Progressive 2012 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2012 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

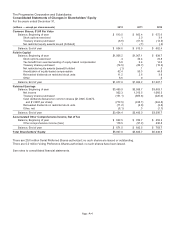

Income Taxes The income tax provision is calculated under the balance sheet approach. Deferred tax assets and liabilities

are recorded based on the difference between the financial statement and tax bases of assets and liabilities at the enacted

tax rates. The principal items giving rise to such differences are investment securities (e.g., net unrealized gains (losses),

write-downs on securities determined to be other-than-temporarily impaired, and derivative instruments), loss and loss

adjustment expense reserves, unearned premiums reserves, deferred acquisition costs, property and equipment, and non-

deductible accruals. We review our deferred tax assets regularly for recoverability. See Note 5 – Income Taxes for further

discussion.

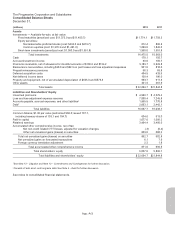

Property and Equipment Property and equipment are recorded at cost, less accumulated depreciation, and include

capitalized software developed or acquired for internal use. Depreciation is recognized over the estimated useful lives of the

assets using accelerated methods for most computer equipment and the straight-line method for certain computer

equipment and all other fixed assets. The useful lives range from 2 to 3 years for computer equipment and laptop

computers; 7 to 40 years for buildings, improvements, and integrated components; and 3 to 10 years for all other property

and equipment. Land and buildings comprised 75% of total property and equipment at both December 31, 2012 and 2011.

Total capitalized interest, which primarily relates to capitalized software projects, for the years ended December 31, was:

(millions)

Capitalized

Interest

2012 $.3

2011 .4

2010 1.1

Guaranty Fund Assessments We are subject to state guaranty fund assessments, which provide for the payment of

covered claims or other insurance obligations of insurance companies deemed insolvent. These assessments are accrued

after a formal determination of insolvency has occurred, and we have written the premiums on which the assessments will

be based.

Fees and Other Revenues Fees and other revenues primarily represent fees collected from policyholders relating to

installment charges in accordance with our bill plans, as well as late payment and insufficient funds fees. Other revenues

may include revenue from the sale of tax credits, rental income, and other revenue transactions.

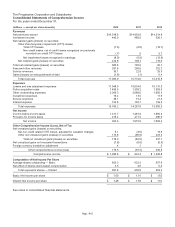

Revision We revised the presentation of our Statements of Comprehensive Income for the years ended December 31,

2011 and 2010, to correctly classify $266.5 million and $252.2 million, respectively, of fees and other revenues as a

component of total revenues and to conform to our current-year presentation. Previously, these items were presented net

within our other underwriting expenses, which was not in compliance with GAAP, thereby understating both total revenues

and total expenses. These revisions were not considered to be material, individually or in the aggregate, to previously

issued financial statements. These revisions had no effect on the results of operations (net or comprehensive income),

financial condition (shareholders’ equity), or cash flows in any period presented or in any previously issued financial

statements.

Service Revenues and Expenses Our service businesses provide insurance-related services. Service revenues

generated from processing business for involuntary CAIP plans are earned on a pro rata basis over the term of the related

policies. Service expenses related to these CAIP plans include acquisition expenses, which are deferred and amortized

over the period in which the related revenues are earned. Other service business revenues and expenses are recorded in

the period in which they are earned or incurred.

App.-A-9