Olympus 2014 Annual Report Download - page 4

Download and view the complete annual report

Please find page 4 of the 2014 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Rebuilding of

Business Portfolio /

Optimizing Allocation of

Management Resources

Restoration of

Financial Health

Review and

Reduction of Costs

Back to Basics Profitable GrowthOne Olympus

Restructuring of

Corporate Governance

Olympus is promoting a medium-term vision for the ve years from the scal year ended March 2013. Acting in

accordance with the vision’s slogan of “Back to Basics,” the Company aims to return to the basic values it had at

founding and make a fresh start in order to regain the credibility of its stakeholders, build itself anew, and create

new corporate value.

Basic Strategies Based on Corporate Management Policies

Corporate Management Policies under the New Management

Performance Indices and Targets (Consolidated)

1. Clarifi cation of our core

businesses

2. Identifi cation and liquidation

of non-core businesses

3. Establishment of mechanisms

to drive optimal allocation of

management resources

Contribute to total

wellness of people as a company

centered on Medical Business

Improve pro tability of the entire

Group through drastic review

of cost structures

Improve equity ratio

as soon as possible and

realize stable management

Recover trust

and improve

corporate value

1. Cost reduction

2. Signifi cant curtailment

of indirect expenses

1. Steady fl ow of profi ts from

businesses

2. Maximization of cash fl ow

3. Streamlining of assets

1. Restructuring of the

governance system

2. Reinforcement of internal

controls

3. Strengthening of the

compliance system

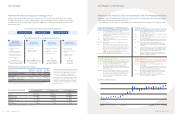

Results of implementing these basic strategies will

be monitored based on four performance indices:

“return on invested capital (ROIC),” “operating

margin,” “free cash fl ow,” and “equity ratio.”

The operating margin and the equity ratio

both reached the levels targeted for fi scal 2017,

meaning these goals were achieved three years

early. We are making steady progress toward

accomplishing the fi scal 2017 targets for ROIC

and free cash fl ow.

* Return on Invested Capital (ROIC): At Olympus, ROIC is calculated using the following assumptions:

Return (Operating income after taxes) / IC (Shareholders’ equity + Interest-bearing debt)

Performance indices FY ended

March 2013

(Results)

FY ended

March 2014

(Results)

FY ending

March 2017

(Targets)

Return on invested capital (ROIC)(*)2.7% 5.9% 10% or more

Operating margin 4.7% 10.3% 10% or more

Free cash flow

(Cash flow from operating activities +

cash flow from investing activities)

¥58.7 billion ¥52.1 billion ¥70.0 billion or

more

Equity ratio 15.5% 32.1% 30% or more

FY ended March 2014 FY ending March 2015(*)FY ending March 2017

Results Forecasts Targets

Net sales ¥713.3 billion ¥760 billion ¥920 billion

Operating income

(Operating margin)

¥73.4 billion

(10%)

¥88 billion

(12%)

¥143 billion

(16%)

Ordinary income

(Ordinary income ratio)

¥50.9 billion

(7%)

¥70 billion

(9%)

¥125 billion

(14%)

Net income

(Net income ratio)

¥13.6 billion

(2%)

¥45 billion

(6%)

¥85 billion

(9%)

1 2 3 4

* Targets for fi scal 2015 are based on forecasts released on May 9, 2014.

Financial Plans (Consolidated)

Our Strategy

Medium-Term Vision (Corporate Strategic Plan)

Our Progress under Review

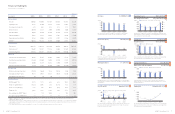

Advances in the Two Years Since the Institution of the New Management Team

In April 2012, Olympus instituted a new management team. Since then, the Company has continued the rapid advance

of the strategies described in the medium-term vision.

The following is a list of the major accomplishments seen in different areas of the Company over the past two years.

Corporate (Management / Others Business)

Apr. 2012 A special general meeting of shareholders is convened,

and anew management team is instituted.

Jun. The medium-term vision (corporate strategic plan) geared

toward creating a new Olympus is announced by the new

management team.

Aug. The transference of the Information & Communication

Business is announced.

Sep. A business and capital alliance with Sony Corporation

is announced.

May 2013 Restructuring measures for the Imaging Business are

announced.

Jun. The Security on Alert designation placed on the Com-

pany’s stock by the Tokyo Stock Exchange is removed.

Jun. A stock option system (linked to performance and stock

price) for corporate offi cer compensation is introduced.

Jul. Capital to the extent of ¥112.6 billion is procured by

issuing new shares through public offering in overseas

markets and disposing of treasury stock.

Feb. 2014 The withdrawal from the biologics business is announced.

Scientifi c Solutions Business

Jun. 2012 A plant in the Philippines is closed as part of efforts to ratio-

nalize production sites and improve operational effi ciency.

Jul. 2013 The strategic FLUOVIEW FVMPE-RS laser scanning

microscope is introduced in the life science fi eld.

Jul. The strategic OmniScan SX series of miniature, light

weight ultrasonic phased array fl aw detectors is launched

in the industrial fi eld.

Apr. 2014 The Life Science & Industrial Business is renamed the

Scientifi c Solutions Business. A shift away from strate-

gies based on product lineups is undertaken to pursue

those oriented toward customer groups in order to

improve business and capital effi ciency and thereby

increase profi tability.

Imaging Business

Mar. 2012 OM-D E-M5, a middle-class strategic mirrorless camera

inthe OM-D series, is launched.

May 2013 Restructuring measures for the Imaging Business are

announced.

The reorganization of manufacturing sites is completed,

effectively consolidating fi ve sites into two sites (Shenzhen

and Vietnam completed during fi scal 2014).

Oct. OM-D E-M1, our fl agship model for OM-D series mirror-

less cameras that offers resolution levels comparable to

full-size single-lens refl ex cameras, is launched.

Feb. 2014 OM-D E-M10, an OM-D series camera that features a

more accessible price, is launched.

Medical Business

Feb. 2012 The THUNDERBEAT integrated energy device with both

advanced bipolar and ultrasonic energy is launched in

the European and U.S. markets.

Apr. The EVIS EXERA III endoscopy system is launched in the

European and U.S. markets.

Nov. The EVIS LUCERA ELITE endoscopy system is launched

in the Japanese market.

Dec. Investment of approximately ¥20 billion in manufacturing

sites in Japan (Aizu, Shirakawa, and Aomori) is decided.

Apr. 2013 A joint venture company between Olympus and

Sony Corporation is established, with Sony to develop

surgical endoscope products with 3D and 4K imaging

capabilities.

Apr. A surgical endoscopy system with 3D imaging capabilities

is launched in the European, U.S., and Japanese mar-

kets; the world’s fi rst 3D videoscope for surgery equipped

with a bending tip islaunched simultaneously.

Nov. Our largest training and service center is established in

Guangzhou, adding to existing Chinese training centers

situated in Shanghai and Beijing.

0

3,000

2,000

1,000

4,000

April 2012 January 2013 January 2014 July 2014

Stock Price over Past Two Years

(¥)

5

OLYMPUS Annual Report 2014

4OLYMPUS Annual Report 2014