PACCAR 2011 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2011 PACCAR annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

TO OUR SHAREHOLDERS

PACCAR had an excellent year in 2011, as our primary markets improved due

to stronger economies and customers updating their fleets. The company has earned

an impressive 73 consecutive years of net income. This remarkable achievement

was due to our 23,400 employees who delivered industry-leading product quality,

innovation and outstanding operating efficiency. PACCAR benefited from its global

diversification, superior financial strength and strong growth from aftermarket business

and financial services. PACCAR’s $823 million of capital investments and research

and development in 2011 enhanced its manufacturing capability and accelerated new

product introductions. PACCAR delivered 138,000 trucks to its customers and sold

$2.6 billion of aftermarket parts and services. PACCAR’s excellent S&P credit rating

of A+ results from consistent profitability, a strong balance sheet and good cash flow.

Looking ahead to 2012, the North American truck market is expected to continue to

improve. The European truck market could be lower due to the Eurozone economic

challenges. It is anticipated that there will be continued growth in the aftermarket

business due to the aging of the truck parc. PACCAR Financial Services’ revenues

should increase due to a growing portfolio.

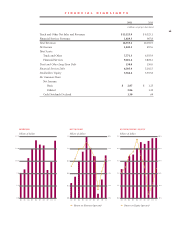

PACCAR’s net income of $1.04 billion on revenues of $16.4 billion was the fourth

best in company history. PACCAR declared regular dividends of $.60 per share and a

special dividend of $.70 per share. Regular quarterly cash dividends have tripled in

the last 10 years. Shareholder equity is a robust $5.4 billion.

Class 8 industry truck sales in North America, including

Mexico, rose to 216,000 vehicles in 2011 compared to

141,000 units the prior year. The European 15+ tonne

market in 2011 improved to 244,000 vehicles, compared

to 183,000 in 2010. Our customers are generating better

profits due to increased freight and higher rates, which

is translating into more industry truck orders.

PACCAR’s excellent financial performance in 2011

resulted from higher truck and parts sales and margins.

The company’s 2011 after-tax return on revenues was

6.4%. After-tax return on beginning shareholder equity

(ROE) was 19.4% in 2011, compared to 9.0% in 2010.