Public Storage 2010 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2010 Public Storage annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

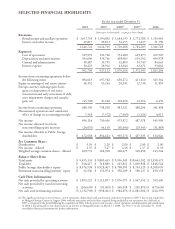

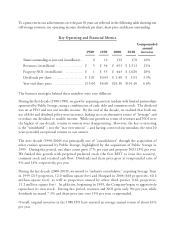

The table below breaks down shareholder returns for each decade and for our 30-year history.

Shareholder Returns

Annual Annual

return from return from

dividends* share price**

1

* Beginning stock price for the period divided by the average dividend per share over the period.

** Annual compound return using beginning of period share price.

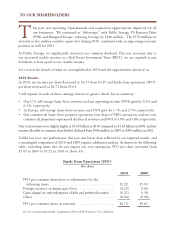

Over this 30-year period, we worked hard and did a lot of things right. To a certain extent, the

wind has been at our back. Over the last 30 years, ten-year Treasury bond yields have declined

4

(amazing how these numbers track each other). As Warren Buffett explained, “At all times, in

all markets, in all parts of the world, the tiniest changes in interest rates change the value of

every financial asset.” It is almost certain that the wind will be in our face over the next 30 years.

Conclusion

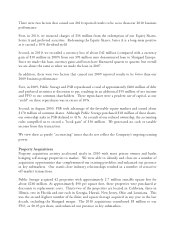

In last year’s shareholder letter, I provided data that showed there would be abundant opportunities

for prudent acquisitions resulting from an environment of deteriorating operating fundamentals,

falling real estate values and inability to refinance many real estate loans written during peak values.

October 2007 peak, according to the Moody’s/REAL Commercial Property Price Index. Near record

low interest rates are attracting additional real estate buyers with the prospect of cheap financing from a

recovering Commercial Mortgage Backed Securities (CMBS) market and could help stabilize values.

The CMBS market is expected to issue over $50 billion in securities in 2011, up from $11 billion

in 2010 and $2 billion in 2009. However, with total real estate debt of over $1.5 trillion coming due

over the next five years, much more liquidity is needed. In addition, Forsight Analytics estimates that

as much as half of the loans maturing the next five years are secured by properties worth less than

the outstanding principal balance.

estate, ownership will continue to move from “private” to “public.”

We believe there will be increased opportunities to deploy capital in 2011.