUHFDVKIORZVDWWULEXWDEOHWRFKDQJHVLQWKHILYH\HDU86WUHDVXU\UDWHVUHODWHGWRWKHSODQQHGLVVXDQFHRIGHEW

VHFXULWLHVLQ,QFRQQHFWLRQZLWKWKH&RPSDQ\VVHQLRUQRWHVRIIHULQJLQ0DUFKVHH1RWHWKH&RPSDQ\VHWWOHG

WKH7UHDVXU\/RFN$JUHHPHQWVZKLFKZHUHDFFRXQWHGIRUDVFDVKIORZKHGJHV7KHORVVRQVHWWOHPHQWRIWKH7UHDVXU\/RFN

$JUHHPHQWVZDVQRWPDWHULDO

7KHWRWDOQHWORVVQHWRIWD[HVUHFRJQL]HGLQDFFXPXODWHGRWKHUFRPSUHKHQVLYHORVVUHODWHGWRWKH&RPSDQ\VFDVK

IORZKHGJHVDVRI'HFHPEHUDQGZDVPLOOLRQDQGPLOOLRQUHVSHFWLYHO\7KHORVVUHFRJQL]HGRQWKH

&RPSDQ\VFDVKIORZKHGJHVIRUWKH\HDUVHQGHG'HFHPEHUDQGDVDUHVXOWRILQHIIHFWLYHQHVVZDVQRW

PDWHULDO7KHQHWDPRXQWRIGHIHUUHGORVVHVRQFDVKIORZKHGJHVWKDWLVH[SHFWHGWREHUHFODVVLILHGIURPDFFXPXODWHGRWKHU

FRPSUHKHQVLYHORVVLQWRHDUQLQJVZLWKLQWKHQH[WWZHOYHPRQWKVLVPLOOLRQ

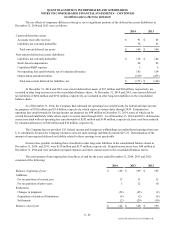

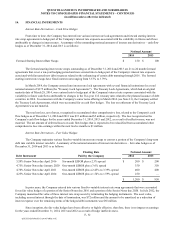

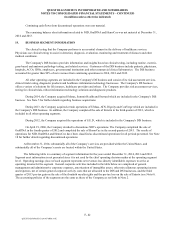

Interest Rate Derivatives – Fair Value Hedges

7KH&RPSDQ\PDLQWDLQVYDULRXVIL[HGWRYDULDEOHLQWHUHVWUDWHVZDSVWRFRQYHUWDSRUWLRQRIWKH&RPSDQ\VORQJWHUP

GHEWLQWRYDULDEOHLQWHUHVWUDWHGHEW$VXPPDU\RIWKHQRWLRQDODPRXQWVRILQWHUHVWUDWHGHULYDWLYHV–IDLUYDOXHKHGJHVDVRI

'HFHPEHUDQGLVDVIROORZV

Floating Rate Notional Amount

Debt Instrument Paid by the Company 2014 2013

6HQLRU1RWHVGXH$SULO 6L[PRQWK/,%25SOXVDVSUHDG

6HQLRU1RWHVGXH-DQXDU\ 2QHPRQWK/,%25SOXVDVSUHDG

6HQLRU1RWHVGXH$SULO 2QHPRQWK/,%25SOXVDWRVSUHDG

6HQLRU1RWHVGXH$SULO 2QHPRQWK/,%25SOXVDWRVSUHDG ²

,QSULRU\HDUVWKH&RPSDQ\HQWHUHGLQWRYDULRXVIL[HGWRYDULDEOHLQWHUHVWUDWHVZDSDJUHHPHQWVWKDWZHUHDFFRXQWHG

IRUDVIDLUYDOXHKHGJHVRIDSRUWLRQRIWKH6HQLRU1RWHVGXHDQGDSRUWLRQRIWKH6HQLRU1RWHVGXH,Q-XO\WKH

&RPSDQ\PRQHWL]HGWKHYDOXHRIWKHVHLQWHUHVWUDWHVZDSDVVHWVE\WHUPLQDWLQJWKHKHGJLQJLQVWUXPHQWV7KHDVVHWYDOXH

LQFOXGLQJDFFUXHGLQWHUHVWWKURXJKWKHGDWHRIWHUPLQDWLRQZDVPLOOLRQDQGWKHDPRXQWWREHDPRUWL]HGDVDUHGXFWLRQRI

LQWHUHVWH[SHQVHRYHUWKHUHPDLQLQJWHUPVRIWKHKHGJHGGHEWLQVWUXPHQWVZDVPLOOLRQ

6LQFHLQFHSWLRQWKHIDLUYDOXHKHGJHVKDYHEHHQHIIHFWLYHRUKLJKO\HIIHFWLYHWKHUHIRUHWKHUHLVQRLPSDFWRQHDUQLQJV

IRUWKH\HDUVHQGHG'HFHPEHUDQGDVDUHVXOWRIKHGJHLQHIIHFWLYHQHVV

48(67',$*1267,&6)250

.