Public Storage 2010 Annual Report Download - page 19

Download and view the complete annual report

Please find page 19 of the 2010 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

5

as soon as reasonably practicable after the reports and amendments are electronically filed with or furnished to the

SEC.

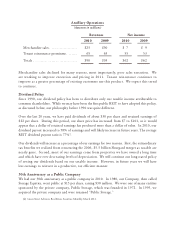

The Impact of Current Economic Factors

Our business has been negatively affected by the recessionary environment experienced in 2008 through

2010. Occupancies, rental rates and overall rental income at our facilities came under pressure as demand for self-

storage space softened. We responded by reducing rental rates, increasing promotional discounts, and increasing

our marketing activities to stimulate additional demand for our storage space and increase our market share.

Revenues generated by our Same Store facilities decreased from $1.468 billion in 2008 to $1.423 billion in 2009,

representing a reduction of 3.1%. Our operating metrics began to stabilize in the latter part of 2009 and started to

improve as we moved into the second half of 2010. Revenues generated by our Same Store facilities stabilized in

2010 at $1.428 billion, flat as compared to 2009.

See ³*URZWKDQG,QYHVWPHQW6WUDWHJLHV´ DQG³)LQDQFLQJRIWKH&RPSDQ\¶V*URZWK6WUDWHJLHV´below

for more information regarding our long-term strategy to grow the cash flows and equity values of the Company.

Competition

Self-storage facilities generally draw customers who either reside or have their businesses located within a

three to five mile radius. Many of our facilities operate within three to five miles of well-located and well-managed

competitors that seek the same group of customers. Many of our competitors utilize the same marketing channels we

use, including yellow page advertising, Internet advertising, as well as signage and banners. As a result, competition

is significant and affects the occupancy levels, rental rates, rental income and operating expenses of our facilities.

While competition is significant, the self-storage industry remains fragmented in the U.S. We believe that

we own approximately 5% of the aggregate self-storage square footage in the U.S., and that collectively the five

largest self-storage operators in the U.S. own approximately 10% of the aggregate self-storage space in the U.S.,

with the remaining 90% owned by numerous private regional and local operators. This market fragmentation

enhances the advantage of our economies of scale and our brand relative to other operators VHH³%XVLQHVV Attributes

± (FRQRPLHVRI6FDOH´EHORZ, and provides an opportunity for growth through acquisitions over the long term.

In seeking investments, we compete with a wide variety of institutions and other investors. The amount of

funds available for real estate investments greatly influences the competition for ownership interests in facilities and,

by extension, the yields that we can achieve on newly acquired investments.

Business Attributes

We believe that we possess several primary business attributes that permit us to compete effectively:

Centralized information networks: Our facilities are part of comprehensive centralized reporting and

information networks which enable the management team to identify changing market conditions and operating

WUHQGV DV ZHOO DV DQDO\]H FXVWRPHU GDWD DQG TXLFNO\ FKDQJH RXU SURSHUWLHV¶ SULFLQJ DQG promotional mix on an

automated basis.

National Telephone Reservation System: We operate a centralized telephone reservation system, which

provides added customer service and helps to maximize utilization of available self-storage space. Customers

calling either the toll-free telephone referral system, (800) 44-STORE, or a storage facility, are directed to the

national reservation system. A representative discusses with the customer space requirements, price and location

preferences and also informs the customer of other products and services provided by the Company and its

subsidiaries. We believe that the centralized telephone reservation system enhances our ability to market storage

space in the U.S. relative to handling these calls at individual properties, because it allows us to more effectively

offer all spaces at all facilities in the vicinity of a customer and to provide higher-quality selling efforts through

dedicated sales specialists.