Progressive 2012 Annual Report Download - page 21

Download and view the complete annual report

Please find page 21 of the 2012 Progressive annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

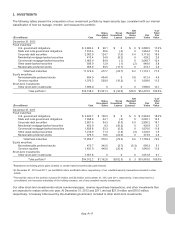

At December 31, 2012, vendor-quoted prices represented 57% of our Level 1 classifications (excluding short-term

investments), compared to 59% at December 31, 2011. The securities quoted by vendors in Level 1 represent our holdings

in U.S. Treasury Notes, which are frequently traded and the quotes are considered similar to exchange-traded quotes. The

balance of our Level 1 pricing comes from quotes obtained directly from trades made on an active exchange.

At December 31, 2012, vendor-quoted prices comprised 98% of our Level 2 classifications (excluding short-term

investments), while dealer-quoted prices represented 2%, compared to 96% and 4%, respectively, at December 31, 2011.

In our process for selecting a source (e.g., dealer, pricing service) to provide pricing for securities in our portfolio, we

reviewed documentation from the sources that detailed the pricing techniques and methodologies used by these sources

and determined if their policies adequately considered market activity, either based on specific transactions for the particular

security type or based on modeling of securities with similar credit quality, duration, yield, and structure that were recently

transacted. Once a source is chosen, we continue to monitor any changes or modifications to their processes by reviewing

their documentation on internal controls for pricing and market reviews.

As part of our pricing procedures, we obtain quotes from more than one source to help us fully evaluate the market price of

securities. However, our internal pricing policy is to use a consistent source for individual securities in order to maintain the

integrity of our valuation process. Quotes obtained from the sources are not considered binding offers to transact. Under our

policy, when a review of the valuation received from our selected source appears outside what is considered market level

activity (which is defined as trading at spreads or yields significantly different than comparable securities or outside the

general sector level movement without a reasonable explanation), we may use an alternate source’s price. To the extent we

determine that it is prudent to substitute one source’s price for another, we will contact the initial source to obtain an

understanding of the factors that may be contributing to the significant price variance, which often leads the source to adjust

their pricing input data for future pricing.

To allow us to determine if our initial source is providing a price that is outside of a reasonable range, we review our

portfolio pricing on a weekly basis. We frequently challenge prices from our sources when a price provided does not match

our expectations based on our evaluation of market trends/activity. Initially, we perform a global review of our portfolio by

sector to identify securities whose prices appear outside of a reasonable range. We refine our review to analyze prices by

specific criteria, such as whether the security is investment or non-investment-grade, prime or sub-prime, or a consumer

product (e.g., auto, credit card). Through this review, we try to determine what contributed to the price variances among

sources by analyzing spread movement, comparable security trades, if available, or industry or specific issuer

fundamentals. We review quality control measures of our sources as they become available to determine if any significant

changes have occurred from period to period that might indicate issues/concerns regarding their evaluation or market

coverage. We also review data assumptions as supplied by our sources to determine if that data is relevant to current

market conditions. In addition, we independently review each sector for transaction volumes, new issuances, and changes

in spreads, as well as the overall movement of interest rates along the yield curve to determine if sufficient activity and

liquidity exists to provide a credible source for our market valuations.

During each valuation period, we create internal estimations of portfolio valuation (performance returns), based on current

market-related activity (i.e., interest rate and credit spread movements and other credit-related factors) within each major

sector of our portfolio. We compare our internally generated portfolio results with those generated based on quotes we

received externally and research material valuation differences. We compare our results to index returns for each major

sector adjusting for duration and credit quality differences to better understand our portfolio’s results. Additionally, we review

on a monthly basis our external sales transactions and compare the actual final market sales price to a previous market

valuation price. This review provides us further validation that our pricing sources are providing market level prices, since

we are able to explain significant price changes (i.e., greater than 2%) as known events occur in the market place and affect

a particular security’s price at sale.

This analysis provides us additional comfort regarding the source’s process, the quality of its review, and its willingness to

improve its analysis based on feedback from clients. We believe this effort helps ensure that we are reporting the most

representative fair values of our securities.

With limited exceptions, our Level 3 securities are also priced externally; however, due to several factors (e.g., nature of the

securities, level of activity, and lack of similar securities trading to obtain observable market level inputs), these valuations

are more subjective in nature. Certain private equity investments and fixed-income investments included in the Level 3

category are valued using external pricing supplemented by internal review and analysis.

App.-A-21