Olympus 2014 Annual Report Download - page 12

Download and view the complete annual report

Please find page 12 of the 2014 Olympus annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

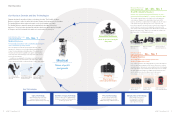

Special Feature

Reliable Growth

in Global Markets

Since successfully creating the world’s rst gastrocamera, Olympus has continued to provide the world with top-class

technologies, products, services, and solutions centered on gastrointestinal endoscopes. Today, our Medical Business

spreads across the globe with approximately 80% of sales coming from outside of Japan. The two pillars of this business

are early diagnosis, which is made possible by our gastrointestinal endoscopes, and minimally invasive treatments, which

use our surgical devices. By providing value in these two areas, we are helping improve the quality of life of patients

around the world while contributing to lower medical costs. In this special feature, we explain the global strategies and

initiatives being implemented in the Medical Business, which has been positioned as a growth driver for Olympus.

One of the core strengths of the Company’s Medical Busi-

ness is its industry-leading global service network. As

endoscopes are inserted directly into the human body even

a small malfunction can lead to a serious medical accident.

For this reason, instruments that have been repaired must

have the same performance as new instruments. Safe and

reliable use is one of the essential values of an endoscope.

Ever since beginning its endoscope business, Olympus has

continued striving to enhance its service network based on

that mind-set. Currently, there are more than 200 Olympus

repair sites spread across the globe. This global service

network is the industry’s largest and just another way Olympus

works to make sure that patients can undergo endoscopic

examination and treatment procedures with peace of mind.

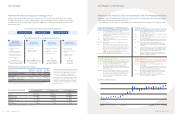

Operating Environment and Outlook

AmericasJapan

Operating environment chang-

ing rapidly due to introduction of

Healthcare Reform, which aims

to reduce medical costs

Operating environment changes

anticipated to prove benefi cial

in medium-to-long term for

Olympus as provider of early

diagnosis and minimally invasive

treatment methods

Recovery trend due to yen

depreciation and job market

improvement

Stable, ongoing growth forecast

due to sales contributions from

new products, such as EVIS

LUCERA ELITE

Overall macroeconomic outlook

in Europe, Middle East, and

Africa mixed and unsettled

Healthcare providers and hospi-

tals increasingly expect inte-

grated value propositions that

cover clinical and economic

aspects from medical technol-

ogy companies

Growth potential high in China

and other markets

Population and subsequently

number of patients large,

but number of physicians

relatively low

Political issues and strengthen-

ing of regulations by different

countries expected to continue

Europe Asia / Oceania

Nacho Abia

Division Manager of

Medical Business Div.

of Americas, Medical

Business Group

Frank Drewalowski

Division Manager of

Medical Business Div.

of Europe, Medical

Business Group

Mitsuhiro Hikosaka

Division Manager of

Medical Business Div.

of Asia / Oceania,

Medical Business Group

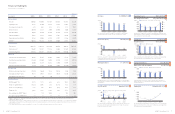

Net Sales for the Medical Business

Industry-Leading Global Service Network

Major repair sites Repair sites

(¥ Billion)

2005/32004/3 2006/3 2007/3 2008/3 2009/3 2011/32010/3 2012/3 2013/3 2014/3

0

200

100

300

500

400

230.5

216.9

266.3

311.7

353.3 350.7

383.8 355.3 349.2

394.7

492.3

137.7

121.0

175.9

(¥ Billion)

0

100

50

150

200

2012/3 2013/3 2014/3

(¥ Billion)

2012/3 2013/3 2014/3

89.5

80.4

105.9

0

100

50

150

200

102.9

91.9

128.7

(¥ Billion)

0

100

50

150

200

2012/3 2013/3 2014/3

(¥ Billion)

0

100

50

150

200

2012/3 2013/3 2014/3

54.3

45.5

69.7

Regional Strategies

Principal Manufacturing and Major Repairs Sites

Net Sales

Revise strategies in energy

device fi eld; strengthen special-

ized sales forces targeting

GPOs and IDNs

Reinforce operations in urology

and ENT areas

Reorganize manufacturing sites

to improve production effi ciency

of surgical devices

Strengthen principal domestic

manufacturing sites to respond

to expanding global demand for

gastrointestinal endoscopes

Enhance solutions capabilities

for operating rooms centered on

surgical and energy devices

Accelerate sales promotions

targeting clinics; strengthen

sales approach for pancreatic-

biliary-area endotherapy devices

Work closely with customers on

a local level and exchange best

practices across countries

Expand sales force in growth

areas, such as surgical energy

and ENT devices

Introduce new, systematic sales

training programs to respond to

evolving customer needs

Further strengthen training sup-

port and service systems that will

be key to expanding markets

Progressively introduce new

products to achieve growth

Track sales results by stringently

managing targets by region

and fi eld

Principal manufacturing sites:

Memphis (TN, U.S.), Norwalk (OH,

U.S.), Maple Grove (MN, U.S.)

(New facility in Brooklyn Park, MN,

scheduled to be operational fall 2014.)

Major repair site:

San Jose (CA, U.S.)

Principal manufacturing sites:

Aizu and Shirakawa (Fukushima),

Aomori, Hinode (Tokyo)

Major repair sites:

Shirakawa (Fukushima),

Ina (Nagano)

Principal manufacturing sites:

Hamburg and Berlin (Germany),

Southend-on-Sea / Cardiff (U.K.),

Prerov (Czech Republic)

Major repair sites:

Germany, U.K., Czech Republic

Principal manufacturing site:

Long Thanh (Vietnam)

Major repair sites:

Shanghai and Guangzhou (China),

Australia, Singapore

China Others

Endotherapy Devices

Boston Scientifi c Corporation (U.S.)

Gastrointestinal Endoscopes

FUJIFILM Medical Co., Ltd. (Japan)

HOYA CORPORATION (Japan)

Surgical Endoscopes

Stryker Corporation (U.S.)

KARL STORZ GmbH & Co. KG

(Germany)

Energy Devices

Ethicon Endo-Surgery Inc. (U.S.)

Covidien plc (U.S.)

Competitors by Field

21

OLYMPUS Annual Report 2014

20 OLYMPUS Annual Report 2014